Dell 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

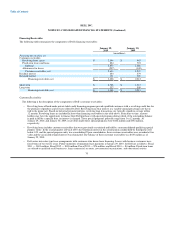

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Consolidated Financial Statements. See Note 3 of Notes to Consolidated Financial Statements for additional information.

– Impairments of Debt Securities — The pronouncement changed the impairment recognition and presentation model for debt

securities. An other-than-temporary impairment is now triggered when there is intent to sell the security, it is more likely than not

that the security will be required to be sold before recovery in value, or the security is not expected to recover its entire amortized

cost basis ("credit related loss"). Credit related losses on debt securities will be considered an other-than-temporary impairment

recognized in earnings, and any other losses due to a decline in fair value relative to the amortized cost deemed not to be

other-than-temporary will be recorded in other comprehensive income. Dell adopted the pronouncement in the second quarter of

Fiscal 2010. The adoption did not have a material impact on Dell's Consolidated Financial Statements. See Note 3 of Notes to

Consolidated Financial Statements for additional information.

– Subsequent Events — The pronouncement codifies existing standards of accounting for and disclosures of events that occur after the

balance sheet date but before financial statements are issued or are available to be issued. Dell adopted the pronouncement in the

second quarter of Fiscal 2010. The adoption did not have any impact on Dell's Consolidated Financial Statements.

Recently Issued but Not Yet Adopted Accounting Pronouncements

– Revenue Arrangements with Multiple Deliverables — The guidance amends the current revenue recognition guidance for multiple

deliverable arrangements. It allows the use of management's best estimate of selling price for individual elements of an arrangement

when vendor specific objective evidence, or third-party evidence is unavailable. Additionally, it eliminates the residual method of

revenue recognition in accounting for multiple deliverable arrangements. The guidance is effective for fiscal years beginning on or

after June 15, 2010 (Dell's Fiscal 2012), but early adoption is permitted. Management does not expect the adoption of this guidance

to have a material impact on Dell's Consolidated Financial Statements. Dell has elected to early adopt the guidance in the first quarter

of Fiscal 2011 on a prospective basis.

– Revenue Arrangements with Software Elements — The pronouncement modifies the scope of the software revenue recognition

guidance to exclude tangible products that contain both software and non-software components that function together to deliver the

product's essential functionality. The pronouncement is effective for fiscal years beginning on or after June 15, 2010 (Dell's Fiscal

2012), but early adoption is permitted. This guidance must be adopted in the same period an entity adopts the amended revenue

arrangements with multiple deliverables guidance described above. Management does not expect the adoption of this guidance to

have a material impact on Dell's Consolidated Financial Statements. Dell has elected to early adopt the guidance in the first quarter of

Fiscal 2011 on a prospective basis.

– Variable Interest Entities and Transfers of Financial Assets and Extinguishments of Liabilities — The pronouncement on transfers of

financial assets and extinguishments of liabilities removes the concept of a qualifying special-purpose entity and removes the

exception from applying variable interest entity accounting to qualifying special-purpose entities. The new guidance on variable

interest entities requires an entity to perform an ongoing analysis to determine whether the entity's variable interest or interests give it

a controlling financial interest in a variable interest entity. The pronouncements are effective for fiscal years beginning after

November 15, 2009. Dell will adopt the pronouncements for interim and annual reporting periods beginning in the first quarter of

Fiscal 2011. Dell expects the adoption of these two pronouncements to result in the consolidation of its qualifying special purpose

entities beginning in the first quarter of Fiscal 2011. The impact of the required consolidations is not expected to be material to Dell's

financial position, net income, or cash flows. See Note 4 of Notes to Consolidated Financial Statements for additional information.

Reclassifications — Dell has revised the presentation of certain prior period amounts reported within cash flows from operating activities

presented in the Consolidated Statements of Cash Flows. The revision had no impact to the

60