Energizer 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENR 2005 Annual Report 13

The Company’s acquisition of SWS was completed on March 28,

2003; therefore, SWS is not included in the attached historical finan-

cial statements prior to this date. The comparison of September 30,

2004 amounts are versus pro forma SWS results for the year ended

September 30, 2003. Segment profit excludes the impact of the

2003 cost of products sold related to the SWS inventory write-up,

which is discussed in further detail in Note 3 to the Consolidated

Financial Statements.

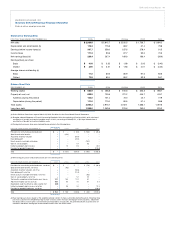

Razor and blade sales increased $62.7, or 7%, in 2005 including

favorable currency impacts of $23.9. Absent currencies, sales

increased $38.8, or 4%, as incremental sales of QUATTRO for

Women,QUATTRO Power and QUATTRO Energy totaling $67.8,

and higher disposable and replacement blade sales were partially

offset by lower sales of base QUATTRO and Intuition razor handles,

as those product sales normalized following significant trial-generat-

ing promotional activity in the U.S. and initial product launches in

international markets. Legacy brands also declined as sales shifted

to newer products. Segment profit for the year increased $31.6 with

currency impacts accounting for $6.6. Absent currencies, segment

profit increased 29% as margin contribution from higher sales of

$21.0 and lower A&P expense of $12.2 were partially offset by

higher SG&A of $8.6. The decline in A&P in 2005 reflects a returnto

normalized spending levels following major launches in international

markets last year. The increase in SG&A spending reflects increased

investment in resources to support business growth; however, this

increase represents a slight reduction in SG&A as a percent of sales.

For the year ended September 30, 2004, sales increased $123.1,

or 17%, as incremental sales of Intuition and QUATTRO and $52.4

of favorable currency were partially offset by anticipated declines in

other product lines. QUATTRO and Intuition combined contributed

almost $275 of net sales in 2004, an increase of more than $150.

Segment profit for the year increased $28.8, or 51%, with currency

impacts accounting for $15.7 of the improvement. Absent currencies,

higher sales and lower product costs resulted in increased gross

margin of $83.7, which was partially offset by significantly higher

A&P expense, and to a lesser extent, higher selling expenses in

support of the new brands.

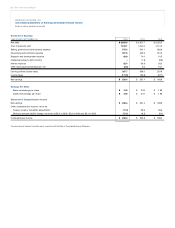

General Corporate and Other Expenses

Corporate and other expenses were $16.2 higher in 2005 due to

higher expenses for equity,compensation and retirement plans,

financial compliance, information systems and litigation. This was

partially offset by lower business realignment costs, which

decreased by $14.0 in 2005.

In 2004, corporate and other expenses increased $36.8, primarily

reflecting higher legal, integration and business realignment costs,

which includes incremental integration costs of $11.6, and higher

management and administrative costs following the SWS acquisition.

Legal expense increased $11.7 reflecting the impact of litigation costs

in a number of lawsuits, primarily related to intellectual property matters.

Major integration activities were completed as of September 30,

2004. Annualized integration savings were approximately $18 in

total, with approximately $13 of savings realized in 2004.

As a percent of sales, general corporate and other expenses were

3.3% in 2005, 2.9% in 2004 and 2.0% in 2003. The increases in

2005 and 2004 are mainly driven by the items discussed above.

Special Pension Termination Benefits

During the fourth quarter of fiscal 2004, Energizer announced a

Voluntary Enhanced Retirement Option (VERO) offered to approxi-

mately 600 eligible employees in the U.S. of which 321 employees

accepted. A charge of $15.2, pre-tax, was recorded in fiscal 2004

related to the VERO and certain other special pension benefits and

the estimated impact of such benefits on the Company’s pension

plan is reflected in the amounts shown in Note 10 to the Consolidated

Financial Statements. Future cost savings from the VERO program

are expected to be approximately $10 annually, with approximately

$6 realized in 2005.

Intellectual Property Rights Income

The Company entered into agreements to license certain intellectual

property to other parties in separate transactions. Such agreements

do not require any future performance by the Company, thus all

committed consideration was recorded as income at the time each

agreement was executed. The Company recorded income related

to such agreements of $1.5 pre-tax, or $0.9 after-tax, and $8.5 pre-

tax, or $5.2 after-tax, in the years ended September 30, 2004 and

2003, respectively.

Interest and Other Financing Items

Interest expense increased $21.6 in 2005 due to higher interest

rates and higher average borrowings resulting from share repur-

chases. In 2004, interest expense increased $2.6 on higher average

debt, offset by lower interest rates. Higher average debt in 2004

reflects the borrowings for the SWS acquisition outstanding for a

full year compared to six months in 2003. The lower effective inter-

est rate for 2004 was a result of paying offhigh fixed rate debt in

September 2003 and generally lower rates on variable rate debt.

In 2005, other financing expense was favorable $4.3 primarily due

to higher interest income and lower exchange losses. Other financing

expense declined $13.7 in 2004 compared to 2003, which included

a$20.0 charge in 2003 related to early repayment of debt. Additionally,

2004 experienced net currency exchange losses compared to net

gains in 2003.

Income Taxes

Income taxes, which include federal, state and foreign taxes, were

28.0%, 25.3% and 28.5% of earnings before income taxes in 2005,

2004 and 2003, respectively. Earnings before income taxes and

income tax provision include certain unusual items and adjustments

to prior recorded tax accruals in all years, which impact the overall

tax rate. The most significant of these are described as follows: