Energizer 2001 Annual Report Download - page 17

Download and view the complete annual report

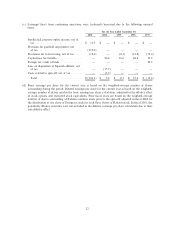

Please find page 17 of the 2001 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Segment proÑt for South and Central America decreased $2.4, or 17%, in 2000 as higher marketing,

distribution and management costs were partially oÅset by the gross margin increase.

General Corporate Expenses

General corporate expenses decreased $16.2 in 2001 compared to 2000 due to lower incentive and stock

compensation costs, higher pension income, and favorable proÑt-in-inventory adjustments associated with

decreased intercompany inventory levels, partially oÅset by higher management costs, including the incremen-

tal costs of operating as a stand-alone company for a full year, compared to six months in Ñscal 2000. General

corporate expenses decreased $16.6 in 2000 due to higher pension income and lower consulting, reorganization

and information systems costs, as well as a lighting product recall charge in 1999. These costs were partially

oÅset by additional costs of operating as a stand-alone company for the last six months of Ñscal 2000. As a

percent of sales, general corporate expenses were 1.2% in 2001, 1.9% in 2000 and 2.9% in 1999.

Research and Development Expense

Research and development expense was $46.4 in 2001, $49.9 in 2000 and $48.5 in 1999. Energizer strives

to maintain technological leadership in the primary battery business. Research and development costs were

slightly higher in 2000 and 1999 due to increased activity related to Energizer e2. As a percent of sales,

research and development expense was 2.7% in 2001 and 2.6% in 2000 and 1999.

Goodwill Impairment Charge

Energizer monitors changing business conditions, which may indicate that the remaining useful life of

goodwill and other intangible assets may warrant revision, or carrying amounts may require adjustment.

Continuing unfavorable business trends in Europe, and the unfavorable costs of U.S. dollar-based products

resulting from currency declines, represent such conditions. As part of its annual business planning cycle,

Energizer performed a thorough evaluation of its European business in the fourth quarter of Ñscal 2001, which

resulted in an impairment charge for $119.0 of related goodwill. At September 30, 2001, the carrying amount

of goodwill related to Energizer's European business was $8.5.

Restructuring Charges

Energizer recorded restructuring charges each year from 1994 through 1999, and in 2001. These charges

included a reduction in carbon zinc plant capacity as demand for this type of battery continues to decline,

plant closures for the movement and consolidation of alkaline production to new or more eÇcient locations in

an eÅort to achieve lower product costs, and staÇng reorganizations and reductions in various world areas to

enhance management eÅectiveness and reduce overhead costs. A detailed discussion of such charges and

expenditures during 1999 through 2001 follows.

Because there continues to be a migration of consumer demand from carbon zinc to alkaline batteries, a

comprehensive study of Energizer's carbon zinc facilities to determine the optimum number of carbon zinc

manufacturing plants was completed in the fourth quarter of Ñscal 2001. Energizer also reviewed its worldwide

operations in light of competitive market conditions and available technologies and techniques, and is

adjusting its organization accordingly. As a result, Energizer adopted restructuring plans to eliminate carbon

zinc capacity, and to reduce and realign certain selling, production, research and administrative functions. The

total cost associated with this plan is expected to be $35.6 before taxes, of which $29.8 ($19.4 after-taxes, or

$.21 per share) was recorded in the fourth quarter, with the remainder expected to be recorded in the Ñrst

quarter of Ñscal 2002.

These restructuring activities are expected to improve the Company's operating eÇciency, downsize and

centralize corporate functions, and decrease costs. The plans will result in the closure of one carbon zinc

production facility in South and Central America, and the severance of 570 employees, consisting of 375

production and 195 sales, research and administrative employees, primarily in the United States and South

and Central America.

14