Energizer 2001 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2001 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

(Dollars in millions except per share data)

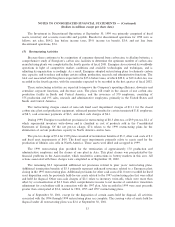

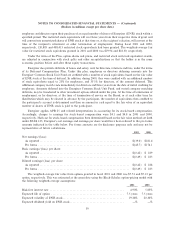

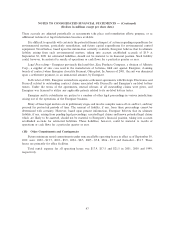

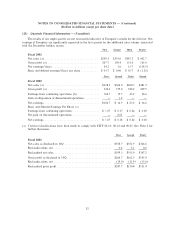

The following table presents the net expense/(income) allocated to Energizer for the respective plans

prior to the spin-oÅ.

2000 1999

DeÑned beneÑt plans ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $(2.1) $5.2

Postretirement beneÑts ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 3.3 5.8

(11) DeÑned Contribution Plan

Energizer sponsors employee savings plans, which cover substantially all U.S. employees. Energizer

matches 50% of participants' before-tax contributions up to 6% of compensation. In addition, participants can

make after-tax contributions of 1% of compensation into the savings plan. This participant after-tax

contribution is matched within the pension plan at 325%. Amounts charged to expense during Ñscal 2001 were

$3.8. Subsequent to the spin-oÅ from Ralston, Energizer charged $1.8 to expense in Ñscal 2000.

Prior to the spin-oÅ, substantially all regular Energizer employees in the United States were eligible to

participate in the Ralston-sponsored deÑned contribution plans. Participant contributions were matched in

accordance with Ralston's plan terms. Prior to the spin-oÅ, Energizer recorded costs as allocated by Ralston.

The amount of such costs was $1.2 for the six months ended March 31, 2000 and $3.0 in 1999.

(12) Debt

Immediately prior to the spin-oÅ, Ralston borrowed $478.0 through several interim-funding facilities and

assigned all repayment obligations of those facilities to Energizer. In April and May 2000, Energizer entered

into separate Ñnancing agreements, including an agreement to sell domestic trade receivables as discussed in

Note 13 below, and repaid the interim-funding facilities.

Notes payable at September 30, 2001 and 2000 consisted of notes payable to Ñnancial institutions with

original maturities of less than one year of $110.3 and $135.0, respectively, and had a weighted-average

interest rate of 6.9% and 7.9%, respectively.

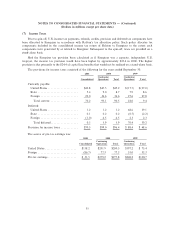

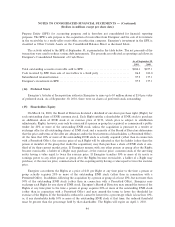

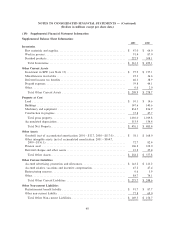

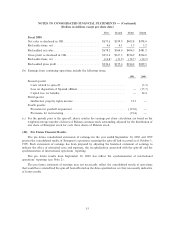

The detail of long-term debt at September 30 is as follows.

2001 2000

Private Placement, interest rates ranging from 7.8% to 8.0%, due 2003 to 2010 ÏÏÏÏÏÏÏÏ $175.0 $175.0

Revolving Credit Facility, interest rate 3.7%, due 2006ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 50.0 195.0

225.0 370.0

Less current portionÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì

Total long-term debt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $225.0 $370.0

Energizer maintains total committed long-term debt facilities of $625.0, of which $400.0 remained

available as of September 30, 2001.

Under the terms of the facilities, the ratio of Energizer's total indebtedness to its EBITDA cannot be

greater than 3 to 1 and the ratio of its EBIT to total interest expense must exceed 3 to 1.

Aggregate maturities on all long-term debt are as follows: $15.0 in 2003, $160.0 in 2005 and $50.0

thereafter.

(13) Sale of Accounts Receivable

Energizer entered into an agreement to sell, on an ongoing basis, a pool of domestic trade accounts

receivable to a wholly owned bankruptcy-remote subsidiary of Energizer. The subsidiary qualiÑes as a Special

43