Dish Network 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

46

“Subscriber-related expenses” as a percentage of “Subscriber-related revenue” could materially increase absent

corresponding price increases in our DISH Network programming packages.

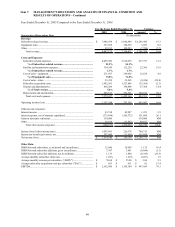

Satellite and transmission expenses. “Satellite and transmission expenses” totaled $147.5 million during the year

ended December 31, 2006, an increase of $12.9 million or 9.6% compared to 2005. This increase primarily resulted

from higher operational costs associated with our capital leases of AMC-15 and AMC-16. “Satellite and

transmission expenses” totaled 1.6% and 1.7% of “Subscriber-related revenue” during the years ended December 31,

2006 and 2005, respectively. These expenses will increase further in the future as we increase the size of our satellite

fleet, if we obtain in-orbit satellite insurance, as we increase the number and operations of our digital broadcast centers

and as additional local markets and other programming services are launched.

Cost of sales – equipment. “Cost of sales – equipment” totaled $282.4 million during the year ended December 31,

2006, an increase of $10.7 million or 3.9% compared to 2005. This increase primarily resulted from an increase in

charges for defective, slow moving and obsolete inventory. “Cost of sales – equipment” represented 78.0% and

73.8% of “Equipment sales,” during the years ended December 31, 2006 and 2005, respectively. The increase in the

expense to revenue ratio principally related to higher charges for defective, slow moving and obsolete inventory in

2006.

Subscriber acquisition costs. “Subscriber acquisition costs” totaled $1.596 billion for the year ended December 31,

2006, an increase of $103.7 million or 6.9% compared to 2005. The increase in “Subscriber acquisition costs” was

primarily attributable to an increase in gross new subscribers and a decline in the number of co-branded subscribers

acquired under our original AT&T agreement, for which we did not incur subscriber acquisition costs. This increase

was also attributable to higher installation and acquisition advertising costs, partially offset by a higher number of

DISH Network subscribers participating in our equipment lease program for new subscribers. The introduction of new

equipment resulted in a decrease in our cost per installation during 2006 compared to 2005; however, as a result of

increased volume, our overall installation expense increased.

SAC. SAC was $686 during the year ended December 31, 2006 compared to $693 during 2005, a decrease of $7, or

1.0%. This decrease was primarily attributable to the equipment redeployment benefits of our equipment lease

programs, discussed below, and lower average equipment and installation costs, partially offset by a decline in the

number of co-branded subscribers acquired under our original AT&T agreement and higher acquisition advertising

costs. As previously discussed, the calculation of SAC for prior periods has been revised to conform to the current

year presentation.

Our principal method for reducing the cost of subscriber equipment, which is included in SAC, is to lease our

receiver systems to new subscribers rather than selling systems to them at little or no cost. Upon termination of

service, lease subscribers are required to return the leased equipment to us or be charged for the equipment. Leased

equipment that is returned to us which we redeploy to new lease customers, results in reduced capital expenditures,

and thus reduced SAC.

The percentage of our new subscribers choosing to lease rather than purchase equipment continued to increase for

the year ended December 31, 2006 compared to 2005. During the years ended December 31, 2006 and 2005, the

amount of equipment capitalized under our lease program for new subscribers totaled $816.5 million and $861.5

million, respectively. This decrease in capital expenditures under our lease program for new subscribers resulted

primarily from lower hardware costs per receiver, fewer receivers per installation as the number of dual tuner receivers

we install continues to increase, increased redeployment of equipment returned by disconnecting lease program

subscribers, and a reduction in accessory costs related to the introduction of less costly installation technology and our

migration away from relatively expensive and complex subscriber equipment installations. Capital expenditures

resulting from our equipment lease program for new subscribers have been, and we expect will continue to be,

partially mitigated by, among other things, the redeployment of equipment returned by disconnecting lease program

subscribers. However, to remain competitive we will have to upgrade or replace subscriber equipment periodically

as technology changes, and the associated costs may be substantial. To the extent technological changes render a

portion of our existing equipment obsolete, we would be unable to redeploy all returned equipment and would

realize less benefit from the SAC reduction associated with redeployment of that returned lease equipment.