Energizer 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

(Dollars in millions except per share data)

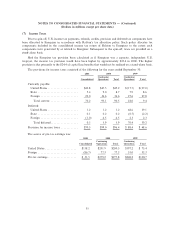

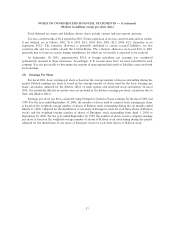

Total deferred tax assets and liabilities shown above include current and non-current amounts.

Tax loss carryforwards of $1.4 expired in 2001. Future expiration of tax loss carryforwards and tax credits,

if not utilized, are as follows: 2002, $1.6; 2003, $4.2; 2004, $4.6; 2005, $3.5; 2006, $2.2; thereafter or no

expiration, $12.5. The valuation allowance is primarily attributed to certain accrued liabilities, tax loss

carryforwards and tax credits outside the United States. The valuation allowance increased $4.0 in 2001

primarily due to losses in certain foreign subsidiaries for which no tax beneÑt is expected to be realized.

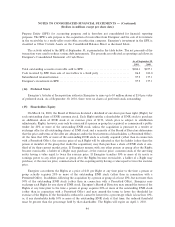

At September 30, 2001, approximately $52.8 of foreign subsidiary net earnings was considered

permanently invested in those businesses. Accordingly, U.S. income taxes have not been provided for such

earnings. It is not practicable to determine the amount of unrecognized deferred tax liabilities associated with

such earnings.

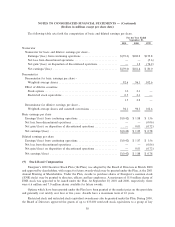

(8) Earnings Per Share

For Ñscal 2001, basic earnings per share is based on the average number of shares outstanding during the

period. Diluted earnings per share is based on the average number of shares used for the basic earnings per

share calculation, adjusted for the dilutive eÅect of stock options and restricted stock equivalents. In Ñscal

2001, the potentially dilutive securities were not included in the dilutive earnings per share calculation due to

their anti-dilutive eÅect.

Earnings per share has been calculated using Energizer's historical basis earnings for the Ñscal 2000 and

1999. For the year ended September 30, 2000, the number of shares used to compute basic earnings per share

is based on the weighted-average number of shares of Ralston stock outstanding during the six months ended

March 31, 2000 (adjusted for the distribution of one share of Energizer stock for each three shares of Ralston

stock) and the weighted-average number of shares of Energizer stock outstanding from April 1, 2000 to

September 30, 2000. For the year ended September 30, 1999, the number of shares used to compute earnings

per share is based on the weighted-average number of shares of Ralston stock outstanding during the period,

adjusted for the distribution of one share of Energizer stock for each three shares of Ralston stock.

37