Dell 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

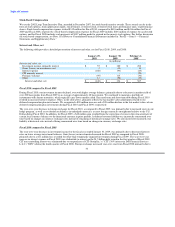

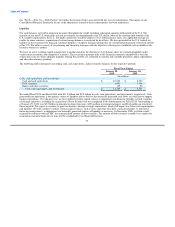

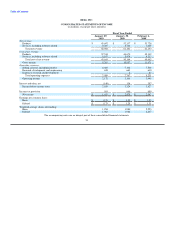

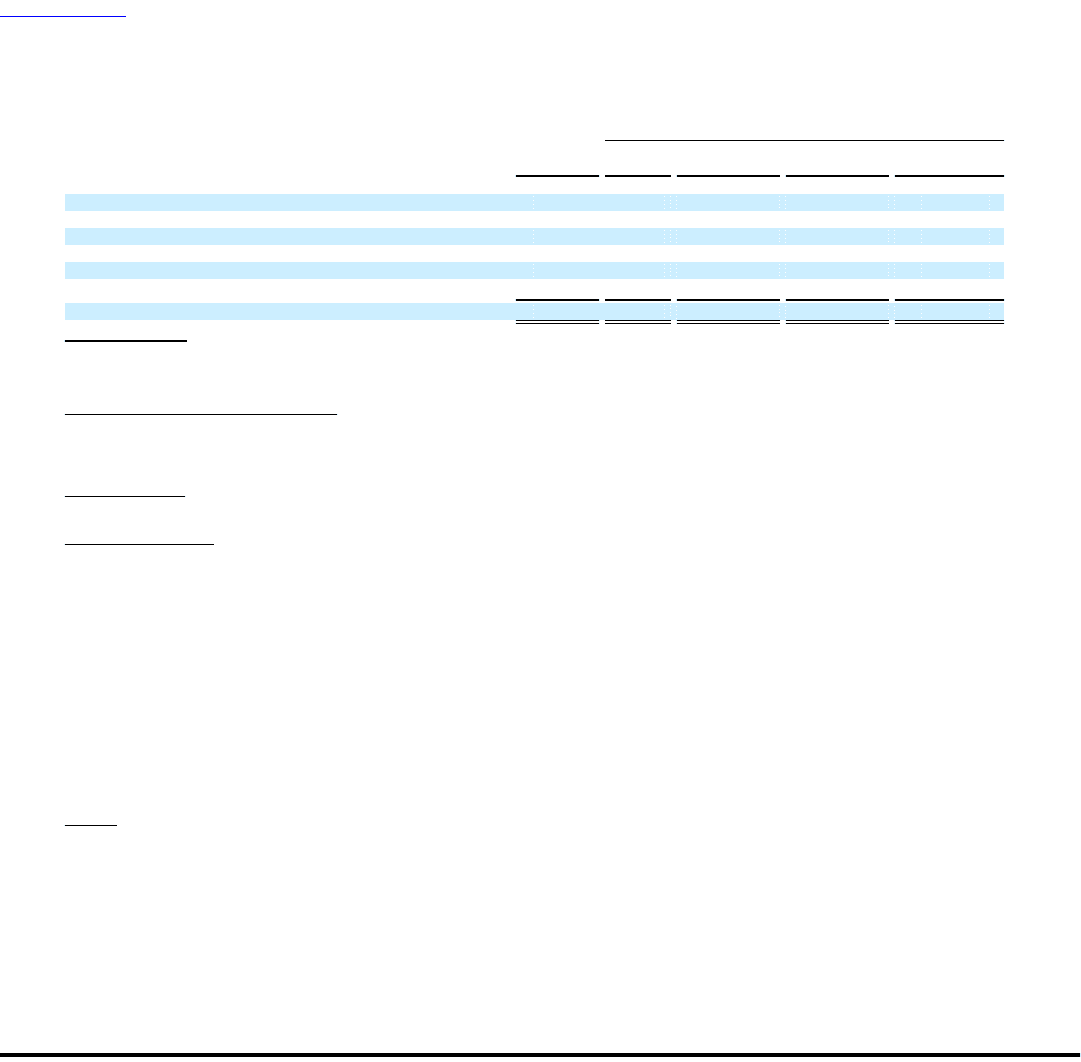

Contractual Cash Obligations

The following table summarizes our contractual cash obligations at January 29, 2010:

Payments Due by Period

Fiscal Fiscal Fiscal

Total 2011 2012-2013 2014-2015 Thereafter

(in millions)

Contractual cash obligations:

Principal payments on long term debt $ 3,324 $ - $ 424 $ 1,100 $ 1,800

Operating leases 441 112 156 83 90

Purchase obligations 383 313 70 - -

Interest 1,969 181 354 278 1,156

Current portion of uncertain tax positions(a) - - - - -

Contractual cash obligations $ 6,117 $ 606 $ 1,004 $ 1,461 $ 3,046

(a) We had approximately $2.1 billion in additional liabilities associated with uncertain tax positions that are not expected to be liquidated in Fiscal 2011. We are

unable to reliably estimate the expected payment dates for these additional non-current liabilities.

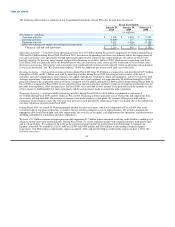

Principal Payments on Long Term Debt— Our expected principal cash payments related to long term debt are exclusive of hedge

accounting adjustments or discounts and premiums. We have several outstanding long-term unsecured notes with varying maturities

depending on the agreement. For additional information, see Note 3 of Notes to Consolidated Financial Statements under "Part II —

Item 8 — Financial Statements and Supplementary Data".

Operating Leases — We lease property and equipment, manufacturing facilities, and office space under non-cancellable leases. Certain

of these leases obligate us to pay taxes, maintenance, and repair costs.

Purchase Obligations — Purchase obligations are defined as contractual obligations to purchase goods or services that are enforceable

and legally binding on us. These obligations specify all significant terms, including fixed or minimum quantities to be purchased; fixed,

minimum, or variable price provisions; and the approximate timing of the transaction. Purchase obligations do not include contracts that

may be cancelled without penalty.

We utilize several suppliers to manufacture sub-assemblies for our products. Our efficient supply chain management allows us to enter

into flexible and mutually beneficial purchase arrangements with our suppliers in order to minimize inventory risk. Consistent with

industry practice, we acquire raw materials or other goods and services, including product components, by issuing to suppliers

authorizations to purchase based on our projected demand and manufacturing needs. These purchase orders are typically fulfilled within

30 days and are entered into during the ordinary course of business in order to establish best pricing and continuity of supply for our

production. Purchase orders are not included in the table above as they typically represent our authorization to purchase rather than

binding purchase obligations.

Purchase obligations decreased approximately $404 million from January 30, 2009, to $383 million at January 30, 2010. The decrease

was primarily due to the fulfillment of commitments to purchase key components and services, partially offset by the renewal of or entry

into new purchase contracts.

Interest — See Note 3 of Notes to Consolidated Financial Statements included in "Part II — Item 8 — Financial Statements and

Supplementary Data" for further discussion of our debt and related interest expense.

Risk Factors Affecting Our Business and Prospects

There are numerous significant risks that affect our business, operating results, financial condition and prospects. Many of these risks are

beyond our control. These risks include those relating to:

• weak global economic conditions and instability in financial markets;

• weak economic conditions and additional regulation affecting our financial services activities;

• intense competition;

43