Dish Network 2005 Annual Report Download - page 52

Download and view the complete annual report

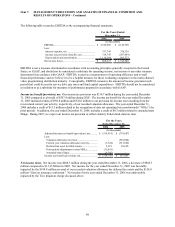

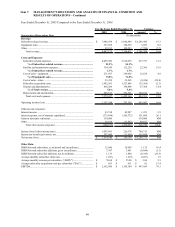

Please find page 52 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

42

SAC. We are not aware of any uniform standards for calculating the “average subscriber acquisition costs per new

subscriber activation,” or SAC, and we believe presentations of SAC may not be calculated consistently by different

companies in the same or similar businesses. We include all new DISH Network subscribers in our calculation,

including DISH Network subscribers added with little or no subscriber acquisition costs.

Prior to January 1, 2006, we calculated SAC for the period by dividing the amount of our expense line item

“Subscriber acquisition costs” for the period, by our gross new DISH Network subscribers added during that period.

Separately, we then disclosed our “Equivalent SAC” for the period by adding the value of equipment capitalized

under our lease program for new subscribers, and other offsetting amounts, as described below, to our “Subscriber

acquisition cost” expense line item prior to dividing by our gross new subscriber number. Management believes

subscriber acquisition cost measures are commonly used by those evaluating companies in the multi-channel video

programming distribution (“MVPD”) industry. Because our Equivalent SAC includes all of the costs of acquiring

subscribers (i.e., subsidized and capitalized equipment), our management focuses on Equivalent SAC as the more

comprehensive measure of how much we are spending to acquire new subscribers. As such, effective January 1,

2006, we began disclosing only “Equivalent SAC,” which we now refer to as SAC. SAC is now calculated as

“Subscriber acquisition costs,” plus the value of equipment capitalized under our lease program for new subscribers,

divided by gross subscriber additions. During the first quarter of 2006, we included in our calculation of SAC the

benefit of payments we received in connection with equipment not returned to us from disconnecting lease

subscribers and returned equipment that is made available for sale rather than being redeployed through our lease

program, as described in that Form 10-Q. Effective the second quarter of 2006, our revised SAC calculation no

longer includes these benefits. Instead, these benefits are separately disclosed. All prior period SAC calculations

have been revised to conform to the current period calculation.

General and administrative expenses. “General and administrative expenses” consists primarily of employee-

related costs associated with administrative services such as legal, information systems, accounting and finance,

including non-cash, stock-based compensation expense related to the adoption of Statement of Financial Accounting

Standards No. 123R (As Amended), “Share-Based Payment” (“SFAS 123R”). It also includes outside professional

fees (i.e. legal and accounting services) and other items associated with facilities and administration.

Interest expense. “Interest expense” primarily includes interest expense, prepayment premiums and amortization of

debt issuance costs associated with our senior debt and convertible subordinated debt securities (net of capitalized

interest) and interest expense associated with our capital lease obligations.

“Other” income (expense). The main components of “Other” income and expense are unrealized gains and losses

from changes in fair value of non-marketable strategic investments accounted for at fair value, equity in earnings

and losses of our affiliates, gains and losses realized on the sale of investments, and impairment of marketable and

non-marketable investment securities.

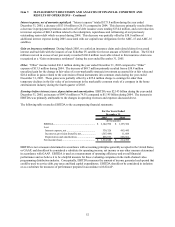

Earnings before interest, taxes, depreciation and amortization (“EBITDA”). EBITDA is defined as “Net income

(loss)” plus “Interest expense” net of “Interest income,” “Taxes” and “Depreciation and amortization.”

DISH Network subscribers. We include customers obtained through direct sales, and through our retail networks,

including our co-branding relationship with AT&T and other distribution relationships, in our DISH Network

subscriber count. We believe our overall economic return for co-branded and traditional subscribers will be

comparable. We also provide DISH Network service to hotels, motels and other commercial accounts. For certain of

these commercial accounts, we divide our total revenue for these commercial accounts by an amount approximately

equal to the retail price of our most widely distributed programming package, America’s Top 100 (but taking into

account, periodically, price changes and other factors), and include the resulting number, which is substantially smaller

than the actual number of commercial units served, in our DISH Network subscriber count.

During April 2004, we acquired a C-band subscription television service business, the assets of which primarily consist

of acquired customer relationships. Although we are converting some of these customer relationships from C-band

subscription television services to our DISH Network DBS subscription television service, acquired C-band subscribers

are not included in our DISH Network subscriber count unless they have also subscribed to our DISH Network DBS

television service.