EasyJet 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet supports the work to make airspace more efficient through

the Single European Sky initiative, and the European Commission’s

efforts to drive lower costs into airspace. Europe now has a real

opportunity to address the inefficiencies in airspace, and it is vital

that individual Member States are not allowed to escape their

responsibilities to deliver change and control costs.

easyJet remains concerned with the continual increase in taxes

onaviation across Europe, which is undermining European growth

and ultimately jobs. easyJet has undertaken work to demonstrate

togovernments that these taxes are not in their interest or those

ofconsumers or people working within the sector.

Towards the end of 2012, the European Commission will set out

aredraft of the EU 261 regulations, which govern passenger rights.

easyJet is focused on ensuring that the reform brings clarity to

airline obligations. easyJet believes in the importance of providing

passengers with the right level of protection, but also the protection

passengers value and want to pay for.

The airports easyJet flies to are central to its business model.

easyJet’s network focuses on primary airports where people want

to fly to and this provides easyJet with access to important

catchments and drives up unit revenues. Primary airports tend

tohave pricing power and could engage in monopolistic behaviour

if they are not regulated.

Where airports are monopolies, regulation is the only effective

answer. Only in this way will passengers be protected from

excessive airport charges and poor service. easyJet has focused

onensuring that there is effective regulation where it is needed, but

also that regulators understand the needs of point-to-point airlines

and their passengers. There is cost pressure from regulated airports

across Europe from a combination of lower passenger volumes,

restricted access to finance and upcoming regulatory reviews.

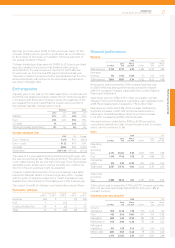

Thecost increases from the regulatory reviews in Spain and Italy

were disappointing for easyJet and there are upcoming reviews

at Gatwick, Geneva and Stansted. To address the risk of increasing

airport costs, easyJet has put in place a more sophisticated

approach to regulated airport charges building on experience

ofworking with governments and economic regulators. This has

involved developing economic evidence on the impact of airport

charges, providing technical input into regulatory reviews and

ensuring that easyJet is properly represented in discussions with

regulators and governments.

At non-regulated airports, easyJet has worked where possible

toputin place long-term contracts that mitigate the risk of future

cost increases and ensure that easyJet can build on a long-term

sustainable platform.

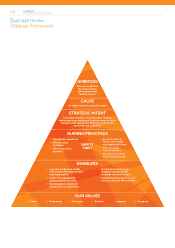

Strategic progress: easyJet is uniquely positioned to

bethe structural winner in European short-haul aviation

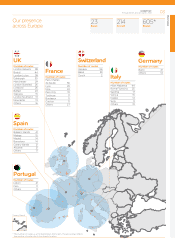

easyJet is structurally positioned as the strongest pan European

airline due to its cost advantage, leading market positions at

convenient airports and great customer proposition of low fares

with friendly and efficient service supported by one of the strongest

balance sheets in European aviation. As inefficient and financially

weak competitors retrench, easyJet will continue its strategy to build

its leading position on Europe’s top 100 routes where it has a 25%

market share to become the leading point-to-point airline flying

between primary airports. This will enable easyJet to deliver

passenger growth, in excess of the market overall, of around 3%

to5% per annum and tangible returns to shareholders of an

annual ordinary dividend of three times cover.

(4) Market share data from OAG. Size of European market based on internal easyJet

definition. Historic data based on the 12 month period from October 2011 to end

September 2012. Forward looking data based on available OAG information to

the end of March 2013 with assumptions made on Ryanair growth.

Example only. Not a current offer.

ROIS EN LEUR CHÂTEAU

et vous, vos envies ?

nice au départ de lille

à partir de

39€ aller simple,

taxes incluses

*

Business review

easyJet plc

Annual report and accounts 2012 13