EasyJet 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

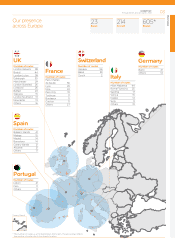

Switzerland

Switzerland continues to be a focus market for easyJet. With 7.2%

capacity growth, easyJet has consolidated its leadership position

inboth Geneva with around 37% market share and Basel with 43%

market share(4). The capacity increase has enabled easyJet to

launch 7 new routes and add frequencies on core routes such as

Berlin, Barcelona and London. easyJet now operates 19 aircraft out

of its Swiss bases.

France

easyJet grew capacity in France by 8.2% in the year and is the

second largest carrier in France with over 12% market share(4)

andbases 24 aircraft in France. A key part of easyJet’s strategy

inFrance is to address regional demand for both domestic and

international flights and to become the alternative carrier to Air

France. Capacity growth was focused on the French regions driven

by 11 new routes from its new bases in Nice and Toulouse which

opened in March. This brings the total number of routes touching

these two bases to 41.

Brand consideration(5) and customer satisfaction scores have

increased in the year. Since April 2012, easyJet.com is the

mostvisited airline website in France.

Italy

easyJet is the third largest carrier in Italy, with a market share of

11%(4). easyJet has 23 aircraft based in Italy with a number 1 share(4)

in its main Milan Malpensa base and a strong presence in Rome

Fiumicino, Venice and Naples.

The easyJet brand is increasing its profile in Italy with the recent

launch of easyJet’s first television advertising campaign. Brand

consideration(5) has increased by 11 percentage points up to

46%thanks to more targeted marketing activities in the key

catchment areas.

Germany

In a highly regional market, easyJet’s focus in Germany has

remained on building a strategic European point-to-point network

in Berlin (now with 50% market share in Schönefeld(4)). easyJet

has continued to build both its leisure and business product out

ofBerlin whilst rationalising the non-essential network in Dortmund

toimprove profitability.

Spain

The outbound Spanish market, remains one of the most

competitive in Europe, with the existing overcapacity leading to

lower yields than in other easyJet markets. Lower yields and high

and increasing airport charges led to the decision to cease having

crew and aircraft based in Madrid from 1 December 2012. The base

closure is on plan and 87% of the 300+ staff currently based in

Madrid have accepted the offer to relocate to another easyJet

operational base in Europe.

easyJet remains committed to Spain, including Madrid, and will

continue to fly to and from Spain out of its other bases. Although

capacity will be reduced by around 9%, easyJet expects to carry

over 12 million passengers to and from Spain next year.

Portugal

easyJet is the third largest carrier in Portugal with a market share of

around 13%(4) and is also the second carrier in Lisbon Portela airport,

having opened a base there in April 2012. The base launched with

two aircraft and a third one started there in November 2012.

(1) Source: On-time performance as measured by internal easyJet system.

(2) Source: On-time performance as measured by flightstats.com.

(3) Source: customer satisfaction data from GfK Customer Satisfaction Tracker.

Time period: FY 2012 versus FY 2011. Data updated October 2012.

(4) Market share data from OAG. Size of European market based on internal easyJet

definition. Historic data based on the 12 month period from October 2011 to end

September 2012. Forward looking data based on available OAG information to

the end of March 2013 with assumptions made on Ryanair growth.

(5) Brand consideration scores from GfK ascent.

Business review

easyJet plc

Annual report and accounts 2012 11