Dish Network 2005 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–35

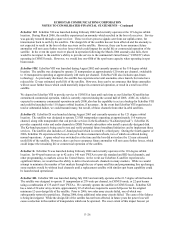

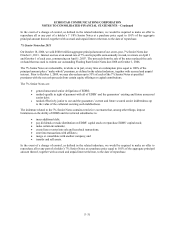

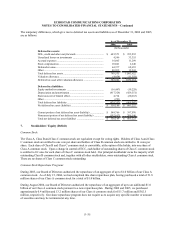

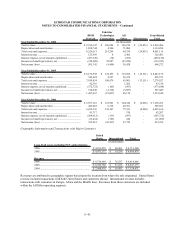

The temporary differences, which give rise to deferred tax assets and liabilities as of December 31, 2006 and 2005,

are as follows:

As of December 31,

2006 2005

(In thousands)

Deferred tax assets:

NOL, credit and other carryforwards .......................................... 645,571$ 955,832$

Unrealized losses on investments ............................................... 4,546 33,355

Accrued expenses ....................................................................... 16,065 11,299

Stock compensation .................................................................... 10,041 2,240

Deferred revenue......................................................................... 64,377 68,655

Other ........................................................................................... 48,935 12,241

Total deferred tax assets ............................................................. 789,535 1,083,622

Valuation allowance ................................................................... (4,034) (11,358)

Deferred tax asset after valuation allowance .............................. 785,501 1,072,264

Deferred tax liabilities:

Equity method investments ........................................................ (16,447) (19,228)

Depreciation and amortization .................................................... (417,328) (429,551)

State taxes net of federal effect.................................................... 4,714 (20,263)

Other ........................................................................................... (291) -

Total deferred tax liabilities ........................................................ (429,352) (469,042)

Net deferred tax asset (liability) ................................................. 356,149$ 603,222$

Current portion of net deferred tax asset (liability) ..................... 548,766$ 397,076$

Noncurrent portion of net deferred tax asset (liability) ............... (192,617) 206,146

Total net deferred tax asset (liability) ......................................... 356,149$ 603,222$

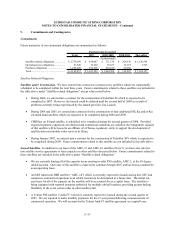

7. Stockholders’ Equity (Deficit)

Common Stock

The Class A, Class B and Class C common stock are equivalent except for voting rights. Holders of Class A and Class

C common stock are entitled to one vote per share and holders of Class B common stock are entitled to 10 votes per

share. Each share of Class B and Class C common stock is convertible, at the option of the holder, into one share of

Class A common stock. Upon a change in control of ECC, each holder of outstanding shares of Class C common stock

is entitled to 10 votes for each share of Class C common stock held. Our principal stockholder owns the majority of all

outstanding Class B common stock and, together with all other stockholders, owns outstanding Class A common stock.

There are no shares of Class C common stock outstanding.

Common Stock Repurchase Programs

During 2003, our Board of Directors authorized the repurchase of an aggregate of up to $1.0 billion of our Class A

common stock. As of July 15, 2004, we had completed this share repurchase plan, having purchased a total of 31.8

million shares of our Class A common stock for a total of $1.0 billion.

During August 2004, our Board of Directors authorized the repurchase of an aggregate of up to an additional $1.0

billion of our Class A common stock pursuant to a new repurchase plan. During 2006 and 2005, we purchased

approximately 0.4 million and 13.2 million shares of our Class A common stock for $11.7 million and $362.5

million, respectively. Our share repurchase program does not require us to acquire any specific number or amount

of securities and may be terminated at any time.