Dell 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

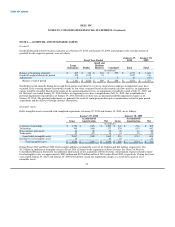

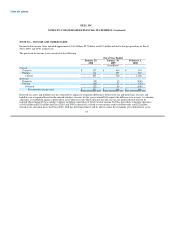

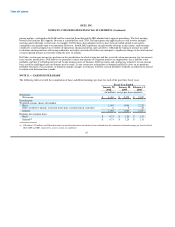

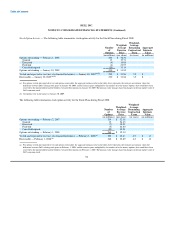

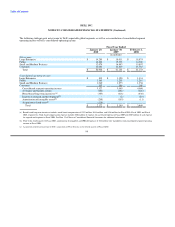

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Total

(in millions)

Balance at February 3, 2007 (adoption) $ 1,096

Increases related to tax positions of the current year 390

Increases related to tax positions of prior years 34

Reductions for tax positions of prior years (13)

Lapse of statute of limitations (6)

Settlements (18)

Balance at February 1, 2008 1,483

Increases related to tax positions of the current year 298

Increases related to tax positions of prior years 19

Reductions for tax positions of prior years (217)

Lapse of statute of limitations (7)

Settlements (38)

Balance at January 30, 2009 1,538

Increases related to tax positions of the current year 298

Increases related to tax positions of prior years 32

Reductions for tax positions of prior years (69)

Lapse of statute of limitations (3)

Settlements (3)

Balance at January 29, 2010 $ 1,793

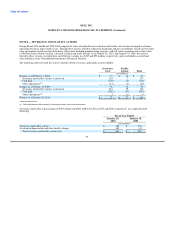

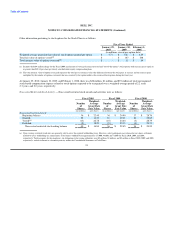

Fiscal 2009 reductions for tax positions of prior years in the table above include $163 million of items that did not impact Dell's effective

tax rate for Fiscal 2009. These items include foreign currency translation, withdrawal of positions expected to be taken for prior year tax

filings, and a reduction that is included in the deferred tax asset valuation allowance at January 30, 2009. There were no significant items

of a similar nature in Fiscal 2010.

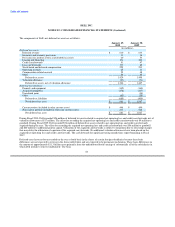

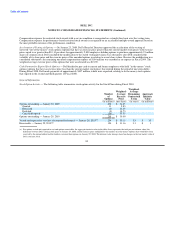

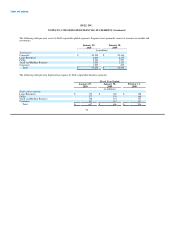

Associated with the unrecognized tax benefits of $1.8 billion, $1.5 billion, and $1.5 billion at January 29, 2010, January 30, 2009, and

February 1, 2008, respectively, are interest and penalties as well as $209 million, $166 million and $171 million of offsetting tax benefits

associated with estimated transfer pricing, the benefit of interest deductions, and state income tax benefits. The net amount of

$2.1 billion, if recognized, would favorably affect Dell's effective tax rate.

Interest and penalties related to income tax liabilities are included in income tax expense. The balance of gross accrued interest and

penalties recorded in the Consolidated Statements of Financial Position at January 29, 2010, January 30, 2009, and February 1, 2008 was

$507 million, $400 million, and $288 million, respectively. During Fiscal 2010, 2009, and 2008, $107 million, $112 million, and

$88 million, respectively, related to interest and penalties were included in income tax expense.

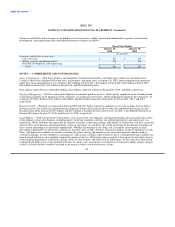

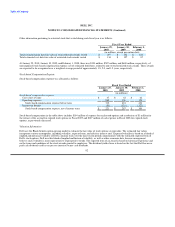

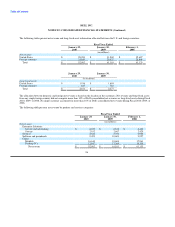

Dell is currently under income tax audits in various jurisdictions, including the United States. The tax periods open to examination by the

major taxing jurisdictions to which Dell is subject include fiscal years 1997 through 2010. As a result of these audits, Dell maintains

ongoing discussions and negotiations relating to tax matters with the taxing authorities in these various jurisdictions. Dell's U.S. federal

income tax returns for fiscal years 2007 through 2009 are currently under examination by the Internal Revenue Service ("IRS"). In

April 2009, the IRS issued a Revenue Agent's Report ("RAR") for fiscal years 2004 through 2006 proposing certain assessments

primarily related to transfer pricing matters. Dell disagrees with certain of the proposed assessments, primarily related to transfer

86