Dish Network 2005 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–45

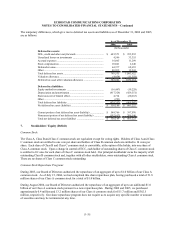

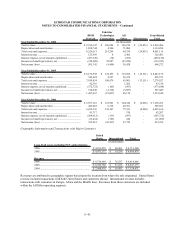

in “Total revenue” in our Consolidated Statements of Operations and Comprehensive Income (Loss). Net

Income for the periods was not affected.

(2) “Total revenue” in our Consolidated Statements of Operations and Comprehensive Income (Loss) for the three

months ended December 31, 2006 reflects a $13.8 million out of period pre-tax adjustment for payments

received from subscribers during the first nine months of the year. This adjustment was not material to all prior

periods presented and did not impact our Consolidated Statements of Operations and Comprehensive Income

(Loss) for the year ended December 31, 2006.

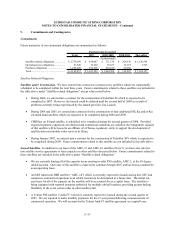

13. Related Party Transactions

We own 50% of NagraStar L.L.C. (“NagraStar”), a joint venture that is our exclusive provider of encryption and

related security systems intended to assure that only paying customers have access to our programming. Because

we are not required to consolidate NagraStar, but we do have the ability to significantly influence its operating

policies, we accounted for our investment in NagraStar under the equity method of accounting for all periods

presented. During the years ended December 31, 2006, 2005 and 2004, we purchased security access devices from

NagraStar of $55.8 million, $121.4 million and $123.8 million, respectively. As of December 31, 2006 and 2005,

amounts payable to NagraStar totaled $3.3 million and $3.9 million, respectively. Additionally, as of December 31,

2006, we were committed to purchase $35.5 million of security access devices from NagraStar.

14. Subsequent Events

On February 21, 2007, we announced a $40.0 million investment in TU Media Corp., a Korean provider of satellite-

delivered mobile video services.

During February 2007, we began participating in an FCC Auction for licenses in the 1.4 GHz band. Through

February 26, 2007, we were the provisional winning bidder for licenses totaling approximately $52.0 million and we

may continue to bid on the licenses available in the Auction through its conclusion.