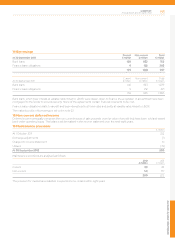

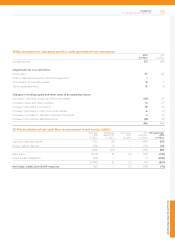

EasyJet 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

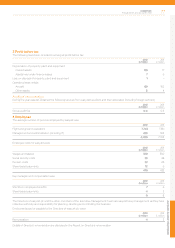

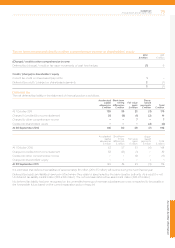

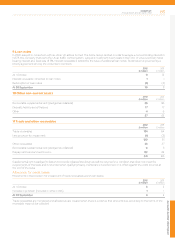

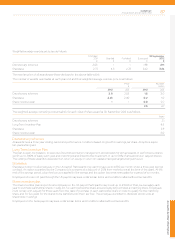

Tax on items recognised directly in other comprehensive income or shareholders’ equity

2012

£ million

2011

£ million

(Charge) / credit to other comprehensive income

Deferred tax (charge) / credit on fair value movements of cash flow hedges (7) 9

Credit / (charge) to shareholders’ equity

Current tax credit on share-based payments 1 –

Deferred tax credit / (charge) on share-based payments 2 (1)

3 (1)

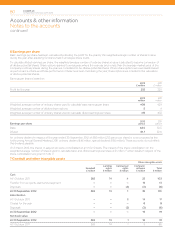

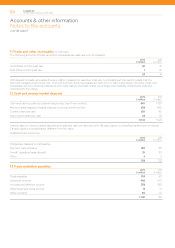

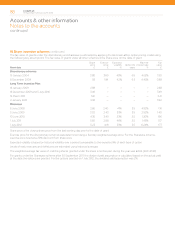

Deferred tax

The net deferred tax liability in the statement of financial position is as follows:

Accelerated

capital

allowances

£ million

Short-term

timing

differences

£ million

Fair value

gains

£ million

Share-

based

payments

£ million

Total

£ million

At 1 October 2011

Charged / (credited) to income statement

Charged to other comprehensive income

Credited to shareholders’ equity

At 30 September 2012 146 30 29 (7) 198

Accelerated

capital

allowances

£ million

Short-term

timing

differences

£ million

Fair value

gains

£ million

Share-

based

payments

£ million

Total

£ million

At 1 October 2010 62 57 33 (4) 148

Charged / (credited) to income statement 58 (18) (1) – 39

Credited to other comprehensive income – – (9) – (9)

Charged to shareholders’ equity – – – 1 1

At 30 September 2011 120 39 23 (3) 179

It is estimated that deferred tax liabilities of approximately £11 million (2011: £5 million) will reverse during the next financial year.

Deferred tax assets and liabilities have been offset where they relate to taxes levied by the same taxation authority. As a result the net

UK deferred tax liability is £212 million (2011: £190 million). The net overseas deferred tax asset is £14 million (2011: £11 million).

No deferred tax liability has been recognised on the unremitted earnings of overseas subsidiaries as no tax is expected to be payable in

the foreseeable future based on the current repatriation policy of easyJet.

120 39 23 (3) 179

26 (9) (1) (2) 14

– – 7 – 7

– – – (2) (2)

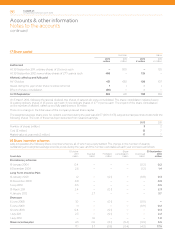

Accounts & other information

easyJet plc

Annual report and accounts 2012 79