EasyJet 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

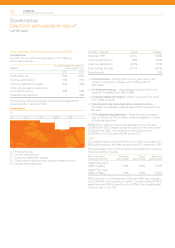

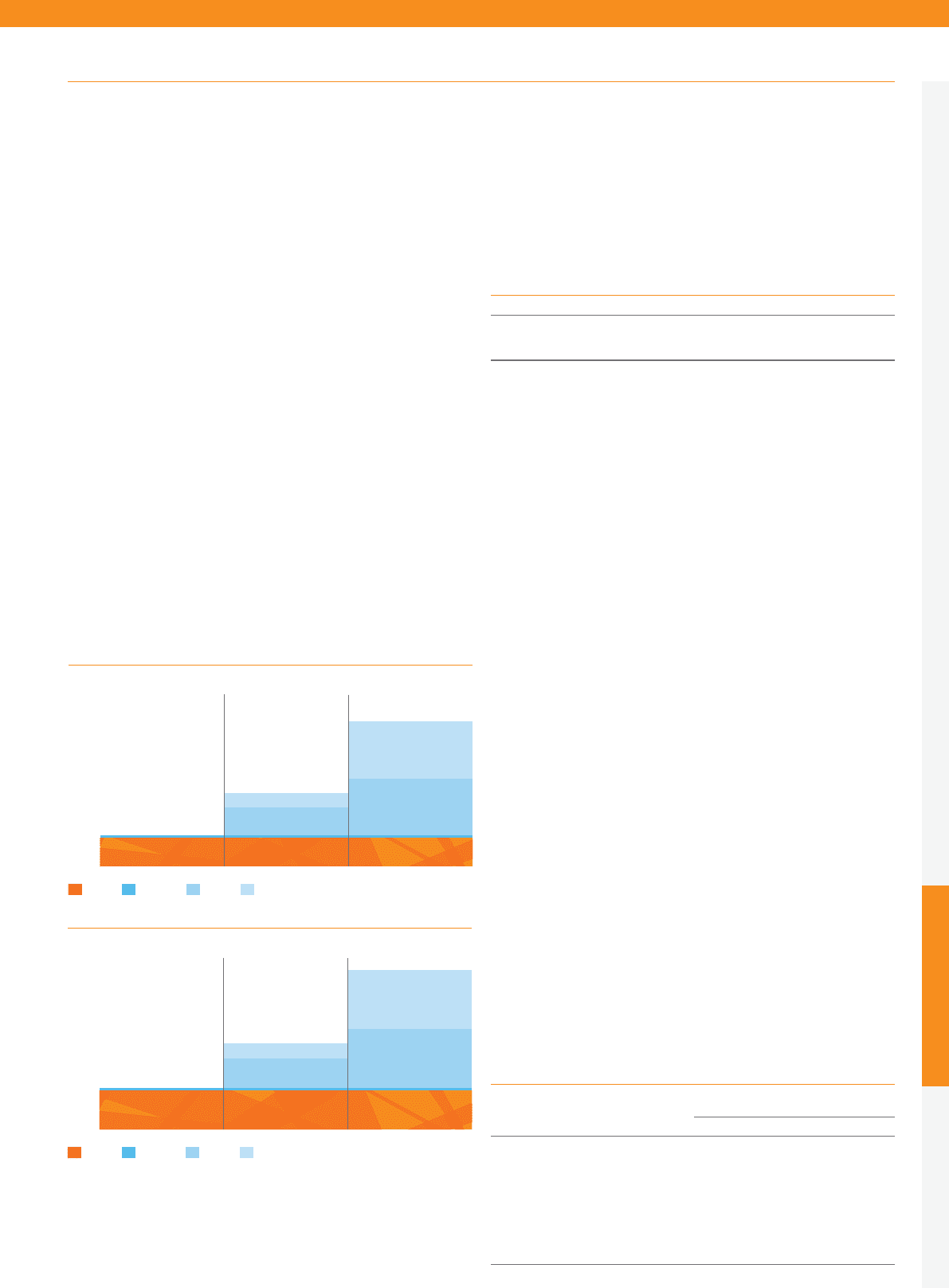

How much could the Executive Directors earn under

the current remuneration guidelines?

