Dish Network 2005 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–22

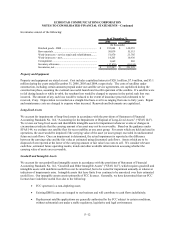

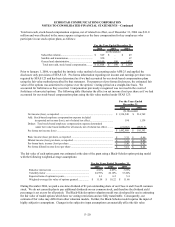

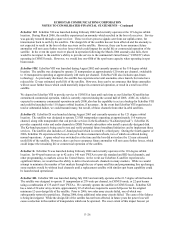

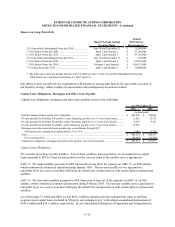

A summary of our stock option activity for the years ended December 31, 2006, 2005 and 2004 is as follows:

2006 2005 2004

Options

Weighted-

Average

Exercise

Price Options

Weighted-

Average

Exercise

Price Options

Weighted-

Average

Exercise

Price

Options outstanding, beginning of year ...... 25,086,883 24.43$ 17,734,216 21.06$ 17,818,818 16.62$

Granted ....................................................... 2,155,500 32.41 10,361,250 29.17 4,238,000 31.64

Exercised .................................................... (1,519,550) 14.14 (916,328) 8.32 (2,182,498) 6.63

Forfeited and Cancelled............................... (2,961,000) 25.99 (2,092,255) 26.38 (2,140,104) 19.80

Options outstanding, end of year................. 22,761,833 25.67 25,086,883 24.43 17,734,216 21.06

Exercisable at end of year............................ 6,568,883 32.85 6,914,133 29.54 5,662,416 25.95

The tax benefit realized from share options exercised during the year ended December 31, 2006 was $10.9 million.

Based on the average market value for the year ended December 31, 2006, the aggregate intrinsic value for the options

outstanding was $186.9 million, of which $32.3 million was exercisable at the end of the period.

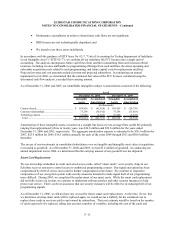

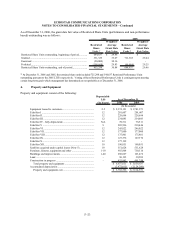

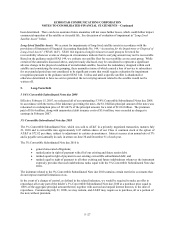

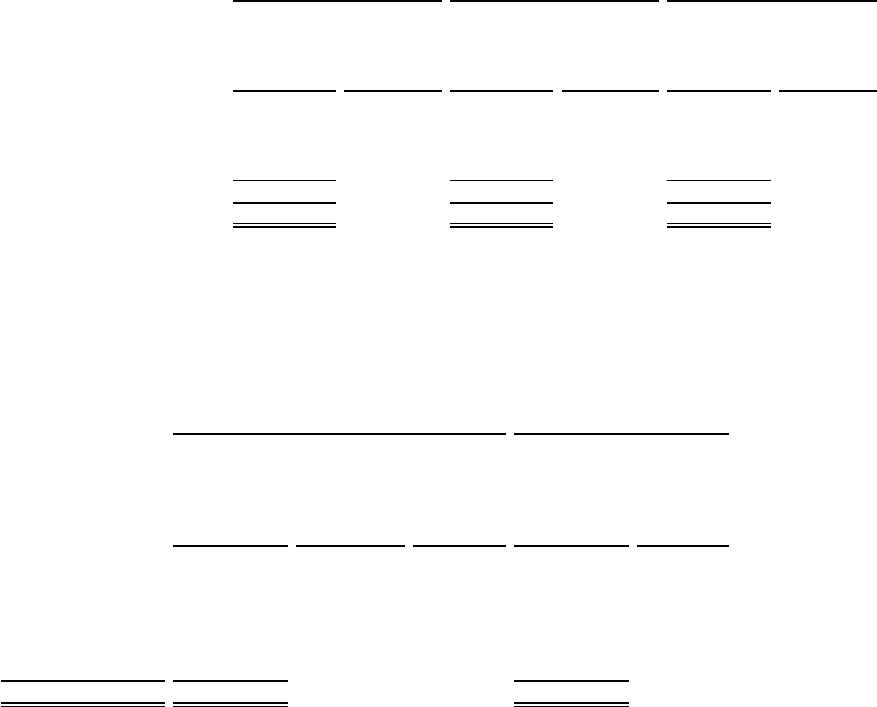

Exercise prices for options outstanding and exercisable as of December 31, 2006 are as follows:

Options Outstanding Options Exercisable

Number

Outstanding

as of

December 31,

2006 *

Weighted-

Average

Remaining

Contractual

Life

Weighted-

Average

Exercise

Price

Number

Exercisable

as of

December 31,

2006

Weighted-

Average

Exercise

Price

2.13$ - 6.00$ 5,442,269 2.00 5.97$ 578,269 5.71$

6.01$ - 20.00$ 938,054 2.31 13.49 334,054 12.66

20.01$ - 29.00$ 2,261,200 7.12 27.48 1,700,800 27.69

29.01$ - 31.00$ 9,083,210 8.29 29.85 1,105,460 30.26

31.01$ - 40.00$ 3,805,100 7.58 33.72 1,750,300 33.85

40.01$ - 79.00$ 1,232,000 3.27 62.87 1,100,000 62.25

2.13$ - 79.00$ 22,761,833 6.03 25.67 6,568,883 32.85

* These amounts include 5.7 million shares and 5.3 million shares outstanding pursuant to the 1999 LTIP and 2005

LTIP, respectively. Vesting of these options is contingent upon meeting certain long-term goals which management has

determined are not probable as of December 31, 2006.

As of December 31, 2006, our total unrecognized compensation cost related to our non-performance based unvested

stock options was $55.2 million. This cost is based on an assumed future forfeiture rate of 8.0% per year and will be

recognized over a weighted-average period of approximately three years.