EasyJet 2012 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Governance

Directors’ remuneration report

for the year ended 30 September 2012

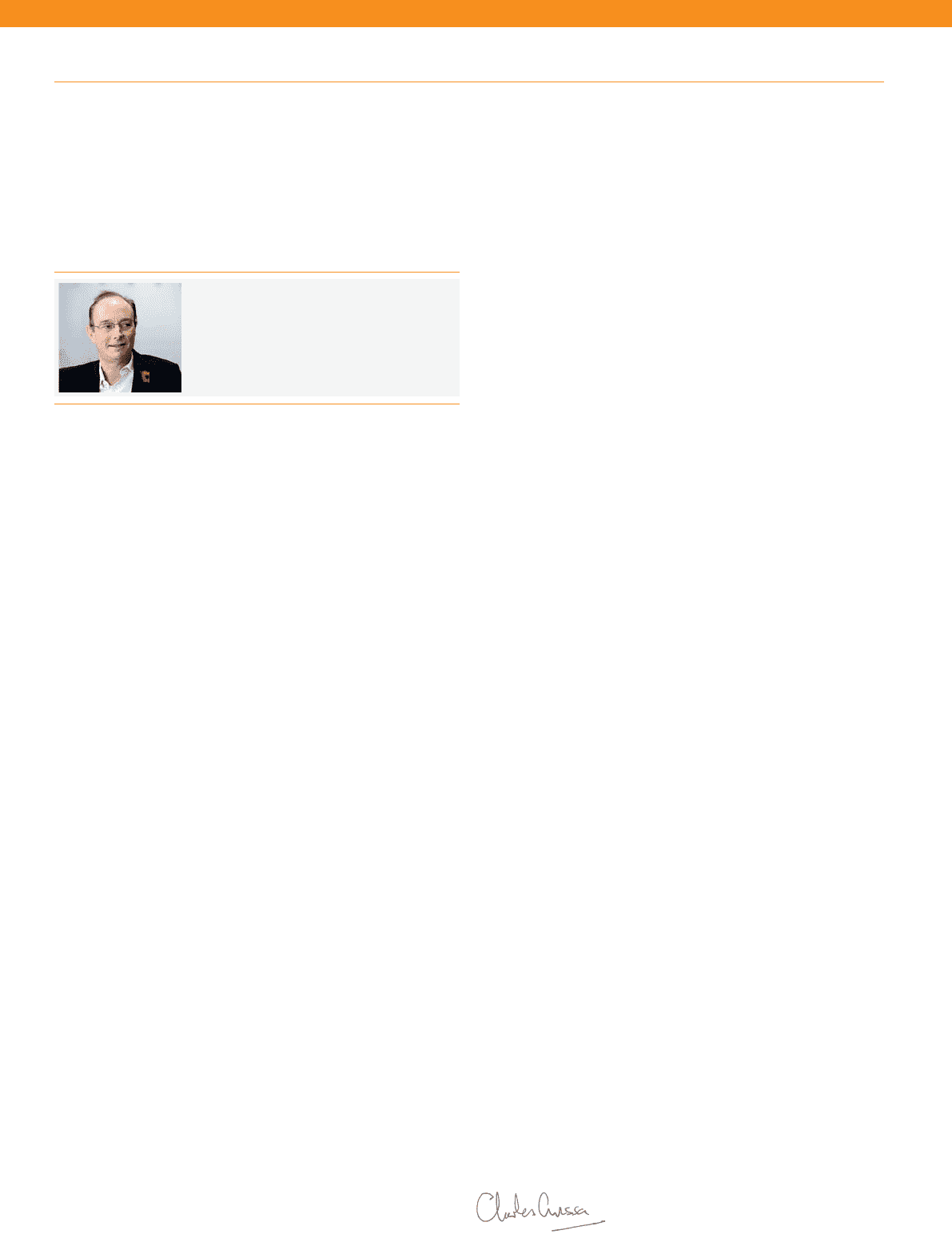

Letter from the Chairman of the

Remuneration Committee

Dear shareholder,

On behalf of the Board, I am pleased to present the

Remuneration Report for the year ended 30 September 2012.

Performance of the Company in 2012

The Company continued its strong performance in 2012 despite

a difficult macroeconomic environment. The key highlights are set

out below:

→27.9% growth in profit before tax.