As mentioned earlier in this report, a significant proportion of

remuneration is linked to performance, particularly at maximum

performance levels.

Neither Executive Director will receive an increase in the overall

opportunity as a result of the changes. The proportion of the

CEO’s pay delivered in cash will decrease.

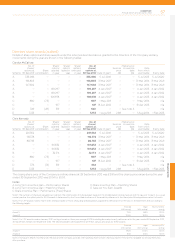

The charts below show how much the CEO and CFO could

earn under easyJet’s remuneration guidelines under different

performance scenarios. The following assumptions have

been made:

Below threshold – There is no bonus and no vesting under

the LTIP.

Meets target – This shows the value payable for performance at

the mid point of the bonus range (giving 50% of the maximum

opportunity) and vesting at threshold under the LTIP (of 25% of

the award).

Exceeds target – There is maximum bonus and maximum vesting

under the LTIP.

The value of any matching shares has been excluded for simplicity.

What are the Executive Directors’ salaries?

The salaries of the CEO and CFO have not been increased since

they joined the Company in July 2010.

The Directors’ salaries for 2012 / 13 are as follows:

1 October 2011 salary 1 October 2012 salary

CEO £665,000 £665,000 (0%)

CFO £400,000 £410,000 (+2.5%)

What pension contributions are given?

In line with the Company’s simple and prudent approach to

remuneration, easyJet normally offers a modest contribution

for Executive Directors to a defined contribution pension scheme

of 7% of basic salary.

While individuals are not obliged to make a contribution,

easyJet operates a pension salary sacrifice arrangement where

individuals can exchange their salary for Company paid pension

contributions. Where individuals exchange salary this reduces

easyJet’s National Insurance Contributions. easyJet credits half

of this saving to the individual’s pension (currently 6.9% of the

amount exchanged).

If an Executive Director has reached the lifetime pension

limit, a cash alternative may be paid with the agreement of

the Committee.

How is successful annual performance rewarded?

The maximum annual bonus opportunity during the 2011 / 12

financial year was 200% of salary for the CEO, with a 100%

of salary opportunity for the CFO.

As stated previously, for the 2012 / 13 financial year, the maximum

bonus will remain unchanged for the CEO but will be increased to

150% of salary for the CFO (with a corresponding decrease in his

LTIP opportunity) ensuring management incentives are aligned.

The annual bonus will now be delivered as follows:

→One-third of any bonus earned will be compulsorily deferred

and subject to forfeiture. This element will be deferred into

shares for three years and will not be subject to any

further matching.

→In addition, Executive Directors can choose to invest a further

proportion of their bonus into the LTIP (CEO 50% of bonus

and CFO 33% of bonus). Matching share awards may be made

linked to this investment which may then be matched on a 1:1

pre-tax basis subject to the LTIP performance conditions.

→The remainder of the bonus will be delivered as cash.

The change in the operation of deferral means a greater

proportion of the CEO’s package will now be subject to deferral

over a three year period.

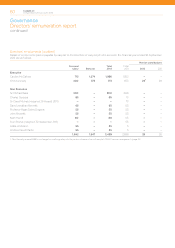

Annual performance is measured against a range of financial and

operational performance indicators as follows:

As percentage of maximum bonus

opportunity

Measure Carolyn McCall OBE Chris Kennedy

Profit before tax 70% 60%

Customer satisfaction targets 10% 10%

Total cost per seat excluding fuel

at constant currency 10% 10%

On-time performance 10% 10%

Departmental objectives – 10%

Chief Executive Officer

£‘000

2,000

0

4,000

3,000

1,000

500

3,500 3,372

Below threshold Exceeds target

2,500

1,500

Meets target

1,710

712

Salary Pension Bonus LTIP

Chief Financial Officer

£‘000

800

0

1,800

1,200

400

200

1,400

1,669

Below threshold Exceeds target

1,000

600

Meets target

900

439

Salary Pension Bonus LTIP

1,600

Governance

easyJet plc

Annual report and accounts 2012 55