Dish Network 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

52

Interest expense, net of amounts capitalized. “Interest expense” totaled $373.8 million during the year ended

December 31, 2005, a decrease of $131.9 million or 26.1% compared to 2004. This decrease primarily resulted from

a decrease in prepayment premiums and write-off of debt issuance costs totaling $134.4 million, and a net reduction

in interest expense of $40.2 million related to the redemption, repurchases and refinancing of our previously

outstanding senior debt which occurred during 2004. This decrease was partially offset by $38.0 million of

additional interest expense during 2005 associated with our capital lease obligations for the AMC-15 and AMC-16

satellites.

Gain on insurance settlement. During March 2005, we settled an insurance claim and related claims for accrued

interest and bad faith with the insurers of our EchoStar IV satellite for the net amount of $240.0 million. The $134.0

million received in excess of our previously recorded $106.0 million receivable related to this insurance claim was

recognized as a “Gain on insurance settlement” during the year ended December 31, 2005.

Other. “Other” income totaled $36.2 million during the year ended December 31, 2005 compared to “Other”

expense of $13.5 million during 2004. The increase of $49.7 million primarily resulted from a $38.8 million

unrealized gain for the change in fair value of a non-marketable strategic investment accounted for at fair value and

$28.4 million in gains related to the conversion of bond instruments into common stock during the year ended

December 31, 2005. These gains were partially offset by a $25.4 million charge to earnings for other than

temporary declines in the fair value of an investment in the marketable common stock of a company in the home

entertainment industry during the fourth quarter of 2005.

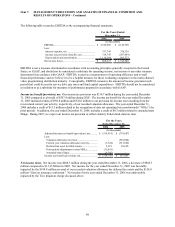

Earnings before interest, taxes, depreciation and amortization. EBITDA was $2.143 billion during the year ended

December 31, 2005, an increase of $947.6 million or 79.3% compared to $1.195 billion during 2004. The increase in

EBITDA was primarily attributable to the changes in operating revenues and expenses discussed above.

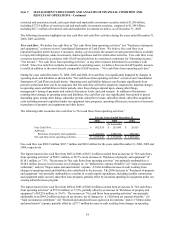

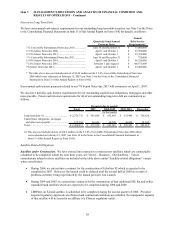

The following table reconciles EBITDA to the accompanying financial statements:

For the Years Ended

December 31,

2005 2004

(In thousands)

EBITDA................................................................ 2,142,990$ 1,195,384$

Less:

Interest expense, net ........................................... 330,326 463,445

Income tax provision (benefit), net...................... (507,449) 11,609

Depreciation and amortization............................ 805,573 505,561

Net income (loss).................................................. 1,514,540$ 214,769$

EBITDA is not a measure determined in accordance with accounting principles generally accepted in the United States,

or GAAP, and should not be considered a substitute for operating income, net income or any other measure determined

in accordance with GAAP. EBITDA is used as a measurement of operating efficiency and overall financial

performance and we believe it to be a helpful measure for those evaluating companies in the multi-channel video

programming distribution industry. Conceptually, EBITDA measures the amount of income generated each period that

could be used to service debt, pay taxes and fund capital expenditures. EBITDA should not be considered in isolation

or as a substitute for measures of performance prepared in accordance with GAAP.