Dell 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

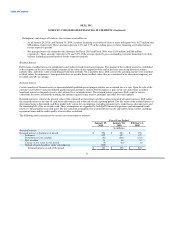

year ended January 29, 2010. See Note 6 of Notes to Consolidated Financial Statements for additional information about goodwill and

intangible assets.

NOTE 3 — FINANCIAL INSTRUMENTS

Investments

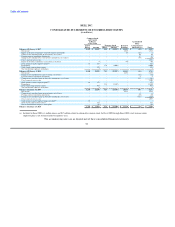

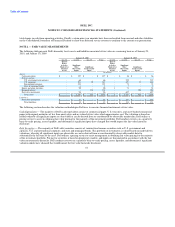

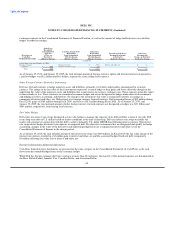

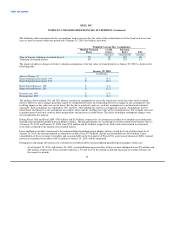

The following table summarizes, by major security type, the fair value and amortized cost of Dell's investments. All debt security

investments with remaining maturities in excess of one year and substantially all equity and other securities are recorded as long-term

investments in the Consolidated Statements of Financial Position.

January 29, 2010 January 30, 2009

Fair Unrealized Unrealized Fair Unrealized Unrealized

Value Cost Gain (Loss) Value Cost Gain (Loss)

(in millions)

Investments

Debt securities:

U.S. government and agencies $ 66 $ 66 $ - $ - $ 539 $ 537 $ 3 $ (1)

U.S. corporate 583 581 3 (1) 484 491 2 (9)

International corporate 391 391 1 (1) 78 77 1 -

State and municipal governments 2 2 - - 5 5 - -

Total debt securities 1,042 1,040 4 (2) 1,106 1,110 6 (10)

Equity and other securities 112 112 - - 88 88 - -

Total investments $ 1,154 $ 1,152 $ 4 $ (2) $ 1,194 $ 1,198 $ 6 $ (10)

Dell's investments in debt securities are classified as available-for-sale. Equity and other securities primarily relate to investments held in

Dell's Deferred Compensation Plan, which are classified as trading securities. Both of these classes of securities are reported at fair value

using the specific identification method. All other investments are initially recorded at cost and reduced for any impairment losses. The

fair value of Dell's portfolio is affected primarily by interest rate movements rather than credit and liquidity risks. Most of Dell's

investments in debt securities have contractual maturities of less than five years.

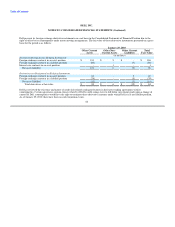

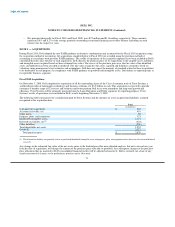

At January 29, 2010, total unrealized losses related to Dell's debt securities, including securities classified as cash equivalents, were

$2 million with a corresponding fair value of $518 million. Of the unrealized losses, $1 million relate to 77 securities that were in a loss

position for less than twelve months, and the fair value of those 77 securities totaled $508 million. The remaining $1 million in unrealized

losses relate to four securities that were in a loss position for twelve months or greater, and the fair value of those four securities totaled

$10 million. The unrealized losses are due to interest rate movements and are expected to be recovered over the contractual term of the

instruments.

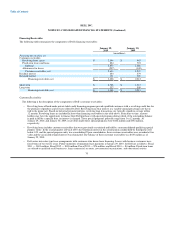

During Fiscal 2010, Dell adopted the new pronouncement that changed the impairment recognition and presentation model for debt

securities. Dell reviews its investment portfolio quarterly to determine if any investment is other-than-temporarily impaired. Under the

amended impairment model for debt securities, an other-than-temporary impairment ("OTTI") loss is recognized in earnings if the entity

has the intent to sell the debt security, or if it is more likely than not that it will be required to sell the debt security before recovery of its

amortized cost basis. However, if an entity does not expect to sell a debt security, it still evaluates expected cash flows to be received and

determines if a credit loss exists. In the event of a credit loss, only the amount of impairment associated with the credit loss is recognized

currently in earnings. Amounts relating to factors other than credit losses are recorded in other comprehensive income. Upon adoption of

the new pronouncement at the beginning of the second quarter of Fiscal 2010, the amounts Dell recorded for the cumulative-effect

adjustment were immaterial. As of January 29, 2010, Dell evaluated debt securities classified as available for sale for OTTI and the

existence of credit losses. Dell did not record any loss for OTTI during Fiscal 2010.

63