EasyJet 2012 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fuel

2012 2011

£ million

£ per

seat

Pence

per ASK £ million

£ per

seat

Pence

per ASK

Fuel 1,149 17.45 1.59 917 14.68 1.32

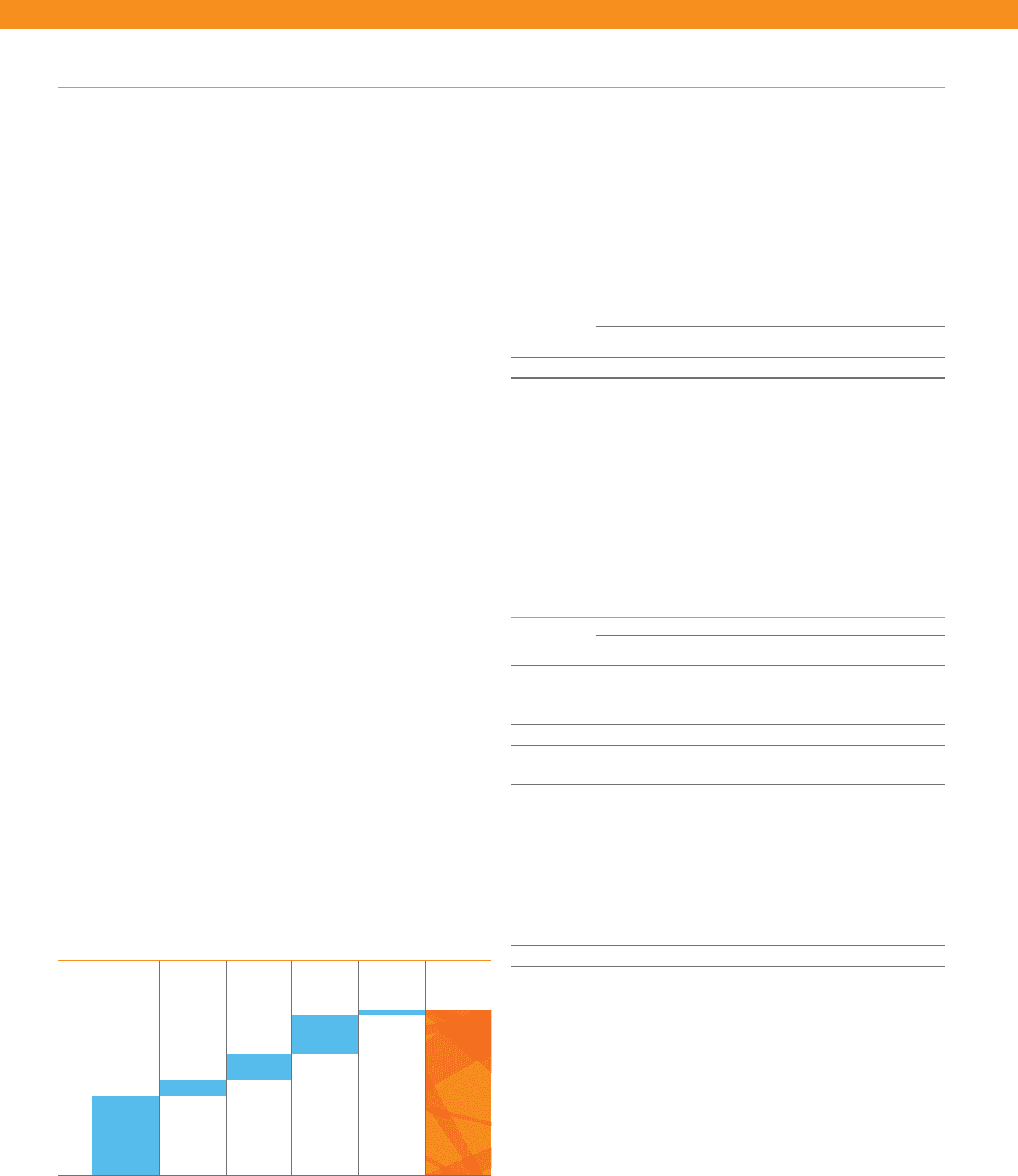

The market price for jet fuel remained high and volatile over the

year, mostly in excess of $1,000 per tonne. Our hedging activities

continued to defer the full impact of this. Average price paid

increased by $164 to $982 per tonne; in sterling terms an increase

of£110 to £618. Of the total increase in fuel costs of £232 million,

£182 million (£2.77 per seat) is due to the roll off of fuel purchases

hedged at favourable rates.

