EasyJet 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accounts & other information

Notes to the accounts

continued

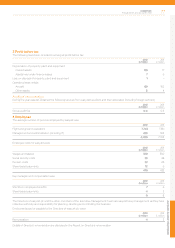

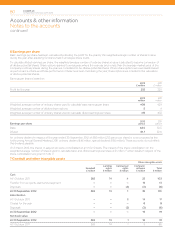

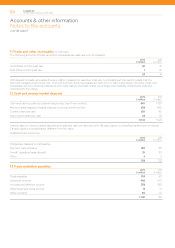

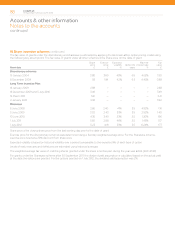

6 Earnings per share

Basic earnings per share has been calculated by dividing the profit for the year by the weighted average number of shares in issue

during the year after adjusting for shares held in employee share trusts.

To calculate diluted earnings per share, the weighted average number of ordinary shares in issue is adjusted to assume conversion of

all dilutive potential shares. Share options granted to employees where the exercise price is less than the average market price of the

Company’s ordinary shares during the year are considered to be dilutive potential shares. Where share options are exercisable based

on performance criteria and those performance criteria have been met during the year, these options are included in the calculation

of dilutive potential shares.

Earnings per share is based on:

2012

£ million

2011

£ million

Profit for the year 255 225

2012

million

2011

million

Weighted average number of ordinary shares used to calculate basic earnings per share 408 429

Weighted average number of dilutive share options 5 4

Weighted average number of ordinary shares used to calculate diluted earnings per share 413 433

Earnings per share 2012

pence

2011

pence

Basic 62.5 52.5

Diluted 61.7 52.0

An ordinary dividend in respect of the year ended 30 September 2012 of £85 million (21.5 pence per share) is to be proposed at the

forthcoming Annual General Meeting (2011: ordinary dividend £46 million, special dividend £150 million). These accounts do not reflect

this dividend payable.

On 5 March 2012, the shares of easyJet plc were consolidated on an 11 for 12 basis. The impact of the share consolidation on the

weighted average number of shares used to calculate basic and diluted earnings per share is 21 million. Further details in respect of the

share consolidation are given in note 17.

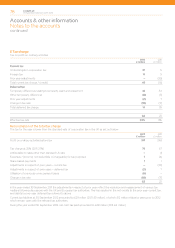

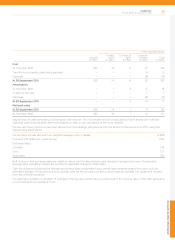

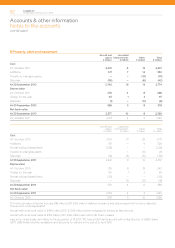

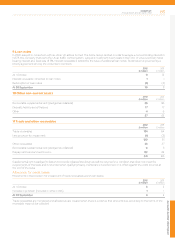

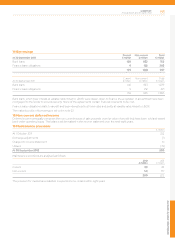

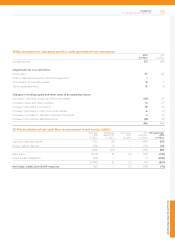

7 Goodwill and other intangible assets

Other intangible assets

Goodwill

£ million

Landing

rights

£ million

Contractual

rights

£ million

Computer

software

£ million

Total

£ million

Cost

At 1 October 2011 365 74 4 25 103

Transfer from property, plant and equipment – – – 13 13

Disposals – – (3) (3) (6)

At 30 September 2012 365 74 1 35 110

Amortisation

At 1 October 2011 – – 3 14 17

Charge for the year – – – 8 8

Disposals – – (3) (3) (6)

At 30 September 2012 – – – 19 19

Net book value

At 30 September 2012 365 74 1 16 91

At 1 October 2011 365 74 1 11 86

easyJet plc

Annual report and accounts 2012

80