Dish Network 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

56

The improvement from 2004 to 2005 was partially offset by the following financing sources of cash:

• During 2004, we sold $1.0 billion principal amount of our 6 5/8% Senior Notes due 2014 and $25.0 million

3% Convertible Subordinated Note due 2011 to CenturyTel Service Group L.L.C.

Other Liquidity Items

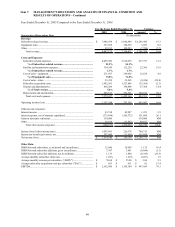

Subscriber turnover. Our percentage monthly subscriber churn for the year ended December 31, 2006 was 1.64%,

compared to percentage subscriber churn for 2005 of 1.65%. Our future subscriber churn may be negatively

impacted by a number of factors, including but not limited to, an increase in competition from existing competitors

and new entrants offering more compelling promotions, as well as new advanced products and services. Competitor

bundling of video services with 2-way high speed Internet access and telephone services may also contribute more

significantly to churn over time. There can be no assurance that these and other factors will not contribute to

relatively higher churn than we have experienced historically. Additionally, certain of our promotions allow

consumers with relatively lower credit scores to become subscribers, and these subscribers typically churn at a

higher rate. However, these subscribers are also acquired at a lower cost resulting in a smaller economic loss upon

disconnect.

Additionally, as the size of our subscriber base increases, even if our churn percentage remains constant or declines,

increasing numbers of gross new DISH Network subscribers are required to sustain net subscriber growth.

Increases in theft of our signal, or our competitors’ signals, also could cause subscriber churn to increase in future

periods. We use microchips embedded in credit card-sized access cards, called “smart cards,” or in security chips in

our EchoStar receiver systems to control access to authorized programming content. Our signal encryption has

been compromised by theft of service and could be further compromised in the future. We continue to respond to

compromises of our encryption system with security measures intended to make signal theft of our programming

more difficult. During 2005, we completed the replacement of our smart cards. While the smart card replacement

did not fully secure our system, we continue to implement software patches and other security measures to help

protect our service. There can be no assurance that our security measures will be effective in reducing theft of our

programming signals. If we are required to replace existing smart cards, the cost could exceed $100.0 million.

Subscriber acquisition and retention costs. Our subscriber acquisition and retention costs can vary significantly

from period to period which can in turn cause significant variability to our net income (loss) and free cash flow

between periods. Our “Subscriber acquisition costs,” SAC and “Subscriber-related expenses” may materially

increase to the extent that we introduce more aggressive promotions in the future if we determine they are necessary

to respond to competition, or for other reasons.

Capital expenditures resulting from our equipment lease program for new subscribers have been, and we expect will

continue to be, partially mitigated by, among other things, the redeployment of equipment returned by disconnecting

lease program subscribers. However, to remain competitive we will have to upgrade or replace subscriber

equipment periodically as technology changes, and the associated costs may be substantial. To the extent

technological changes render existing equipment obsolete, we would cease to benefit from the SAC reduction

associated with redeployment of that returned lease equipment.

Several years ago, we began deploying satellite receivers capable of exploiting 8PSK modulation technology. Since

that technology is now standard in all of our new satellite receivers, our cost to migrate programming channels to

that technology in the future will be substantially lower than if it were necessary to replace all existing consumer

equipment. As we continue to implement 8PSK technology, bandwidth efficiency will improve, significantly

increasing the number of programming channels we can transmit over our existing satellites as an alternative or

supplement to the acquisition of additional spectrum or the construction of additional satellites. New channels we

add to our service using only that technology may allow us to further reduce conversion costs and create additional

revenue opportunities. We have also implemented MPEG-4 technology in all satellite receivers for new customers

who subscribe to our HD programming packages. This technology should result in further bandwidth efficiencies

over time. We have not yet determined the extent to which we will convert the EchoStar DBS System to these new

technologies, or the period of time over which the conversions will occur. Since EchoStar X commenced