EasyJet 2012 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Summary consolidated statement of financial position

2012

£ million

2011

£ million

Change

£ million

Goodwill 365 365 –

Property, plant and equipment 2,395 2,149 246

Net working capital (792) (765) (27)

Restricted cash 159 123 36

Net (debt) / cash (74) 100 (174)

Current and deferred taxation (227) (188) (39)

Other non-current assets and liabilities (32) (79) 47

1,794 1,705 89

Opening shareholders’ equity 1,705 1,501

Profit for the year 255 225

Ordinary dividend paid (46) –

Special dividend paid (150) –

Change in hedging reserve 28 (21)

Other movements 2–

1,794 1,705

Net assets increased by £89 million driven by the profit for the year

offset by dividends paid and a small net change in the hedging reserve.

The net book value of property plant and equipment increased by

£246 million driven principally by the acquisition of 19 A320 family

aircraft, and advance payments for aircraft due to be delivered over

the next two years.

Net working capital was broadly flat at a net negative £792 million.

Passengers pay for their flights in full when booking, therefore the

key component of this balance is unearned revenue, which

increased by £24 million to £496 million. This increase was rather

lower than that seen last year as flights for July and August 2013

didnot go on sale until shortly after year end.

Reconciliation of net cash flow to movement in net (debt) / cash

2012

£ million

2011

£ million

Change

£ million

Cash and cash equivalents 645 1,100 (455)

Money market deposits 238 300 (62)

883 1,400 (517)

Bank loans (752) (1,079) 327

Finance lease obligations (205) (221) 16

(957) (1,300) 343

Net (debt) / cash (74) 100 (174)

easyJet ends the year with £883 million in cash and money market

deposits; a decrease of £517 million compared with 30 September

2011. Net borrowings decreased by £343 million.

Net debt at 30 September 2012 was £74 million compared with net

cash of £100 million at 30 September 2011. At 30 September 2012

gearing was 29%, marginally higher than last year’s gearing of 28%.

Although the net position has changed relatively little, both cash

and debt balances have declined markedly during the year, due

topayment of the special dividend and accelerated repayment of

£162 million mortgage loans and a reduction in the number of

leased aircraft. These actions reduced excess liquidity, and we

ended the year with a cash and money market deposits balance in

line with our policy of holding £4million cash per aircraft in the fleet.

Cash flows and financial position

Summary consolidated statement of cash flows

2012

£ million

2011

£ million

Change

£ million

Net cash generated from operating

activities (excluding dividends) 457 424 33

Ordinary dividend paid (46) – (46)

Special dividend paid (150) – (150)

Net capital expenditure* (389) (478) 89

Net loan and lease finance

(repayment) / drawdown (314) 356 (670)

Net decrease / (increase)

in money market deposits 55 (38) 93

Other including the effect

of exchange rates (68) (76) 8

Net (decrease) / increase

in cash and cash equivalents (455) 188 (643)

Cash and cash equivalents

at beginning of year 1,100 912 188

Cash and cash equivalents

at end of year 645 1,100 (455)

Money market deposits

at end of year 238 300 (62)

Cash and money market deposits

at end of year 883 1,400 (517)

* Stated net of disposal proceeds of £75 million in 2011.

In line with prior years, easyJet generated strong operating cash

flow in the year principally driven by growth in forward bookings

andrevenue per seat. Operating cash flow exceeded capital

expenditure and the ordinary dividend paid in line with the ambition

to self-fund growth and fleet renewal.

Net capital expenditure principally comprises the acquisition of

19A320 aircraft and advance payments on aircraft due to be

delivered mainly over the next two years.

No new loan or lease finance was drawn down during the year, and

mortgage loans on 12 aircraft were fully repaid. Two of these loans had

reached their contractual end, however the other ten loans were

repaid early as part of our strategy to reduce excess liquidity.

