Dish Network 2005 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–17

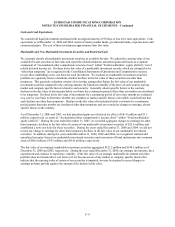

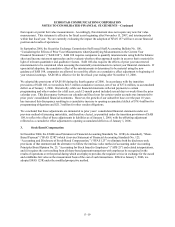

Subscriber Acquisition Costs. Subscriber acquisition costs in our Consolidated Statements of Operations and

Comprehensive Income (Loss) consist of costs incurred to acquire new subscribers through third parties and our direct

customer acquisition distribution channel. Subscriber acquisition costs include the following line items from our

Consolidated Statements of Operations and Comprehensive Income (Loss):

• “Cost of sales – subscriber promotion subsidies” includes the cost of EchoStar receiver systems sold to

retailers and other distributors of our equipment and receiver systems sold directly by us to subscribers.

• “Other subscriber promotion subsidies” includes net costs related to promotional incentives and costs related

to installation.

• “Subscriber acquisition advertising” includes advertising and marketing expenses related to the acquisition of

new DISH Network subscribers. Advertising costs generally are expensed as incurred.

Accounting for dealer sales under our promotions fall within the scope of EITF 01-9. In accordance with that

guidance, we characterize amounts paid to our independent dealers as consideration for equipment installation services

and for equipment buydowns (commissions and rebates) as a reduction of revenue. We expense payments for

equipment installation services as “Other subscriber promotion subsidies.” Our payments for equipment buydowns

represent a partial or complete return of the dealer’s purchase price and are, therefore, netted against the proceeds

received from the dealer. We report the net cost from our various sales promotions through our independent dealer

network as a component of “Other subscriber promotion subsidies.” No net proceeds from the sale of subscriber

related equipment pursuant to our subscriber acquisition promotions are recognized as revenue.

Research and Development Costs

Research and development costs are expensed as incurred. Research and development costs totaled $56.7 million,

$46.1 million and $40.0 million for the years ended December 31, 2006, 2005 and 2004, respectively.

Basic and Diluted Net Income (Loss) Per Share

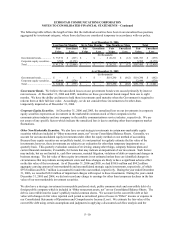

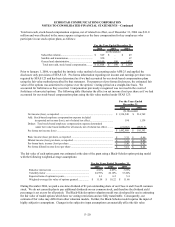

Statement of Financial Accounting Standards No. 128, “Earnings Per Share” (“SFAS 128”) requires entities to

present both basic earnings per share (“EPS”) and diluted EPS. Basic EPS excludes dilution and is computed by

dividing net income (loss) by the weighted-average number of common shares outstanding for the period. Diluted

EPS reflects the potential dilution that could occur if stock options were exercised and convertible securities were

converted to common stock.

The potential dilution from our subordinated notes convertible into common stock was computed using the “if

converted method.” Since we reported net income attributable to common stockholders for the years ending

December 31, 2006, 2005 and 2004, the potential dilution from stock options exercisable into common stock for

these periods was computed using the treasury stock method based on the average market value of our Class A

common stock for the period. The following table reflects the basic and diluted weighted-average shares

outstanding used to calculate basic and diluted earnings per share. Earnings per share amounts for all periods are

presented below in accordance with the requirements of SFAS 128.