Dell 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Compensation expense for restricted stock awards with a service condition is recognized on a straight-line basis over the vesting term.

Compensation expense for performance-based restricted stock awards is recognized on an accelerated multiple-award approach based on

the most probable outcome of the performance condition.

Acceleration of Vesting of Options — On January 23, 2009, Dell's Board of Directors approved the acceleration of the vesting of

unvested "out-of-the-money" stock options (options that have an exercise price greater than the current market stock price) with exercise

prices equal to or greater than $10.14 per share for approximately 2,800 employees holding options to purchase approximately 21 million

shares of common stock. Dell concluded the modification to the stated vesting provisions was substantive after Dell considered the

volatility of its share price and the exercise price of the amended options in relation to recent share values. Because the modification was

considered substantive, the remaining unearned compensation expense of $104 million was recorded as an expense in Fiscal 2009. The

weighted-average exercise price of the options that were accelerated was $21.90.

Cash Payment for Expired Stock Options — Dell decided to pay cash to current and former employees who held "in-the-money" stock

options (options that have an exercise price less than the current market stock price) that expired during the period of unexercisability.

During Fiscal 2008, Dell made payments of approximately $107 million, which were expensed, relating to in-the-money stock options

that expired in the second and third quarters of Fiscal 2008.

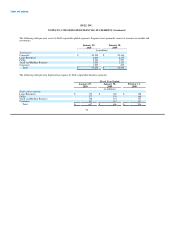

General Information

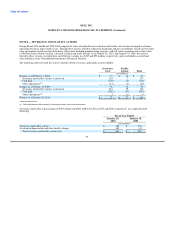

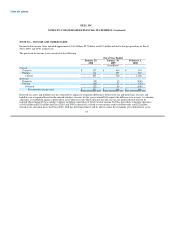

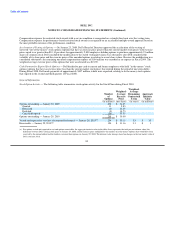

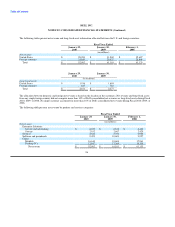

Stock Option Activity — The following table summarizes stock option activity for the Stock Plans during Fiscal 2010:

Weighted-

Weighted- Average

Number Average Remaining Aggregate

of Exercise Contractual Intrinsic

Options Price Term Value

(in millions) (per share) (in years) (in millions)

Options outstanding — January 30, 2009 230 $ 31.85

Granted 11 9.83

Exercised (0) 12.05

Forfeited (0) 14.73

Cancelled/expired (36) 35.59

Options outstanding — January 29, 2010 205 $ 30.00

Vested and expected to vest (net of estimated forfeitures) — January 29, 2010(a) 204 $ 30.15 3.5 $ 35

Exercisable — January 29, 2010(a) 194 $ 31.16 3.1 $ 1

(a) For options vested and expected to vest and options exercisable, the aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the

difference between Dell's closing stock price on January 29, 2010, and the exercise price multiplied by the number of in-the-money options) that would have been

received by the option holders had the holders exercised their options on January 29, 2010. The intrinsic value changes based on changes in the fair market value of

Dell's common stock.

89