Dish Network 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–12

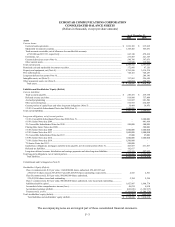

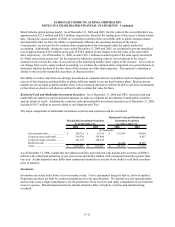

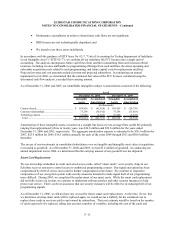

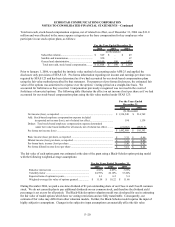

Inventories consist of the following:

As of December 31,

2006 2005

(In thousands)

Finished goods - DBS ..................................................... $ 132,604 $ 140,955

Raw materials .................................................................. 50,039 55,115

Work-in-process - service repair and refurbishment........ 51,870 23,705

Work-in-process - new..................................................... 14,203 10,936

Consignment .................................................................... 1,669 803

Inventory allowance.........................................................

(

12,878

)

(

10,185

)

Inventories, net................................................................. 237,507$ 221,329$

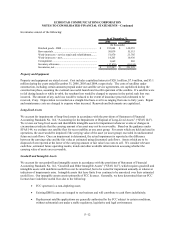

Property and Equipment

Property and equipment are stated at cost. Cost includes capitalized interest of $20.1 million, $7.6 million, and $3.1

million during the years ended December 31, 2006, 2005 and 2004, respectively. The costs of satellites under

construction, including certain amounts prepaid under our satellite service agreements, are capitalized during the

construction phase, assuming the eventual successful launch and in-orbit operation of the satellite. If a satellite were

to fail during launch or while in-orbit, the resultant loss would be charged to expense in the period such loss was

incurred. The amount of any such loss would be reduced to the extent of insurance proceeds estimated to be

received, if any. Depreciation is recorded on a straight-line basis over lives ranging from one to forty years. Repair

and maintenance costs are charged to expense when incurred. Renewals and betterments are capitalized.

Long-Lived Assets

We account for impairments of long-lived assets in accordance with the provisions of Statement of Financial

Accounting Standards No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets” (“SFAS 144”).

We review our long-lived assets and identifiable intangible assets for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. Based on the guidance under

SFAS 144, we evaluate our satellite fleet for recoverability as one asset group. For assets which are held and used in

operations, the asset would be impaired if the carrying value of the asset (or asset group) exceeded its undiscounted

future net cash flows. Once an impairment is determined, the actual impairment is reported as the difference

between the carrying value and the fair value as estimated using discounted cash flows. Assets which are to be

disposed of are reported at the lower of the carrying amount or fair value less costs to sell. We consider relevant

cash flow, estimated future operating results, trends and other available information in assessing whether the

carrying value of assets are recoverable.

Goodwill and Intangible Assets

We account for our goodwill and intangible assets in accordance with the provisions of Statement of Financial

Accounting Standards No. 142, “Goodwill and Other Intangible Assets” (“SFAS 142”), which requires goodwill and

intangible assets with indefinite useful lives not be amortized, but to be tested for impairment annually or whenever

indicators of impairments arise. Intangible assets that have finite lives continue to be amortized over their estimated

useful lives. Our intangible assets consist primarily of FCC licenses. Generally, we have determined that our FCC

licenses have indefinite useful lives due to the following:

• FCC spectrum is a non-depleting asset;

• Existing DBS licenses are integral to our business and will contribute to cash flows indefinitely;

• Replacement satellite applications are generally authorized by the FCC subject to certain conditions,

without substantial cost under a stable regulatory, legislative and legal environment;