EasyJet 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

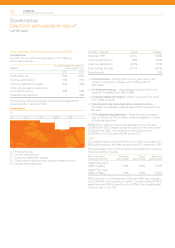

How is remuneration structured for 2013?

Element Purpose and link to strategy Operation for 2013 Performance metrics

Changes effective for

2012 / 13 financial year and

associated rationale

Salary To provide a core reward

for the role

Sufficient level to recruit

and retain individuals

of the necessary calibre

to execute our

business strategy

Annual review with any change

effective from 1 October

Set by reference to companies

of a similar size and complexity

targeted at or around median

Scope of the role and

responsibilities, performance,

experience and potential retention

issues are also considered

None, although overall

performance of the

individual is taken

into account in

reviewing salaries

Neither the CEO or CFO

has received a salary

increase since joining in

July 2010

The CEO will not receive

an increase at this time.

The CFO received a salary

increase of 2.5% effective

1 October 2012, in line with

those across the wider

workforce. This results

in the following salaries:

CEO £665,000 and

CFO £410,000

Benefits In line with the Company’s

strategy to keep

remuneration simple and

consistent, the Executive

Directors receive no

conventional executive

Company benefits

Executives can pay for voluntary

benefits, where Company

purchasing power may provide

an advantage to employees

Executives receive modest

personal accident and life

assurance cover (0.5 x salary),

at the same levels as the wider

employee population

– No change

Pension To provide employees with

long-term savings via

modest pension provision

Defined contribution plan with

the same monthly employer

contributions as those offered to

all eligible employees below the

Board of 7% of basic salary

HMRC approved salary sacrifice

arrangement for employee

contribution

– No change

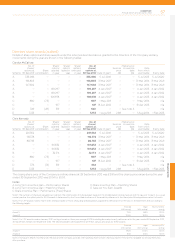

Annual

bonus

To incentivise and

recognise execution of

the business strategy

on an annual basis

Rewards the achievement

of annual financial and

operational goals

Compulsory and voluntary

deferral provides alignment

with shareholders

Bonuses subject to

clawback (repayment)

in the event of a

misstatement of results

Maximum opportunity of 200%

of salary for CEO and 150% of

salary for CFO

One-third subject to compulsory

deferral into shares for three years

Executives can choose to defer

a further portion of their bonus

into shares which is subject to

matching

The remainder of the bonus will

be paid in cash

Primary measure is profit

before tax

Performance is also

assessed against a range

of operational measures –

customer satisfaction,

operating costs, on-time

performance and in the

case of the CFO

departmental objectives

In addition, there is a safety

underpin which must be

satisfied before bonuses

are paid, under this the

Committee will review the

Company’s record over the

period in relation to safety

and, in the event that it

was considered

appropriate to do so, the

Committee may scale

back the bonus earned

based on performance

against the other metrics

Rebalancing of CFO’s

annual bonus opportunity

from 100% of salary to

150% of salary

(corresponding decrease

in LTIP opportunity)

Introduction of compulsory

deferral element with no

potential for a matching

element to be earned

Tougher targets

with higher levels of

performance required

(relative to budget) and

a lower payout (90%

of maximum vs. 85%

previously) for delivery of

the threshold performance

target

Introduction of a formal

safety underpin

Introduction of clawback

Governance

easyJet plc

Annual report and accounts 2012 53