Dish Network 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–13

• Maintenance expenditures in order to obtain future cash flows are not significant;

• DBS licenses are not technologically dependent; and

• We intend to use these assets indefinitely.

In accordance with the guidance of EITF Issue No. 02-7, “Unit of Accounting for Testing Impairment of Indefinite-

Lived Intangible Asset” (“EITF 02-7”), we combine all our indefinite life FCC licenses into a single unit of

accounting. The analysis encompasses future cash flows from satellites transmitting from such licensed orbital

locations, including revenue attributable to programming offerings from such satellites, the direct operating and

subscriber acquisition costs related to such programming, and future capital costs for replacement satellites.

Projected revenue and cost amounts included current and projected subscribers. In conducting our annual

impairment test in 2006, we determined that the estimated fair value of the FCC licenses, calculated using the

discounted cash flow analysis, exceeded their carrying amount.

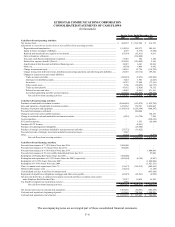

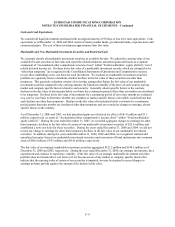

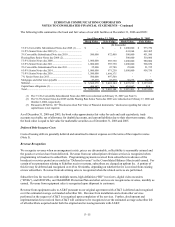

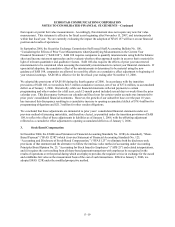

As of December 31, 2006 and 2005, our identifiable intangibles subject to amortization consisted of the following:

As of

December 31, 2006 December 31, 2005

Intangible Accumulated Intangible Accumulated

Assets Amortization Assets Amortization

(In thousands)

Contract based......................................................... 189,426$ (45,924)$ 189,426$ (29,739)$

Customer relationships............................................ 73,298 (50,142) 73,298 (31,818)

Technology-based.................................................... 33,500 (5,655) 25,500 (3,377)

Total ..................................................................... 296,224$ (101,721)$ 288,224$ (64,934)$

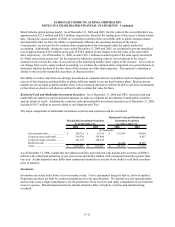

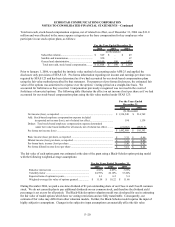

Amortization of these intangible assets, recorded on a straight line basis over an average finite useful life primarily

ranging from approximately three to twenty years, was $36.8 million and $39.0 million for the years ended

December 31, 2006 and 2005, respectively. The aggregate amortization expense is estimated to be $36.5 million for

2007, $22.9 million for 2008, $18.1 million annually for each of the years 2009 through 2011 and $80.8 million

thereafter.

The excess of our investments in consolidated subsidiaries over net tangible and intangible asset value at acquisition

is recorded as goodwill. As of December 31, 2006 and 2005, we had $3.4 million of goodwill. In conducting our

annual impairment test in 2006, we determined that the carrying amount of our goodwill was not impaired.

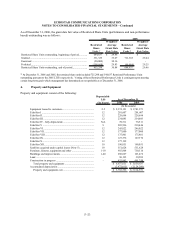

Smart Card Replacement

We use microchips embedded in credit card-sized access cards, called “smart cards,” or in security chips in our

EchoStar receiver systems to control access to authorized programming content. Our signal encryption has been

compromised by theft of service and could be further compromised in the future. We continue to respond to

compromises of our encryption system with security measures intended to make signal theft of our programming

more difficult. During 2005, we completed the replacement of our smart cards. While the smart card replacement

did not fully secure our system, we continue to implement software patches and other security measures to help

protect our service. There can be no assurance that our security measures will be effective in reducing theft of our

programming signals.

As of December 31, 2006, we did not have any accrual for future smart card replacement. At the time, if ever, that

we determine existing smart cards will be replaced again, we would accrue a liability for the estimated cost to

replace those cards in receivers sold to and owned by subscribers. That cost estimate would be based on the number

of cards expected to be replaced, taking into account a number of variables, including the cost of the cards and