Dish Network 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS – Continued

60

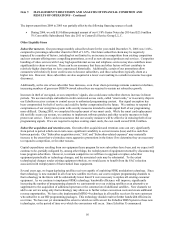

control of inventory levels, and can materially impact our future operating asset and liability balances, and our future

working capital requirements.

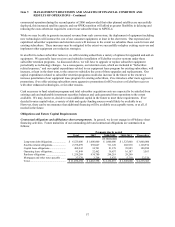

Programming Contracts

In the normal course of business, we have entered into numerous contracts to purchase programming content where

our payment obligations are fully contingent on the number of subscribers to whom we provide the respective

content. These programming commitments are not included in the table above. The terms of our contracts typically

range from one to ten years with annual rate increases. Our programming expenses will continue to increase to the

extent we are successful growing our subscriber base. Programming expenses are included in “Subscriber-related

expenses” in the accompanying consolidated statements of operations and comprehensive income (loss).

Satellite insurance. We currently have no commercial insurance coverage on the satellites we own. We do not use

commercial insurance to mitigate the potential financial impact of in-orbit failures because we believe that the

premium costs are uneconomic relative to the risk of satellite failure. We believe we generally have in-orbit satellite

capacity sufficient to recover, in a relatively short time frame, transmission of most of our critical programming in

the event one of our in-orbit satellites fails. We could not, however, recover certain local markets, international and

other niche programming. Further, programming continuity cannot be assured in the event of multiple satellite

losses.

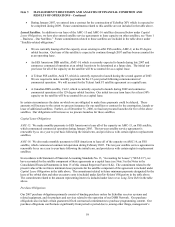

Future capital requirements. In addition to our DBS business plan, we are exploring business plans for extended

FSS Ku-band and FSS Ka-band satellite systems, including licenses to operate at the 97, 109, 113 and 121 degree

orbital locations.

As a result of expected penetration of our new and existing subscriber equipment lease programs, we anticipate an

increase in capitalized subscriber equipment during 2007. We expect our capital expenditures for 2007 to be higher

than 2006 capital expenditures of $1.396 billion.

From time to time we evaluate opportunities for strategic investments or acquisitions that would complement our

current services and products, enhance our technical capabilities or otherwise offer growth opportunities. We may

make investments in or partner with others to expand our business into mobile and portable video, data and voice

services. Future material investments or acquisitions may require that we obtain additional capital. Also, as

discussed previously, our Board of Directors approved extending the plan to repurchase our Class A common stock,

which could require that we raise additional capital. The maximum dollar value of shares that may still be purchased

under the plan is $625.8 million. There can be no assurance that we could raise all required capital or that required

capital would be available on acceptable terms.

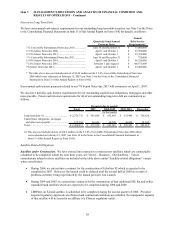

Security Ratings

Our current credit ratings are Ba3 and BB- on our long-term senior notes, and B2 and B with respect to our publicly

traded convertible subordinated notes, as rated by Moody’s Investor Service and Standard and Poor’s Rating Service,

respectively. Debt ratings by the various rating agencies reflect each agency’s opinion of the ability of issuers to repay

debt obligations as they come due.

With respect to Moody’s, the Ba3 rating for our senior debt indicates that the obligations are judged to have speculative

elements and are subject to substantial credit risk. For S&P, the BB- rating indicates the issuer is less vulnerable to

nonpayment of interest and principal obligations than other speculative issues. However, the issuer faces major

ongoing uncertainties or exposure to adverse business, financial, or economic conditions, which could lead to the

obligor’s inadequate capacity to meet its financial commitment on the obligation.

Effective February 15, 2007, we redeemed all of our outstanding 5 3/4% Convertible Subordinated Notes due 2008.

Critical Accounting Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make

estimates, judgments and assumptions that affect amounts reported therein. Management bases its estimates,