Energizer 2001 Annual Report Download - page 20

Download and view the complete annual report

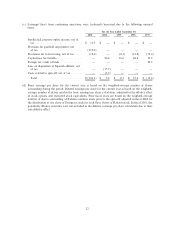

Please find page 20 of the 2001 Energizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Working capital was $288.1 and $401.7 at September 30, 2001 and 2000, respectively. Capital

expenditures totaled $77.9, $72.8 and $69.2 in 2001, 2000 and 1999, respectively. These expenditures were

funded by cash Öow from operations. Capital expenditures of approximately $50.0 are anticipated in 2002 and

are expected to be Ñnanced with funds generated from operations. Net transactions with Ralston, prior to the

spin-oÅ, resulted in cash usage of $210.7 and $293.7 in 2000 and 1999, respectively.

Immediately prior to the spin-oÅ, Ralston borrowed $478.0 through several interim-funding facilities and

assigned all repayment obligations of those facilities to Energizer. In April and May of 2000, Energizer

entered into separate Ñnancing agreements and repaid the interim funding facilities. Total long-term debt

outstanding of $225.0 at September 30, 2001 includes $50.0 of borrowings with a variable interest rate.

Energizer maintains total committed debt facilities of $625.0, of which $400.0 remained available as of

September 30, 2001.

Under the terms of the facilities, the ratio of Energizer's total indebtedness to its EBITDA cannot be

greater than 3 to 1 and the ratio of its EBIT to total interest expense must exceed 3 to 1. Energizer's ratio of

total indebtedness to EBITDA was 1.5 to 1 and the ratio of EBIT to total interest expense was 5 to 1 as of

September 30, 2001.

In Ñscal 2000, Energizer entered into an agreement to sell, on an ongoing basis, a pool of domestic trade

accounts receivable to a wholly owned bankruptcy-remote subsidiary of Energizer. Energizer received $100.0

of net proceeds from this arrangement in Ñscal 2000, which was used to repay interim funding facilities as

discussed above. Net proceeds received from this arrangement declined $13.8 in 2001 as a result of lower

qualifying accounts receivable. See Note 13 to the Consolidated Financial Statements for further discussion

regarding the sale of accounts receivable.

In September 2000, Energizer's Board of Directors approved a share repurchase plan authorizing the

repurchase of up to 5 million shares of Energizer's common stock. As of September 30, 2001, approximately

3.8 million shares, or $79.6, of Energizer common stock had been purchased under the authorization. No

shares were purchased after Ñscal 2001 year-end.

Energizer believes that cash Öows from operating activities and periodic borrowings under existing credit

facilities will be adequate to meet short-term and long-term liquidity requirements prior to the maturity of

Energizer's credit facilities, although no guarantee can be given in this regard.

INFLATION

Management recognizes that inÖationary pressures may have an adverse eÅect on Energizer through

higher asset replacement costs and related depreciation, and higher material, labor and other costs. Energizer

tries to minimize these eÅects through cost reductions and productivity improvements as well as price

increases to maintain reasonable proÑt margins. It is management's view, however, that inÖation has not had a

signiÑcant impact on operations in the three years ended September 30, 2001.

SEASONAL FACTORS

Energizer's results are signiÑcantly impacted in the Ñrst quarter of the Ñscal year by the additional sales

volume associated with the December holiday season, particularly in North America. First quarter sales

accounted for 33%, 35% and 31% of total net sales in 2001, 2000 and 1999, respectively. The Ñrst quarter

percentage in 2000 was also higher due to Y2K-driven demand.

ENVIRONMENTAL MATTERS

The operations of Energizer, like those of other companies engaged in the battery business, are subject to

various federal, state, foreign and local laws and regulations intended to protect the public health and the

environment. These regulations primarily relate to worker safety, air and water quality, underground fuel

storage tanks, and waste handling and disposal.

17