Energizer 2001 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2001 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

page 3 RELYING ON OUR PROVEN STRENGTHS | page 4 PRIMARY AND MINIATURE BATTERIES | page 7 FLASHLIGHTS AND LIGHTING | page 8 WORLD MARKETS AND GLOBAL OPERATIONS

page 9 FINANCIAL REVIEW | inside back cover CORPORATE INFORMATION

CONTENTS

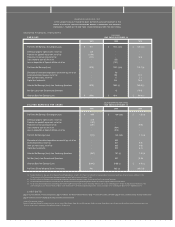

(a) Energizer Holdings, Inc. was spun off from Ralston Purina Company (Ralston) on April 1, 2000. The pro forma fiscal 2000 financial data is presented assuming the spin-off had occurred as of October 1, 1999.

The pro forma fiscal 1999 financial data is presented assuming the spin-off had occurred as of October 1, 1998.

(b) Fiscal 2000 reflects the elimination of the one month lag in reporting of international operations' results. See discussion in Note 2 to the financial statements.

(c) The historical financial information for fiscal years 2000 and 1999 reflect the period during which Energizer was operated as a business segment of Ralston Purina Company.

(d) The pro forma diluted weighted shares outstanding is based on the weighted average number of shares outstanding of Ralston common stock outstanding prior to the spin-off (adjusted for the distribution of one

share of Energizer stock for each three shares of Ralston stock) and in fiscal 2000, the diluted weighted-average number of shares of Energizer stock outstanding from April 1, 2000 to September 30, 2000.

EARNINGS [MILLIONS]

YEAR ENDED SEPTEMBER 30

2001 2000 1999

2001 2000 1999

Copyright © Eveready Battery Company, Inc.

Energizer, e2, Energizer MAX, Eveready, Eveready Super Heavy Duty, Cat & Nine Design, E-SNAP, EZChange, Folding LED, Pocket LED, DoubleBarrel, Find M e, Comfort Grip, Energizer Outfitter Lantern, Energizer Bunny, Energizer Bunny Design, Energizer Battery Character and

”Do you have the Bunny inside?“ are trademarks of Eveready Battery Company, Inc. All rights reserved.

ENERGIZER HOLDINGS, INC.

IS THE LARGEST PUBLICLY TRADED PRIMARY BATTERY/FLASHLIGHT COMPANY IN THE

WORLD WITH TWO OF THE MOST RECOGNIZED BRANDS IN ENERGIZER®AND EVEREADY®.

ENERGIZER IS TRADED ON THE NEW YORK STOCK EXCHANGE UNDER THE ENR SYMBOL.

SELECTED FINANCIAL HIGHLIGHTS

Pro Forma Net Earnings, Excluding Unusuals $ 87.1 $ 154.1 (a)(b) $ 125.2 (a)

Intellectual property rights income, net of tax 12.3 - -

Provision for goodwill impairment, net of tax (119.0) - -

Provisions for restructuring, net of tax (19.4) - (8.3)

Costs related to spin-off, net of tax - (3.3) -

Loss on disposition of Spanish affiliate, net of tax - (15.7) -

Pro Forma Net Earnings/(Loss) (39.0) 135.1 (a)(b) 116.9 (a)

Elimination of international operations one month lag, net of tax - 9.0 -

Incremental interest expense, net of tax - 10.0 21.2

Other pro forma costs, net of tax - 1.7 5.1

Capital loss tax benefits - 24.4 16.6

Historical Net Earnings/(Loss) from Continuing Operations (39.0) 180.2 (c) 159.8 (c)

Net Gain (Loss) from Discontinued Operations - 1.2 (79.8)

Historical Basis Net Earnings/(Loss) $ (39.0) $ 181.4 $ 80.0 (c)

DILUTED EARNINGS PER SHARE [DILUTED EARNINGS PER SHARE]

YEAR ENDED SEPTEMBER 30

Pro Forma Net Earnings, Excluding Unusuals $ 0.93 $ 1.60 (a)(b) $ 1.22 (a)

Intellectual property rights income, net of tax 0.13 - -

Provision for goodwill impairment, net of tax (1.27) - -

Provisions for restructuring, net of tax (0.21) - (0.08)

Costs related to spin-off, net of tax - (0.04) -

Loss on disposition of Spanish affiliate, net of tax - (0.16) -

Pro Form Net Earnings/(Loss) (0.42) 1.40 (a)(b) 1.14 (a)

Elimination of international operations one month lag, net of tax - 0.09 -

Incremental interest, net of tax - 0.11 0.21

Other pro forma costs, net of tax - 0.02 0.05

Capital loss tax benefits - 0.25 0.16

Historical Net Earnings/(Loss) from Continuing Operations (0.42) 1.87 (c) 1.56 (c)

Net Gain (Loss) from Discontinued Operations - 0.01 (0.78)

Historical Basis Net Earnings/(Loss) $(0.42) $1.88 (c) $ 0.78 (c)

Pro Forma Diluted Weighted Shares Outstanding 94.1 96.3 (d) 102.6 (d)