→1.8ppt growth in ROCE (excluding lease adjustment) from 12.7%

in 2011 to 14.5% in 2012.

→A major improvement in On Time Performance from 79%

to 88%, reflecting operational robustness.

→Increasing dividend with a proposed ordinary dividend

of 21.5 pence per share for 2012.

These results should be considered in light of the continuing

challenges faced in the airline industry. In addition to the results

set out above, we remain committed to delivering returns in

excess of our cost of capital and returning surplus capital to

our shareholders.

Aligning remuneration policy with Company principles

Simple and cost effective approach – In line with our low cost and

efficient business model, the Committee aim to set a simple fixed

pay package against the market. For example, our Executive

Directors receive minimal benefits (see page 53).

Support the stated business strategy of growth and returns –

Performance is assessed against a range of financial, operational

and longer term returns ensuring value is delivered to

shareholders, and participants are rewarded for the successful

delivery of the key strategic objectives of the Company.

Pay for performance – Remuneration is heavily weighted towards

variable pay, dependent on performance. This ensures that there

is a clear link between the value created for shareholders and pay.

Key pay outcomes in respect of 2012

Annual bonus payment is based on PBT and key operational

performance targets. Bonuses of 95.8% of the maximum were

awarded to the CEO and 93.3% for the CFO, in respect of 2012.

This reflects the outstanding financial and operational results the

Company has achieved.

Carolyn McCall OBE chose to defer the maximum amount of 50%

of her bonus permitted into shares for three years under the

matching scheme. Chris Kennedy chose to defer a third of his

bonus into shares under the matching scheme.

Long-Term Incentive Plan – LTIP awards made in July 2010 are

due to vest in July 2013. These awards are based on ROE

performance for the financial year ended 30 September 2012.

During this period the Company achieved ROE performance of

14.6%, resulting in 91.7% of the awards vesting.

Pay for 2013

Following discussions with shareholders around the 2012 AGM, we

consulted widely on how best to calculate ROCE to appropriately

reflect the performance of the Company. Given that this has clear

implications on our wider remuneration policy, and taking into

account my recent appointment as Remuneration Committee

Chairman, we also took the opportunity to review remuneration

arrangements as a whole.

The key objective of the review process was to ensure that

remuneration arrangements support the successful delivery of the

strategy of the Company. We also compared our arrangements

against a ‘best practice’ point of view and took on board shareholder

comments. As a result we are making the following changes:

→Salary increases – Neither Executive Director has received a

salary increase since their appointment in July 2010. The CEO

will not receive an increase at this time. The CFO received a

salary increase of 2.5% effective 1 October 2012, in line with

those across the wider workforce.

→Mandatory deferral of annual bonus – One-third of the annual

bonus will now be compulsorily deferred each year and will be

subject to forfeiture (as a result, the CEO will have a lower take

home pay opportunity). Executive Directors will also have the

opportunity to voluntarily defer an additional portion.

→No increase in incentive opportunity –The CFO’s incentive

opportunity (split between short term and long term) has been

rebalanced to ensure alignment with the CEO’s. There is no

increase in overall incentive opportunity for either the CEO

or CFO.

→Tougher annual bonus targets – Higher levels of performance

required and a lower payout for the delivery of threshold

performance target. A formal safety underpin also applies

to the bonus.

→Definition of ROCE – Following extensive shareholder

consultation, this has been revised. ROCE for future LTIP grants

will now include an adjustment for operating leases.

→Introduction of a relative TSR measure to LTIP – The LTIP will

be based 50% on TSR relative to the FTSE 51 to 150 and 50%

on ROCE to incorporate an external relative assessment of

performance. In addition, the TSR portion of the LTIP will not

vest unless the Company has achieved positive TSR

performance over the award period.

→Introduction of clawback – Introduced to both short and

long-term incentives in line with emerging best practice.

Shareholder feedback

We are committed to maintaining an open and transparent

dialogue with shareholders. The objective of this report is to clearly

communicate how much our Executive Directors are earning and

how this is strongly linked to performance. As always, I welcome

any comments you may have.

Charles Gurassa

Remuneration Committee Chairman

19 November 2012

easyJet plc

Annual report and accounts 2012

50

Charles Gurassa

Non Executive Deputy Chairman

andSeniorIndependent Director