EasyJet 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

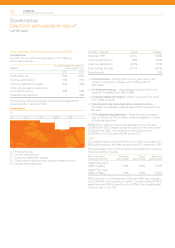

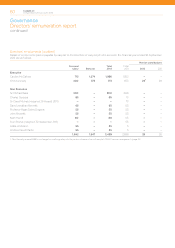

Directors’ share awards (audited)

Details of share options and share awards under the schemes described above granted to the Directors of the Company and any

movements during the year are shown in the following tables:

Carolyn McCall OBE

Scheme

No. of

shares/

options at

30 Sep 20111

Share

consolidation

Share/

options

granted

in year

Share/

options

lapsed in

year

Share/

options

exercised

in year

No. of

shares/

options at

30 Sep 20121 Date of grant

Exercise

price

(£)

Market price

on exercise

date

(£)

Date

from which

exercisable Expiry date

A 335,096 – – – – 335,096 5 Jul 2010 – – 5 Jul 2013 5 Jul 2020

A 196,803 – – – – 196,803 31 Mar 20112 – – 31 Mar 2014 31 Mar 2021

A 147,602 – – – – 147,602 31 Mar 20112 – – 31 Mar 2014 31 Mar 2021

A – – 169,297 – – 169,297 4 Jan 20123 – – 4 Jan 2015 4 Jan 2022

A – – 169,297 – – 169,297 4 Jan 20123 – – 4 Jan 2015 4 Jan 2022

B – – 106,978 – – 106,978 4 Jan 20123 – – 4 Jan 2015 4 Jan 2022

C 880 (73) – – – 807 1 May 2011 – – 1 May 2014 n/a

C – – 617 – – 617 18 Apr 2012 – – 18 Apr 2015 n/a

D 349 (28) 319 – – 640 – – See note 4 – n/a

E 3,133 – – – – 3,133 1 Aug 2011 2.88 – 1 Aug 2014 1 Feb 2015

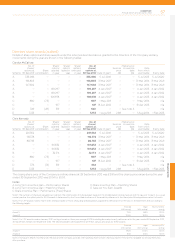

Chris Kennedy

Scheme

No. of

shares/

options at

30 Sep 20111

Share

consolidation

Share/

options

granted

in year

Share/

options

lapsed in

year

Share/

options

exercised

in year

No. of

shares/

options at

30 Sep 20121 Date of grant

Exercise

price

(£)

Market price

on exercise

date

(£)

Date

from which

exercisable Expiry date

A 201,562 – – – – 201,562 5 Jul 2010 – – 5 Jul 2013 5 Jul 2020

A 118,378 – – – – 118,378 31 Mar 20112 – – 31 Mar 2014 31 Mar 2021

A 88,783 – – – – 88,783 31 Mar 20112 – – 31 Mar 2014 31 Mar 2021

A – – 101,832 – – 101,832 4 Jan 20123 – – 4 Jan 2015 4 Jan 2022

A – – 101,832 – – 101,832 4 Jan 20123 – – 4 Jan 2015 4 Jan 2022

B – – 32,174 – – 32,174 4 Jan 20123 – – 4 Jan 2015 4 Jan 2022

C 880 (73) – – – 807 1 May 2011 – – 1 May 2014 n/a

C – – 617 – – 617 18 Apr 2012 – – 18 Apr 2015 n/a

D 376 (31) 319 – – 664 – – See note 4 – n/a

E 3,133 – – – – 3,133 1 Aug 2011 2.88 – 1 Aug 2014 1 Feb 2015

The closing share price of the Company’s ordinary shares at 28 September 2012 was £5.81 and the closing price range during the year

ended 30 September 2012 was £3.54 to £5.93.

Notes

A Long Term Incentive plan – Performance Shares D Share Incentive Plan – Matching Shares

B Long Term Incentive plan – Matching Shares E Save As You Earn Awards

C Share Incentive Plan – Performance (Free) Shares

Note 1: The numbers of share are calculated according to the scheme rules of individual plans based on the middle-market closing share price of the day prior to grant. As is usual

market practice, the option price for SAYE awards is determined by the Committee in advance of the award by reference to the share price following announcement of results.

Note 2: For LTIP awards made in March 2011, vesting is based on ROCE (excluding operating leases adjustment) performance for the year to 30 September 2013, according to

the following targets:

Threshold

(25% vesting)

Target

(50% vesting)

Maximum (100%

vesting)

Award 1 7.0% 8.5% 12.0%

Award 2 10.0% 12.0% 13.0%

Note 3: For LTIP awards made in January 2012, vesting is based on three year average ROCE (excluding lease adjustment) performance for the years ended 30 September 2012,

30 September 2013 and 30 September 2014. The following targets were published in an RNS in January and apply for these awards:

Threshold

(25% vesting)

Target

(50% vesting)

Maximum (100%

vesting)

Award 1 8.0% 10.0% 12.0%

Award 2 11.5% 12.5% 13.0%

Note 4: Participants Shares monthly under the plan and the Company provides one matching share for each share purchased. These are first available for vesting three years

after purchase.

Governance

easyJet plc

Annual report and accounts 2012 57