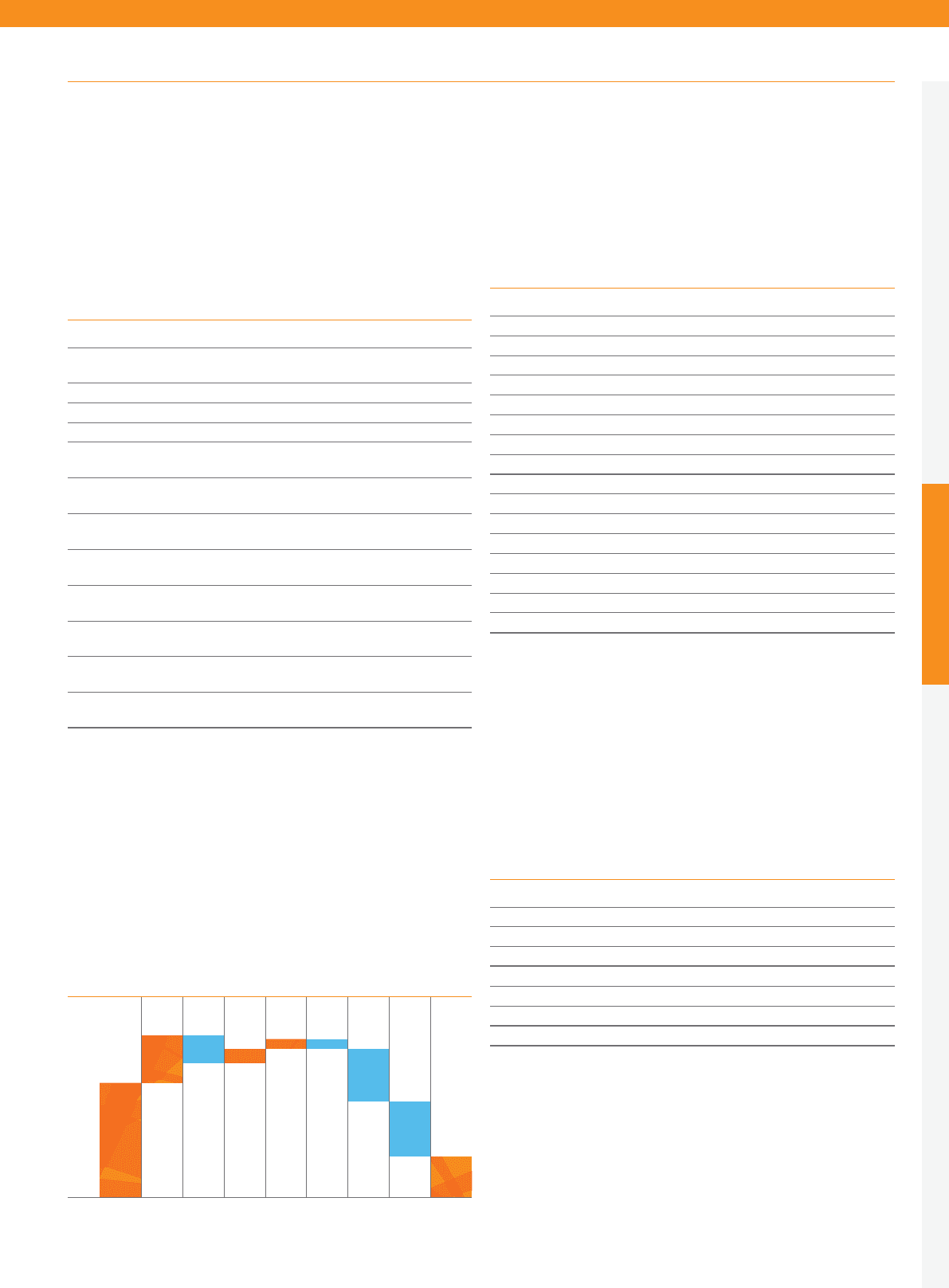

Cash flow

£ million

1,200

600

2012

1,800

1,400

1,000

800

1,600

1,400

883

331 (196)

105

67 (71)

(364)

(389)

2011 Operating

profit

Dividends

paid

Depn &

Amort

Working

capital

Other Financing Capex 2012

Performance and risk

easyJet plc

Annual report and accounts 2012 23