Dish Network 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–34

As of December 31, 2006 and 2005, the Federal NOL includes amounts related to tax deductions for exercised

options that have been allocated directly to contributed capital for exercised stock options totaling $284.1 million

and $274.7 million, respectively.

Stock option compensation expenses for which an estimated deferred tax benefit was previously recorded exceeded

the actual tax deductions allowed during 2006 and 2005. Tax charges associated with the reversal of the prior tax

benefit have been reported in “Additional paid-in capital” in accordance with APB 25 and SFAS 123R. During

2006 and 2005, charges of $0.9 million and $10.4 million, respectively, were made to additional paid-in capital.

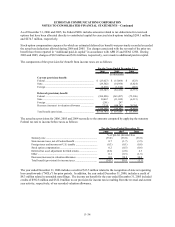

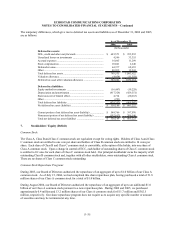

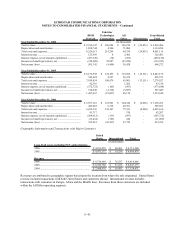

The components of the (provision for) benefit from income taxes are as follows:

For the Years Ended December 31,

2006 2005 2004

(In thousands)

Current

(p

rovision

)

benefit:

Federal ............................................................................ $ (23,027) $ (15,864) $ (523)

State... ............................................................................. (29,502) (14,958) (5,824)

Foreign ............................................................................ (2,818) (1,614) (428)

(55,347) (32,436) (6,775)

Deferred

(p

rovision

)

benefit:

Federal ............................................................................ (304,896) (363,457) (75,306)

State ................................................................................ 38,467 (11,692) (6,313)

Foreign ............................................................................ (291) 247 -

Decrease (increase) in valuation allowance .................... 7,324 914,787 76,785

(259,396) 539,885 (4,834)

Total benefit (provision).................................................. (314,743)$ 507,449$ (11,609)$

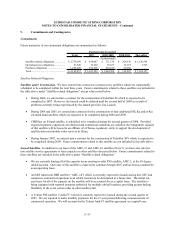

The actual tax provisions for 2006, 2005 and 2004 reconcile to the amounts computed by applying the statutory

Federal tax rate to income before taxes as follows:

For the Years Ended December 31,

2006 2005 2004

% of pre-tax (income)/loss

Statutory rate .............................................................................. (35.0) (35.0) (35.0)

State income taxes, net of Federal benefit .................................. 0.7 (1.7) (3.5)

Foreign taxes and income not U.S. taxable ................................. (0.3) (0.1) (0.8)

Stock option compensation ......................................................... 0.2 (0.5) (0.6)

Deferred tax asset adjustment for filed returns ........................... (0.6) (2.8) 2.3

Other ........................................................................................... 0.1 (0.3) (1.5)

Decrease (increase) in valuation allowance ................................ 0.8 90.8 34.0

Total benefit (provision) for income taxes ................................. (34.1) 50.4 (5.1)

The year ended December 31, 2006 includes a credit of $13.5 million related to the recognition of state net operating

loss carryforwards (“NOLs”) for prior periods. In addition, the year ended December 31, 2006, includes a credit of

$8.3 million related to amended state filings. The income tax benefit for the year ended December 31, 2005 included

credits of $592.8 million and $322.0 million to our provision for income taxes resulting from the reversal and current

year activity, respectively, of our recorded valuation allowance.