Dell 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

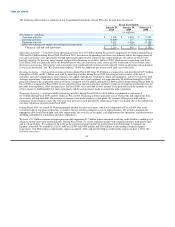

We maintain an allowance to cover expected financing receivable credit losses. The allowance for losses is determined based on various

factors, including historical and anticipated experience, past due receivables, receivable type, and customer risk profile. At January 29,

2010, and January 30, 2009, the allowance for financing receivable losses was $237 million and $149 million, respectively. The increase

in the allowance is primarily due to an increase in revolving loan customer receivables. Based on our assessment of the customer

financing receivables, we believe that we are adequately reserved.

The Credit Card Accountability, Responsibility, and Disclosure Act of 2009 was signed into U.S. law on May 22, 2009, and will affect

the consumer financing provided by DFS. This Act will impose new restrictions on credit card companies in the areas of marketing,

servicing, and pricing of consumer credit accounts. We do not expect the changes will substantially alter how consumer credit is offered

to our customers or how their accounts will be serviced. Commercial credit is unaffected by the change in law. Some provisions of the

law are now in effect, with the majority of provisions of the new law effective in February 2010 and August 2010. We are compliant with

the legislation that currently is in effect and expect to be compliant with future regulations by the established deadlines. Some of the

future regulations, including changes to rules relating to late fees, are subject to additional clarification. We do not expect the impact of

these pending changes to be material to our financial results in future periods.

See Note 4 of Notes to Consolidated Financial Statements included in "Part II — Item 8 — Financial Statements and Supplementary

Data" for additional information about our financing receivables.

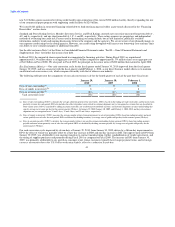

OFF-BALANCE SHEET ARRANGEMENTS

See the "Financing Receivables" section above and Note 4 of Notes to Consolidated Financial Statements included in "Part II —

Item 8 — Financial Statements and Supplementary Data" for information about our off-balance sheet arrangements.

MARKET RISK

We are exposed to a variety of risks, including foreign currency exchange rate fluctuations and changes in the market value of our

investments. In the normal course of business, we employ established policies and procedures to manage these risks.

Foreign Currency Hedging Activities

Our objective in managing our exposures to foreign currency exchange rate fluctuations is to reduce the impact of adverse fluctuations on

earnings and cash flows associated with foreign currency exchange rate changes. Accordingly, we utilize foreign currency option

contracts and forward contracts to hedge our exposure on forecasted transactions and firm commitments in more than 20 currencies in

which we transact business. Our exposure to foreign currency movements is comprised primarily of certain principal currencies. During

Fiscal 2010, these principal currencies were the Euro, British Pound, Japanese Yen, Canadian Dollar, and Australian Dollar. We monitor

our foreign currency exchange exposures to ensure the overall effectiveness of our foreign currency hedge positions. However, there can

be no assurance that our foreign currency hedging activities will continue to substantially offset the impact of fluctuations in currency

exchange rates on our results of operations and financial position in the future.

Based on our foreign currency cash flow hedge instruments outstanding at January 29, 2010, and January 30, 2009, we estimate a

maximum potential one-day loss in fair value of approximately $86 million and $393 million, respectively, using a Value-at-Risk

("VAR,") model. By using market implied rates and incorporating volatility and correlation among the currencies of a portfolio, the VAR

model simulates 3,000 randomly generated market prices and calculates the difference between the fifth percentile and the average as the

Value-at-Risk. In Fiscal 2009, both higher volatility and correlation increased the VAR significantly. Forecasted transactions, firm

commitments, fair value hedge instruments, and accounts receivable and payable denominated in foreign currencies were excluded from

the model. The VAR model is a risk estimation tool, and as such, is not intended to represent actual losses in fair value that will be

incurred. Additionally, as we utilize foreign currency instruments for hedging forecasted and firmly committed transactions, a loss in fair

value for those instruments is generally offset by increases in the value of the underlying exposure.

37