Energizer 2001 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2001 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

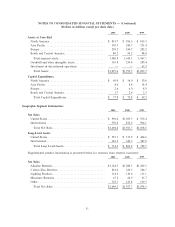

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

(Dollars in millions except per share data)

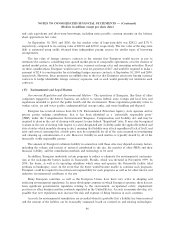

For pension plans with accumulated beneÑt obligations in excess of plan assets, the projected beneÑt

obligation was $10.0 and $9.4 at September 30, 2001 and 2000, respectively. There are no plan assets for these

nonqualiÑed plans as of September 30, 2001.

Pension assets consist primarily of listed common stocks and bonds. The U.S. plan held 1.7 million shares

of ENR stock in both 2001 and 2000. The market values of such stock was $28.8 and $42.4, at September 30,

2001 and 2000, respectively.

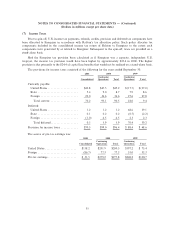

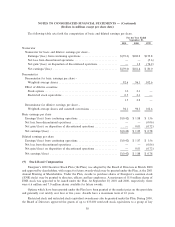

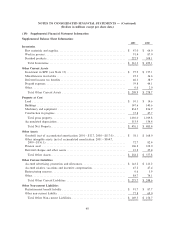

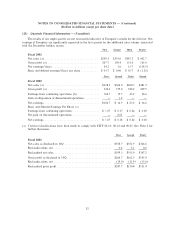

The following table presents pension and postretirement expense for Ñscal 2001 and the period

subsequent to the spin-oÅ (six months ended September 30, 2000).

September 30,

Pension Postretirement

2001 2000 2001 2000

Service costÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 16.6 $ 7.8 $ 0.2 $ 0.1

Interest cost ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 24.5 11.8 6.1 2.8

Expected return on plan assetsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (46.9) (22.4) Ì Ì

Amortization of unrecognized prior service costÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì (0.3) (0.1)

Amortization of unrecognized transition asset ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 0.3 0.1 Ì Ì

Recognized net actuarial/(gain) lossÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (3.3) (1.5) Ì Ì

Net periodic beneÑt cost/(income) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ (8.8) $ (4.2) $ 6.0 $ 2.8

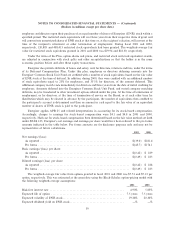

The following table presents assumptions, which reÖect weighted-averages for the component plans, used

in determining the above information.

Pension Postretirement

2001 2000 2001 2000

Discount rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6.6% 6.7% 7.0% 7.0%

Expected return on plan assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 8.7% 8.7% Ì Ì

Compensation increase rate ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5.2% 5.2% Ì Ì

Assumed health care cost trend rates have been used in the valuation of postretirement health insurance

beneÑts as of 2000 and for the beginning of the 2001 valuation. The trend rate used for those periods was 6.5%.

As of September 30, 2001, cost trend rates will no longer materially impact the plan.

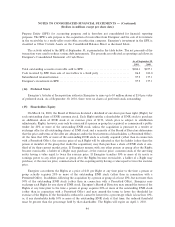

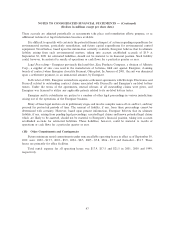

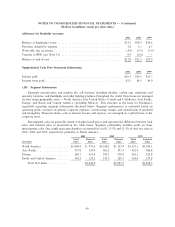

Pre-Spin Pension Plans and Other Postretirement BeneÑts

Prior to the spin-oÅ, Energizer participated in Ralston's noncontributory deÑned beneÑt pension plans

(Plans), which covered substantially all regular employees in the United States and certain employees in other

countries. In Ñscal 1999, Ralston amended the qualiÑed U.S. Pension Plan to allow employees to make an

irrevocable election eÅective January 1, 1999 between two pension beneÑt formulas. Prior to this time, one

beneÑt formula was used. Also eÅective January 1, 1999, assets of the Plan provide employee beneÑts in

addition to normal retirement beneÑts. The additional beneÑt was equal to a 300% match on participants'

after-tax contributions of 1% or 1.75% to the Savings Investment Plan. The cost of the Plans allocated to

Energizer was based on Energizer's percentage of the total liability of the Plans, as shown in the table below.

Prior to the spin-oÅ, Ralston provided health care and life insurance beneÑts for certain groups of retired

Energizer employees. The cost of these beneÑts was allocated to Energizer based on Energizer's percentage of

the total liability related to these beneÑts. Ralston also sponsored plans whereby certain management

employees could defer compensation for cash beneÑts after retirement. The cost of these postretirement

beneÑts is shown in the table below.

42