Dish Network 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

40

subscribers rather than selling systems to them at little or no cost. Leasing enables us to, among other things, reduce

our future subscriber acquisition costs by redeploying equipment returned by disconnected lease subscribers. We

are further reducing the cost of subscriber equipment through our design and deployment of EchoStar receivers with

multiple tuners that allow the subscriber to receive our DISH Network services in multiple rooms using a single

receiver, thereby reducing the number of EchoStar receivers we deploy to each subscriber household.

However, our overall costs to retain existing subscribers and acquire new subscribers, including amounts expensed

and capitalized, both in the aggregate and on a per subscriber basis, may materially increase in the future to the extent

that we introduce more aggressive promotions or newer, more expensive consumer electronics products in response to

new promotions and products offered by our competitors or for other reasons. In addition, expanded use of new

compression technologies, such as MPEG-4 and 8PSK, will inevitably render some portion of our current and future

EchoStar receivers obsolete, and we will incur additional costs, which may be substantial, to upgrade or replace these

receivers. While we may be able to generate increased revenue from such conversions, the deployment of

equipment including new technologies will increase the cost of our consumer equipment, at least in the short term.

Our subscriber acquisition and retention costs will increase to the extent we subsidize those costs for new and

existing subscribers.

Domestic and international expansion. Finally, we are actively involved in pursuing strategic investment and other

new business opportunities both domestically and abroad. These initiatives include, among other things, our

recently announced investments in satellite-delivered mobile video ventures in China and Korea, as well as

investments we make domestically in companies whose products and services complement our core businesses or

may be a strategic fit with our new business initiatives. These investments are intended to provide new markets for

future revenue and long term strategic growth, as well as opportunities to leverage the introduction of new products

and services for the benefit of our core business. However, these investments involve a high degree of risk. They

could expose us to significant financial losses if the underlying ventures are not successful.

EXPLANATION OF KEY METRICS AND OTHER ITEMS

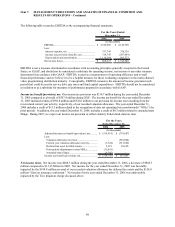

Subscriber-related revenue. “Subscriber-related revenue” consists principally of revenue from basic, movie, local,

pay-per-view, and international subscription television services, equipment rental fees, additional outlet fees from

subscribers with multiple receivers, digital video recorder (“DVR”) fees, advertising sales, fees earned from our

DishHOME Protection Plan, equipment upgrade fees, HD programming and other subscriber revenue. Therefore,

not all of the amounts we include in “Subscriber-related revenue” are recurring on a monthly basis. “Subscriber-

related revenue” also includes revenue from equipment sales, installation and other services related to our original

agreement with AT&T. Revenue from equipment sales to AT&T is deferred and recognized over the estimated

average co-branded subscriber life. Revenue from installation and certain other services performed at the request of

AT&T is recognized upon completion of the services. All prior period amounts were reclassified to conform to the

current period presentation.

Development and implementation fees received from AT&T are being recognized in “Subscriber-related revenue” over

the next several years. In order to estimate the amount recognized monthly, we first divide the number of subscribers

activated during the month under the AT&T agreement by total estimated subscriber activations during the life of the

contract. We then multiply this percentage by the total development and implementation fees received from AT&T.

The resulting estimated amount is recognized monthly as revenue over the estimated average subscriber life.

During the fourth quarter 2005, we modified and extended our distribution and sales agency agreement with AT&T.

We believe our overall economic return is similar under both arrangements. However, the impact of subscriber

acquisition on many of our line item business metrics was substantially different under the original AT&T

agreement, compared to most other sales channels (including the revised AT&T agreement).

Among other things, our “Subscriber-related revenue” has been impacted in a number of respects. Commencing in

the fourth quarter 2005, new subscribers acquired under our revised AT&T agreement do not generate equipment

sales, installation or other services revenue from AT&T. However, our programming services revenue is greater for

subscribers acquired under the revised AT&T agreement.

Deferred equipment sales revenue relating to subscribers acquired through our original AT&T agreement will

continue to have a positive impact on “Subscriber-related revenue” over the estimated average life of those