EasyJet 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

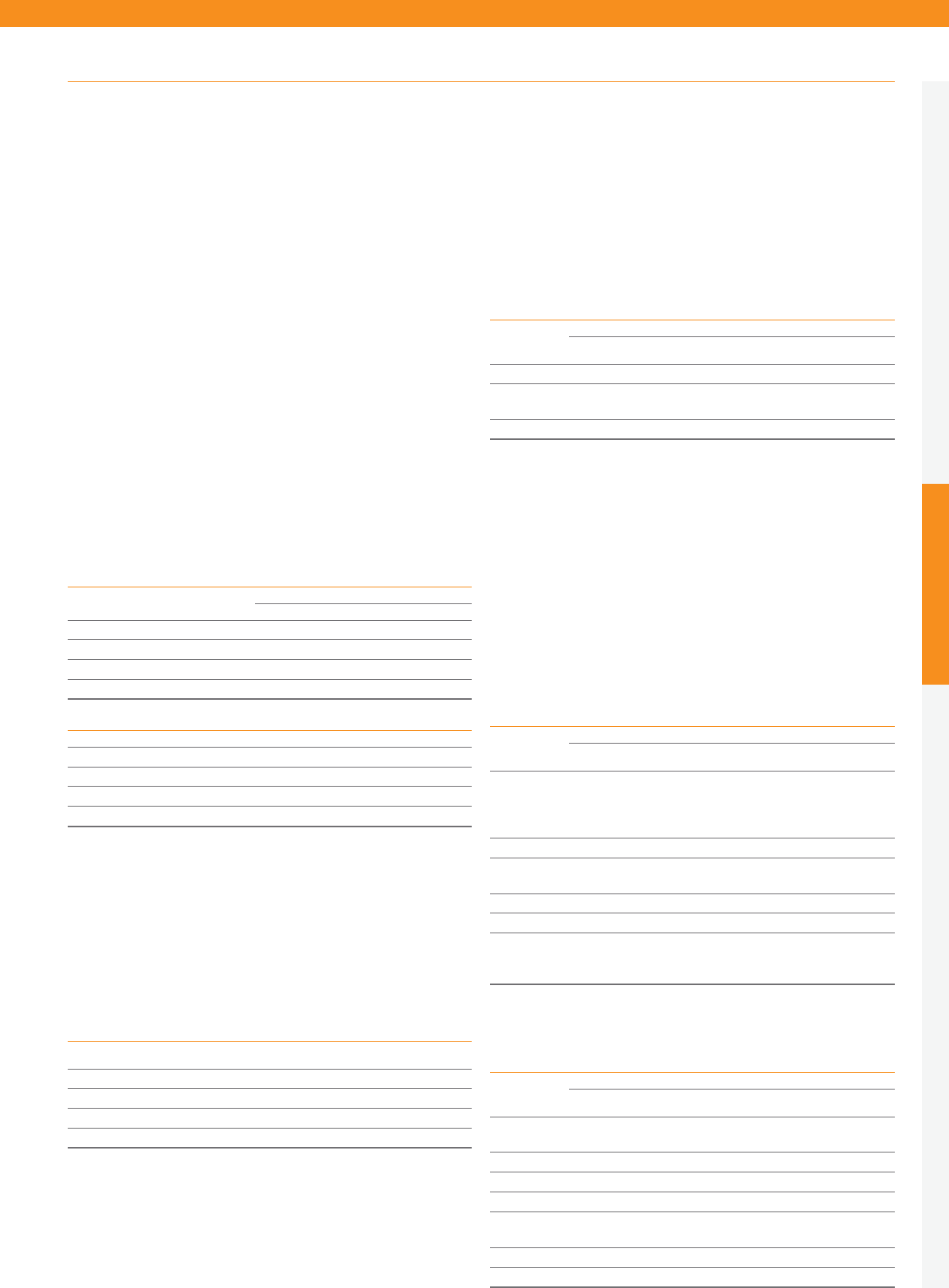

Financial performance

Revenue

2012 2011

£ million

£ per

seat

Pence

per ASK £ million

£ per

seat

Pence

per ASK

Seat revenue 3,794 57.61 5.26 3,389 54.25 4.89

Non-seat

revenue 60 0.90 0.08 63 1.02 0.09

Total revenue 3,854 58.51 5.34 3,452 55.27 4.98

Revenue per seat improved by 5.9% compared with last year

to£58.51 reflecting strong performances across the network

(withthe exception of Spain), particularly from London Gatwick,

France and Switzerland.

