EasyJet 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Market overview

Competitive landscape

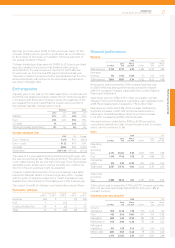

There are 3,000 short-haul aircraft in operation in Europe and

around half of overall capacity is flown by the top five carriers:

Ryanair, IAG, Lufthansa, AF-KLM and easyJet. In recent years,

thesustained high price of aviation fuel combined with restricted

European economic growth and consumer spending, rising aviation

taxes and scarcity of financing has led to a difficult operating

environment for all airlines.

In the past year, several carriers have exited and other carriers have

changed ownership or required refinancing; the charter operators

are seeing their market share and profitability diminishing further;

and the losses incurred from legacy operators’ short-haul operations

are well publicised. Consequently, overall capacity in the European

short-haul aviation market remained flat, and declined slightly on

easyJet’s routes(4).

Overall demand for European point-to-point leisure and business

travel in the medium term is expected to grow slightly ahead

ofGDP and this, combined with the capacity restraint in the

European aviation market, means that there are structural growth

opportunities for carriers such as easyJet with robust business

models and strong competitive positions.

Competitive position

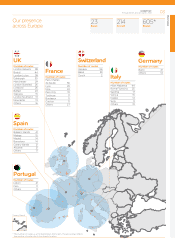

easyJet is one of the very few pan-European low-cost carriers in

theEuropean short-haul passenger aviation market and is focused

on making travel easy and affordable for its customers. easyJet

isthe fourth largest short-haul carrier in Europe with a market

shareof8%(4) and derives its competitive advantages from the

followingattributes:

A leading short-haul network with the highest number of market

pairs within Europe’s top 100 market pairs and strong market

shares in valuable markets such as London, Paris, Milan,

Amsterdam and Geneva;

A low cost, efficient and flexible business model derived from

scale and cost advantage, high asset utilisation, a young

efficient fleet with low cost ownership, a leading online and

digital offering and industry-leading load factors; and

A efficient and robust capital structure.

Regulatory environment

The regulatory environment continues to have a significant impact

on easyJet and over the last year monopoly infrastructure providers

have pushed through unreasonable increases in charges.

However, there are EU proposals on slot and ground handling

frameworks which could improve competition across Europe and

allow better access to congested airports. easyJet has devoted

significant effort to the European Commission’s proposals as these

have the potential to improve competition at airports. In particular,

easyJet is advocating the legalisation of secondary slot trading at

airports across Europe and an increase in competition within the

ground handling market which would lead to lower costs and an

improved service. This is particularly important in Germany and

Portugal, where anti-competitive restrictions on the number of

ground handlers at an airport have led to excessive costs.

Business review

Chief Executive’s introduction

continued

easyJet plc

Annual report and accounts 2012

12