Dish Network 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–32

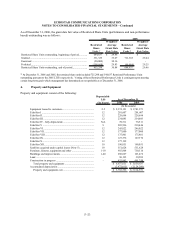

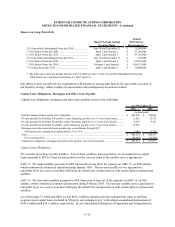

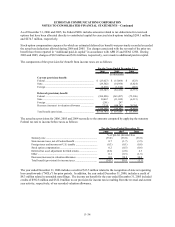

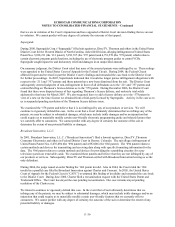

Interest on Long-Term Debt

Annual

Quarterly/Semi-Annual Debt Service

Payment Dates Requirements*

3% Convertible Subordinated Note due 2010 ..................... June 30 and December 31 15,000,000$

5 3/4% Senior Notes due 2008 ............................................ April 1 and October 1 57,500,000$

6 3/8% Senior Notes due 2011............................................. April 1 and October 1 63,750,000$

3% Convertible Subordinated Note due 2011...................... June 30 and December 31 750,000$

6 5/8% Senior Notes due 2014............................................. April 1 and October 1 66,250,000$

7 1/8% Senior Notes due 2016............................................. February 1 and August 1 106,875,000$

7 % Senior Notes due 2013.................................................. April 1 and October 1 35,000,000$

* The table above does not include interest of $14.4 million on the 5 3/4% Convertible Subordinated Notes due

2008 which were redeemed on February 15, 2007 (Note 5).

Our ability to meet our debt service requirements will depend on, among other factors, the successful execution of

our business strategy, which is subject to uncertainties and contingencies beyond our control.

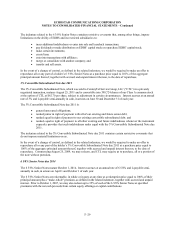

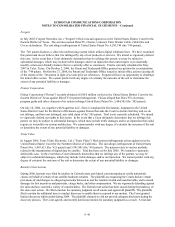

Capital Lease Obligations, Mortgages and Other Notes Payable

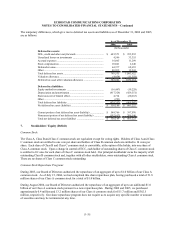

Capital lease obligations, mortgages and other notes payable consist of the following:

As of December 31,

2006 2005

(In thousands)

Satellites financed under capital lease obligations.................................................................................... $ 404,942 $ 438,062

8% note payable for EchoStar VII satellite vendor financing, payable over 13 years from launch........... 11,856 12,735

8% note payable for EchoStar IX satellite vendor financing, payable over 14 years from launch............ 8,659 9,141

6% note payable for EchoStar X satellite vendor financing, payable over 15 years from launch............. 13,955 -

Mortgages and other unsecured notes payable due in installments through 2017

with interest rates ranging from approximately 2% to 13% ................................................................ 2,909 8,399

Total ......................................................................................................................................................... $ 442,321 $ 468,337

Less current portion ............................................................................................................................. (38,464) (36,470)

Capital lease obligations, mortgages and other notes payable, net of current portion .............................. $ 403,857 $ 431,867

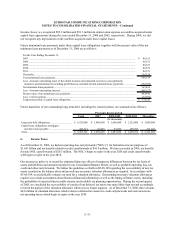

Capital Lease Obligations

We currently lease three in-orbit satellites. Two of these satellites, discussed below, are accounted for as capital

leases pursuant to SFAS 13 and are depreciated over the ten-year terms of the satellite service agreements.

AMC-15. We make monthly payments to SES Americom to lease all of the capacity on AMC 15, an FSS satellite,

which commenced commercial operation during January 2005. The ten-year satellite service agreement is

renewable by us on a year to year basis following the initial term, and provides us with certain rights to replacement

satellites.

AMC-16. We also make monthly payments to SES Americom to lease all of the capacity on AMC 16, an FSS

satellite, which commenced commercial operation during February 2005. The ten-year satellite service agreement is

renewable by us on a year to year basis following the initial term, and provides us with certain rights to replacement

satellites.

As of December 31, 2006 and 2005, we had $551.6 million capitalized for the estimated fair value of satellites

acquired under capital leases included in “Property and equipment, net,” with related accumulated depreciation of

$108.5 million and $53.3 million, respectively. In our Consolidated Statements of Operations and Comprehensive