Dell 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

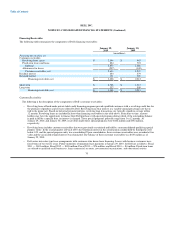

Financing Receivables

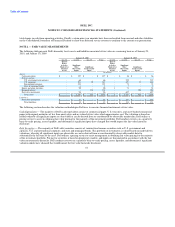

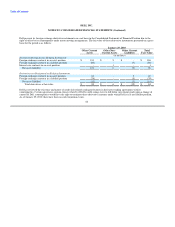

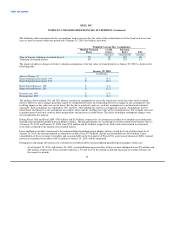

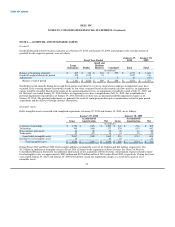

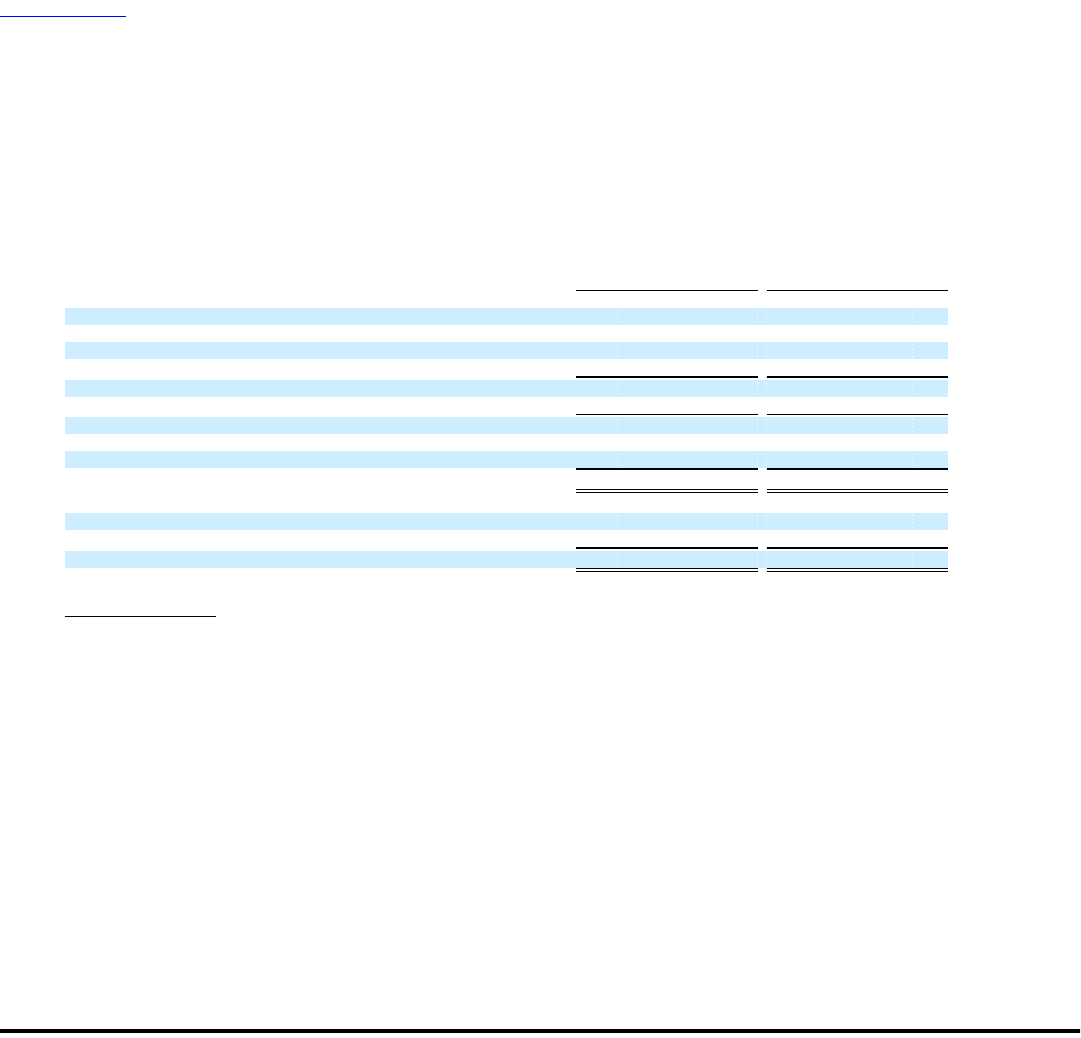

The following table summarizes the components of Dell's financing receivables:

January 29, January 30,

2010 2009

(in millions)

Financing Receivables, net

Customer receivables

Revolving loans, gross $ 2,046 $ 963

Fixed-term leases and loans 824 723

Subtotal 2,870 1,686

Allowances for losses (237) (149)

Customer receivables, net 2,633 1,537

Residual interest 254 279

Retained interest 151 396

Financing receivables, net $ 3,038 $ 2,212

Short-term $ 2,706 $ 1,712

Long-term 332 500

Financing receivables, net $ 3,038 $ 2,212

Customer Receivables

The following is the description of the components of Dell's customer receivables:

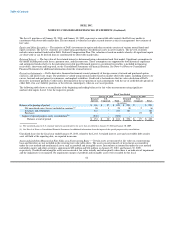

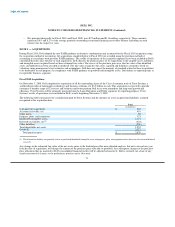

– Revolving loans offered under private label credit financing programs provide qualified customers with a revolving credit line for

the purchase of products and services offered by Dell. Revolving loans bear interest at a variable annual percentage rate that is

tied to the prime rate. Based on historical payment patterns, revolving loan transactions are typically repaid on average within

12 months. Revolving loans are included in short-term financing receivables in the table above. From time to time, account

holders may have the opportunity to finance their Dell purchases with special programs during which, if the outstanding balance

is paid in full by a specific date, no interest is charged. These special programs generally range from 3 to 12 months. At

January 29, 2010, and January 30, 2009, receivables under these special programs were $442 million and $352 million,

respectively.

– Revolving loans includes customer receivables that were previously securitized and held by a nonconsolidated qualifying special

purpose entity. In the second quarter of Fiscal 2010, the beneficial interest in the securitization conduit held by third parties fell

below 10% and the special purpose entity was consolidated. Upon consolidation, these customer receivables were recorded at fair

value and the associated retained interest was eliminated. The balance of these customer receivables was $435 million as of

January 29, 2010.

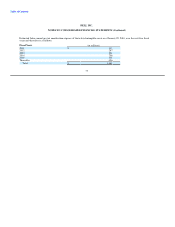

– Dell enters into sales-type lease arrangements with customers who desire lease financing. Leases with business customers have

fixed terms of two to five years. Future maturities of minimum lease payments at January 29, 2010, for Dell are as follows: Fiscal

2011 — $303 million; Fiscal 2012 — $188 million; Fiscal 2013 — $76 million; and Fiscal 2014 — $4 million. Fixed-term loans

are offered to qualified small businesses, large commercial accounts, governmental organizations, and educational entities.

70