Seats flown grew by 5.5% to 65.9 million, principally in London

Gatwick, France and Switzerland. Load factor was marginally higher

at 88.7% and passengers increased by 7.1% to 58.4 million.

Seat revenue contributed 6.2% of this increase, held back by

significant increases in APD, VAT and similar taxes levied on

passengers. Overall these taxes, driven by a further increase

inUKAPD, increased by 8.0% to £6.76 per seat.

Non-seat revenue contracted by 11.8% to £0.90 per seat as

commissions earned from sale of travel insurance and, to a lesser

extent, car hire continued to fall.

Costs

2012 2011

£ million

£ per

seat

Pence

per ASK £ million

£ per

seat

Pence

per ASK

Operating

costs

excluding

fuel 2,174 33.00 3.01 2,067 33.10 2.98

Fuel 1,149 17.45 1.59 917 14.68 1.32

Ownership

costs 214 3.25 0.30 220 3.52 0.32

Total costs 3,537 53.70 4.90 3,204 51.30 4.62

Total costs

excluding

fuel 2,388 36.25 3.31 2,287 36.62 3.30

Total cost per seat increased by 4.7% to £53.70; however excluding

fuel, cost per seat was broadly flat at £36.25, and up by 1.8% at

constant currency.

Operating costs excluding fuel

2012 2011

£ million

£ per

seat

Pence

per ASK £ million

£ per

seat

Pence

per ASK

Ground

operations 955 14.49 1.32 923 14.79 1.33

Crew 432 6.55 0.60 407 6.51 0.58

Navigation 280 4.25 0.39 285 4.56 0.41

Maintenance 203 3.08 0.28 179 2.86 0.26

Selling and

marketing 104 1.58 0.14 102 1.64 0.15

Other costs 200 3.05 0.28 171 2.74 0.25

2,174 33.00 3.01 2,067 33.10 2.98

Earnings per share grew 19.0% to 62.5 pence per share. Of this

increase, 13.6% is due to growth in profit after tax and 5.4% due

to the impact of the share consolidation following payment of

the special dividend in March.

Ordinary dividend per share grew by 104.8% to 21.5 pence per share.

easyJet is pleased to announce that dividend policy is being

amended from this year to pay out one-third of profit after tax

foreach year, up from the one-fifth payout introduced last year.

There are no plans to propose a further special dividend at this time,

and excess liquidity will continue to be used where appropriate to

pay down mortgage debt.

Exchange rates

Capacity grew in the year by 3.4 million seats flown, of which around

two-thirds was deployed in bases outside the UK. While thisresulted

in increased cash flows denominated in euros, the weakness of the

euro against the pound meant that the overall currency profile of

the business was little changed year-on-year:

Revenue Costs

2012 2011 2012 2011

Sterling 47% 47% 24% 24%

Euro 43% 44% 35% 35%

US dollar 1% –35% 35%

Other (principally Swiss franc) 9% 9% 6% 6%

Average exchange rates

2012 2011 Change

Euro – revenue €1.19 €1.15 (3.9%)

Euro – costs €1.22 €1.15 5.8%

US dollar $1.60 $1.61 (0.6%)

Swiss franc CHF 1.46 CHF 1.45 (0.7%)

The value of the euro against sterling declined during the year, with

the year end exchange rate 7.8% lower at €1.25/£1. This decline was

more marked during the second half of the year. Since the business

generates a euro surplus (euro revenue exceeds euro costs) a net

loss from this euro exposure might be expected.

However a significant proportion of summer bookings were taken

before the sharpest decline in the exchange rate, which, coupled

with the policy of hedging surplus euros, meant that easyJet was

shielded from the full impact of the falling euro in this financial year.

The impact on profit of changes in exchange rates was as follows:

Favourable / (adverse)

Euro

£ million

Swiss franc

£ million

US dollar

£ million

Other

£ million

Total

£ million

Revenue (65) 9 1 (5) (60)

Fuel 11 – (10) – 1

Costs excluding fuel 68 4 (5) 2 69

Total 14 13 (14) (3) 10

Performance and risk

easyJet plc

Annual report and accounts 2012 21