Energizer 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

(Dollars in millions except per share data)

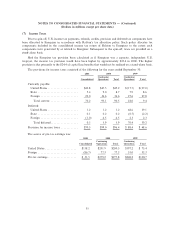

The Investment in Discontinued Operations at September 30, 1999 was primarily comprised of Ñxed

assets, inventory and accounts receivable and payable. Results for discontinued operations for 1999 were as

follows: net sales, $64.2; loss before income taxes, $9.0; income tax beneÑt, $3.4; and net loss from

discontinued operations, $5.6.

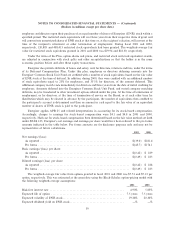

(5) Restructuring Activities

Because there continues to be a migration of consumer demand from carbon zinc to alkaline batteries, a

comprehensive study of Energizer's carbon zinc facilities to determine the optimum number of carbon zinc

manufacturing plants was completed in the fourth quarter of Ñscal 2001. Energizer also reviewed its worldwide

operations in light of competitive market conditions and available technologies and techniques, and is

adjusting its organization accordingly. As a result, Energizer adopted restructuring plans to eliminate carbon

zinc capacity, and to reduce and realign certain selling, production, research and administrative functions. The

total cost associated with this plan is expected to be $35.6 before taxes, of which $29.8, or $19.4 after-tax, was

recorded in the fourth quarter, with the remainder expected to be recorded in the Ñrst quarter of Ñscal 2002.

These restructuring activities are expected to improve the Company's operating eÇciency, downsize and

centralize corporate functions, and decrease costs. The plans will result in the closure of one carbon zinc

production facility in South and Central America, and the severance of 570 employees, consisting of

375 production and 195 sales, research and administrative employees, primarily in the United States and

South and Central America.

The restructuring charges consist of non-cash Ñxed asset impairment charges of $11.1 for the closed

carbon zinc plant and production equipment, enhanced pension beneÑts for certain terminated U.S. employees

of $8.3, cash severance payments of $6.3, and other cash charges of $4.1.

During 1999, Energizer recorded net provisions for restructuring of $8.3 after-tax, or $9.9 pre-tax, $2.1 of

which represented inventory write-downs and is classiÑed as cost of products sold in the Consolidated

Statement of Earnings. Of the net pre-tax charge, $7.4 relates to the 1999 restructuring plans for the

elimination of certain production capacity in North America and in Asia.

The pre-tax charge of $7.4 for 1999 plans consisted of termination beneÑts of $3.2, other cash costs of $.2

and Ñxed asset impairments of $4.0. The Ñxed asset impairments primarily relate to assets used for the

production of lithium coin cells in North America. These assets were idled and scrapped in 1999.

The 1999 restructuring plan provided for the termination of approximately 170 production and

administrative employees and the closure of one plant in Asia. This plant closure was precipitated by the

Ñnancial problems in the Asian market, which resulted in contractions in battery markets in this area. All

actions associated with these charges were completed as of September 30, 2000.

The remaining $2.5 represented additional net provisions related to prior years' restructuring plans.

Additional termination beneÑts of $5.5 primarily represent enhanced severance related to a European plant

closing in the 1997 restructuring plan. Additional provisions for other cash costs of $1.8 were recorded for Ñxed

asset disposition costs for previously held-for-use assets related to the 1997 restructuring plan that were idled

and held for disposal. Other non-cash charges of $2.1 relate to inventory write-oÅs, which were more than

oÅset by a reclassiÑcation of $4.5 from other comprehensive income to net income of cumulative translation

adjustment for a subsidiary sold in connection with the 1997 plan. Also recorded in 1999 were asset proceeds

greater than anticipated of $5.4, related to 1994, 1995 and 1997 restructuring plans.

As of September 30, 2001, except for the disposition of certain assets held for disposal, all activities

associated with the 1994 through 1999 restructuring plans are complete. The carrying value of assets held for

disposal under all restructuring plans was $2.6 at September 30, 2001.

33