Energizer 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Discontinued operations consist of Energizer's worldwide rechargeable Original Equipment Manufactur-

ers' (OEM) battery business. On November 1, 1999, that business was sold to Moltech Corporation for

approximately $20.0.

OPERATING RESULTS

Net Sales

Net sales to customers decreased $205.1, or 11%, in 2001 compared to 2000 with unfavorable pricing and

product mix, lower volumes and currency devaluation each accounting for about one-third of the decline. In

2000, net sales to customers increased $49.2, or 3%, primarily on growth in North America, partially oÅset by

declines in Europe. See comments on sales changes by region in the Segment Results section below.

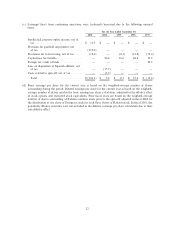

Gross Margin

Gross margin dollars decreased $172.0, or 20%, in 2001 primarily on lower sales in North America and

Asia PaciÑc. Gross margin percentage declined 4.7 percentage points in 2001 to 41.0% on lower sales. Gross

margin dollars increased $64.7, or 8%, in 2000 on increases in North America and Asia PaciÑc, partially oÅset

by declines in Europe. The margin percentage in 2000 improved 2.2 percentage points to 45.8% compared to

1999 on higher volume and lower production costs in North America and Asia PaciÑc as well as lower costs in

South and Central America.

Selling, General and Administrative

Selling, general and administrative expense decreased $24.5, or 7%, in 2001 on lower corporate, Asia

PaciÑc and Europe expenses. In 2000, selling, general and administrative expense decreased $23.6, or 6%, on

lower corporate and Europe expenses, partially oÅset by increases in North America. Selling, general and

administrative expenses were 18.9%, 17.9% and 19.6% of sales in 2001, 2000 and 1999, respectively.

Advertising and Promotion

Advertising and promotion decreased $31.1, or 19%, in 2001 on lower spending in all world areas. In

2000, advertising and promotion increased $26.9, or 20%, on higher spending in North America, partially

oÅset by decreases in Europe. Advertising and promotion as a percent of sales was 7.9%, 8.5% and 7.3% in

2001, 2000 and 1999, respectively.

Segment Results

Energizer's operations are managed via four major geographic areas Ì North America (the United

States, Canada and Caribbean), Asia PaciÑc, Europe, and South and Central America (including Mexico).

This structure is the basis for Energizer's reportable operating segment information presented in Note 20 to

the Consolidated Financial Statements. Energizer evaluates segment proÑtability based on operating proÑt

before general corporate expenses, research and development expenses, restructuring charges, and amortiza-

tion of goodwill and intangibles. Intersegment sales are generally valued at market-based prices, and represent

the diÅerence between total sales and external sales, as presented in Note 20 to the Consolidated Financial

Statements. Segment proÑtability includes proÑt on these intersegment sales.

North America

Net sales to customers decreased $152.9, or 14%, in 2001 with lower volume accounting for slightly more

than half of the decline. Alkaline, carbon zinc and lighting products unit volume decreased 5%, 4% and 17%,

respectively, from 2000, compared to heavy Y2K demand last year, reÖecting retail inventory reductions this

year. Unfavorable pricing and product mix accounted for the remainder of the sales decline, reÖecting

increased promotional spending. Gross margin decreased $120.8 in 2001 on unfavorable pricing and product

mix, lower volume and higher product cost rates associated with lower production levels. Segment proÑt

decreased $106.2, or 34%, as lower gross margin was partially oÅset by lower advertising and promotion

expense.

12