EasyJet 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Key performance indicators

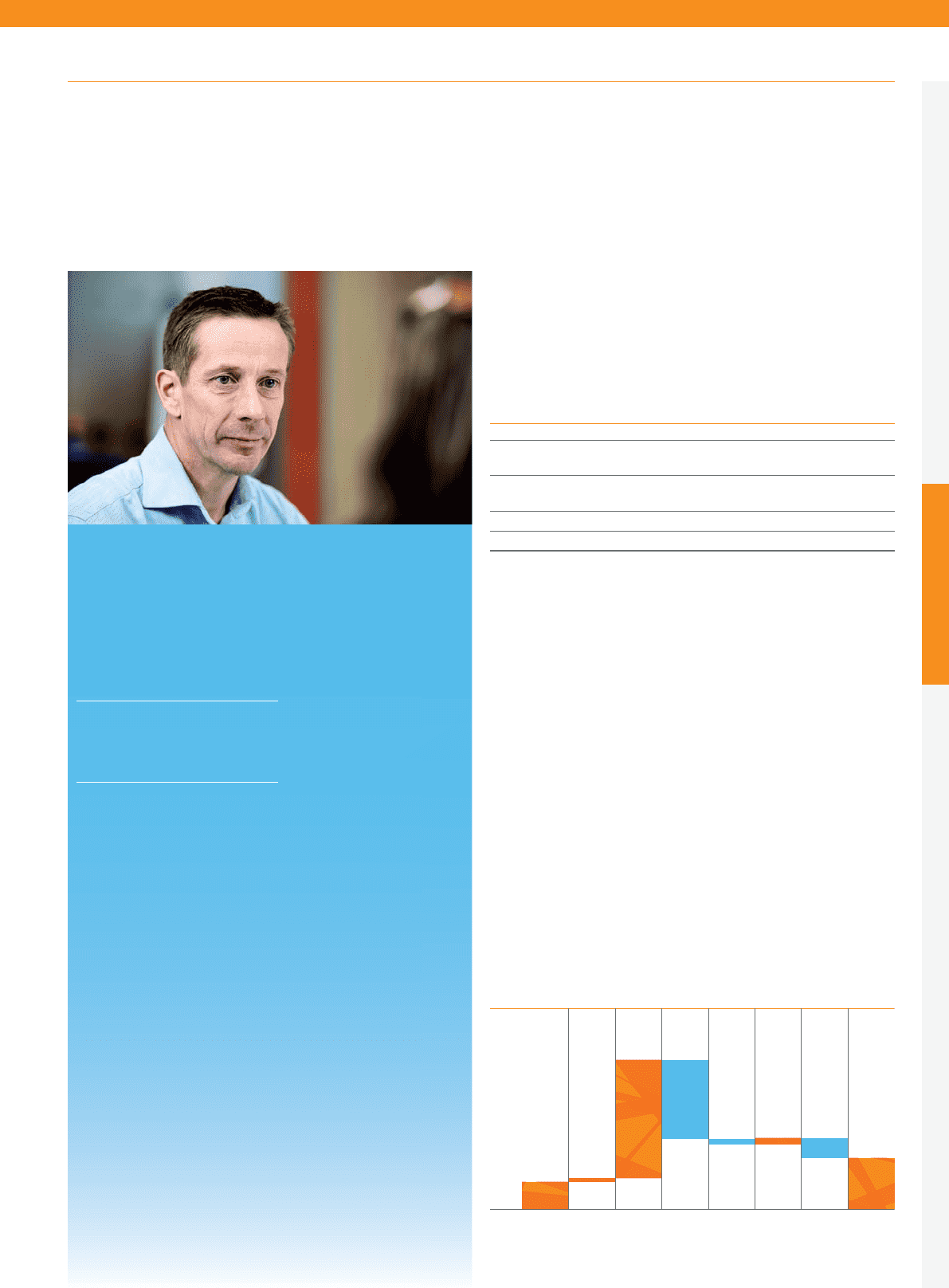

easyJet has delivered a strong financial performance for the 2012

financial year, despite continuing macroeconomic challenges across

Europe and fuel prices remaining both high and volatile. Profit

before tax grew by 27.9% to £317 million, resulting in profit before

tax per seat of £4.81; close to our ambition of £5. Profit after tax was

£255 million, an increase of 13.3% from £225 million last year.

Return on capital employed and capital structure

2012 2011 Change

ROCE – excluding operating

leasesadjustment 14.5% 12.7% +1.8ppt

ROCE – including operating

leasesadjustment 11.3% 9.8% +1.5ppt

Return on equity 14.6% 14.0% +0.6ppt

Gearing 29% 28% +1ppt

When return on capital employed was introduced as a key

performance indicator in 2010, the decision was taken not to adjust

the calculation for aircraft held under operating leases. This was in

the expectation that the IASB’s leasing project would complete in a

relatively short time frame, resulting in all leases being shown on the

statement of financial position.

Over the last year it has become clear that this process is far from

complete and the accounting position is not expected to change

before our 2016 financial year at the earliest. Consequently it has

been decided to amend our ROCE calculation to reflect appropriately

the impact on return on capital of aircraft held under operating

leases by capitalising that at seven times the annual lease rental,

inline with market practice. While the returns indicated by the new

measure are lower, the measures are closely correlated and both

oldand new measures indicate returns in excess of cost of capital.

ROCE including operating leases adjustment for the year was 11.3%,

an increase of 1.5 percentage points from the previous year.

Return on equity improved by 0.6 percentage points to 14.6%. This

increase is lower than that seen in either ROCE measure due to the

increase in effective tax rate from 9% last year to 20% this year.

During the year good progress has been made on reducing excess

liquidity and capital by paying a special dividend of £150 million and

repaying £162 million of relatively high-coupon mortgage debt.

Gearing was stable at 29% (2011: 28%).

Profit before tax per seat

%

6.0

3.0 2012

9.0

7.0

5.0

4.0

8.0

4.81

2011 Currency

impact

(excl fuel)

Revenue Fuel

(inc fuel)

Crew Disruption Other cost 2012 PBT

per seat

3.97 0.12

4.14 (2.77)

(0.18) (0.69)

0.22

Performance and risk

Financial review

Performance and risk

easyJet plc

Annual report and accounts 2012 19

We will maintain a robust capital

structure and deliver sustainable

returns to shareholders.

Chris Kennedy

Chief Financial Officer

£4.81

Profit before tax per seat

(2011: £3.97) +21.3%

11.3%

ROCE (including operating

leases adjustment)

(2011: 9.8%) +1.5ppt