Forward purchases of 1.8 million tonnes of fuel for 2013 and 2014

were executed during the periodic dips below $1,000 at an average

price of $992 per tonne. As a result the hedged percentages are

78% for 2013 at $985 per tonne and 55% for 2014 at $993 per tonne.

Ownership costs

2012 2011

£ million

£ per

seat

Pence

per ASK £ million

£ per

seat

Pence

per ASK

Aircraft

dryleasing 95 1.44 0.13 109 1.75 0.16

Depreciation 97 1.47 0.14 83 1.33 0.12

Amortisation 8 0.12 0.01 7 0.12 0.01

Interest

receivable (10) (0.14) (0.01) (9) (0.15) (0.01)

Interest

payable

andother

financing

charges 25 0.38 0.03 24 0.38 0.03

Net

exchange

(gains) /

losses (1) (0.02) – 6 0.09 0.01

214 3.25 0.30 220 3.52 0.32

Ownership costs declined slightly to £3.25 per seat; continuing

recent strong performance.

The final two Boeing 737 aircraft were returned to lessors during

thefirst quarter, and we now operate a standardised fleet with

twogauges of Airbus aircraft. Depreciation cost per seat increased

by £0.14 to £1.47 driven by the increased proportion of owned

aircraft in the fleet.

The leased proportion of the fleet is currently 26%, which is below

the objective of a 70% owned and 30% leased fleet mix, as

completion of a number of leases was deferred into the first

quarterof the coming financial year. The recent trend of declining

ownership costs is not expected to continue at the same rate,

although the increasing proportion of A320 aircraft in the fleet will

continue to deliver some reductions to depreciation and aircraft

dryleasing costs per seat.

Exchange gains and losses arise from changes in the value of

monetary assets and liabilities denominated in currencies other

than sterling. Fluctuations of the size seen in the last two years

are within the range of expectations given the size of the related

foreign currency cash flows.

Operating costs per seat excluding fuel decreased by 0.3% to

£33.00. At constant currency, operating costs per seat excluding

fuel increased by 2.8% to £34.01 per seat.

Ground operations cost per seat fell by 2.0% but increased by 1.6%

excluding the effect of changes in exchange rates. Although costs

have decreased due to the relatively benign winter weather and

better controls over the use of de-icing fluid, as well as savings on

contract renegotiations with ground handlers, this has been offset

by significant increase at airports operated in Spain by AENA and

adoubling of charges for on-ground navigation services in Italy.

Thefurther increases in AENA charges were a factor in our decision

to withdraw the six aircraft based in Madrid from December 2012.

Crew cost per seat increased by 0.6%, and by 2.8% at constant

currency driven by an average 2% increase in salaries and disciplined

thinning of capacity during the winter months.

Navigation costs fell 6.7% to £4.25 per seat and were down 1.2%

atconstant currency despite regulated cost increases averaging 2%.

This reduction is driven by the increased proportion of A320 aircraft

in the fleet and a slightly shorter average sector length as capacity

based on the European mainland continues to grow at a faster rate

than in the UK.

Maintenance costs have been declining for a number of years, but

increased this year by 7.7% to £3.08 per seat; similar to the level

seen in 2010. This increase is driven by one-off items that are

unlikelyto recur. The cost benefits from reducing the proportion

ofleased aircraft in the fleet have now come to an end, and

theaverage age of the fleet is gradually increasing as planned.

Weare investing in process improvements that will maintain our

costposition in the future.

Other costs increased by 11.3% to £3.05 per seat. This is due to

investment in IT infrastructure, and higher performance-related

employee costs, reflecting the significantly improved profitability

ofthe business. This was partly offset by unusually low levels of

operational disruption resulting in lower compensation payments

under EU Regulation EU261/2004.

Fuel cost

£ million

900

700

1,200

1,000

800

1,100

1,149

2011 2012Volume Market price Jet hedging Foreign

exchange

hedging

917

42

73

104 13

Performance and risk

Financial review

continued

easyJet plc

Annual report and accounts 2012

22