Energizer 2001 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2001 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.currencies to which Energizer's foreign aÇliates are exposed include the U.S. dollar, the Euro and the British

pound, while domestic aÇliates are primarily exposed to the Swiss franc.

Energizer's hedging strategy involves the use of natural hedging techniques, where possible, such as the

oÅsetting or netting of like foreign currency cash Öows. Where natural hedging techniques are not possible,

foreign currency derivatives with a duration of generally one year or less may be used, including forward

exchange contracts, purchased put and call options, and zero-cost option collars. Energizer policy allows

foreign currency derivatives to be used only for identiÑable foreign currency exposures and, therefore,

Energizer does not enter into foreign currency contracts for trading purposes where the sole objective is to

generate proÑts. Energizer has not designated any Ñnancial instruments as hedges for accounting purposes in

the three years ended September 30, 2001.

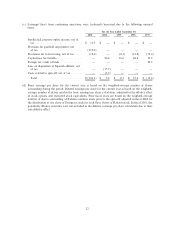

Market risk of foreign currency derivatives is the potential loss in fair value of net currency positions for

outstanding foreign currency contracts at Ñscal year-end, resulting from a hypothetical 10% adverse change in

all foreign currency exchange rates. Market risk does not include foreign currency derivatives that hedge

existing balance sheet exposures, as any losses on these contracts would be fully oÅset by exchange gains on

the underlying exposures for which the contracts are designated as hedges. Accordingly, the market risk of

Energizer's foreign currency derivatives at September 30, 2001 and 2000 amounts to $1.9 and $2.6,

respectively.

Energizer generally views as long-term its investments in foreign subsidiaries with a functional currency

other than the U.S. dollar. As a result, Energizer does not generally hedge these net investments. Capital

structuring techniques are used to manage the net investment in foreign currencies as considered necessary.

Additionally, Energizer attempts to limit its U.S. dollar net monetary liabilities in currencies of hyperinÖation-

ary countries, primarily in Latin America. In terms of foreign currency translation risk, Energizer is exposed to

the Swiss franc and other European currencies; the Mexican and Argentine peso and other Latin American

currencies; and the Singapore dollar, Chinese renminbi, Australian and Hong Kong dollars, and other Asian

currencies. Energizer's net foreign currency investment in foreign subsidiaries and aÇliates translated into

U.S. dollars using year-end exchange rates was $329.2 and $515.1 at September 30, 2001 and 2000,

respectively. The potential loss in value of Energizer's net foreign currency investment in foreign subsidiaries

resulting from a hypothetical 10% adverse change in quoted foreign currency exchange rates at September 30,

2001 and 2000 amounts to $32.9 and $51.5, respectively.

RECENTLY ISSUED ACCOUNTING STANDARDS

See discussion in Note 2 to the Consolidated Financial Statements.

FORWARD-LOOKING INFORMATION

Statements in the Management's Discussion and Analysis of Results of Operations and Financial

Condition and other sections of this Annual Report to Shareholders that are not historical, particularly

statements regarding Energizer's commitment to maintaining technological leadership, the impact of Ener-

gizer's restructuring activity, the future adequacy of cash Öows and Energizer's ability to meet liquidity

requirements, the impact of inÖationary pressures, the impact of future expenditures for environmental

matters and equipment, the impact of adverse changes in interest rates, the market risk of foreign currency

derivatives, and the potential loss in value of Energizer's net foreign currency investment in foreign

subsidiaries, may be considered forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. The Company cautions readers not to place undue reliance on any forward-

looking statements, which speak only as of the date made.

The Company advises readers that various risks and uncertainties could aÅect its Ñnancial performance

and could cause the Company's actual results for future periods to diÅer materially from those anticipated or

projected. The high cost of research and development activities, shifts in consumer demand from higher

quality to lower-priced batteries, and patented innovations by competitors, could aÅect the Company's

commitment or ability to maintain its technological leadership. Severance costs and other expenses associated

with current and proposed restructuring activity may be higher than anticipated, and there may be unknown

19