Dell 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

differences could reverse through a sale of the subsidiaries or the receipt of dividends from the subsidiaries, as well as various other

events. Net of available foreign tax credits, residual income tax of approximately $3.7 billion would be due upon reversal of this excess

book basis as of January 29, 2010.

A portion of Dell's operations is subject to a reduced tax rate or is free of tax under various tax holidays that expire in whole or in part

during Fiscal 2011 through 2019. Many of these tax holidays and reduced tax rates may be extended when certain conditions are met or

may be terminated early if certain conditions are not met. The income tax benefits attributable to the tax status of these subsidiaries were

estimated to be approximately $149 million ($0.08 per share) in Fiscal 2010, $338 million ($0.17 per share) in Fiscal 2009, and

$502 million ($0.23 per share) in Fiscal 2008.

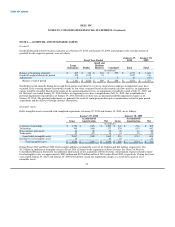

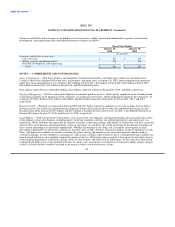

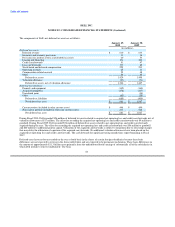

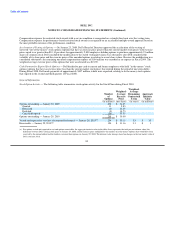

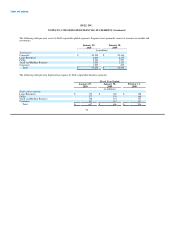

The effective tax rate differed from the statutory U.S. federal income tax rate as follows:

Fiscal Year Ended

January 29, January 30, February 1,

2010 2009 2008

U.S. federal statutory rate 35.0% 35.0% 35.0%

Foreign income taxed at different rates (7.5) (9.8) (12.5)

In-process research and development - - 0.8

Other 1.7 0.2 (0.3)

Total 29.2% 25.4% 23.0%

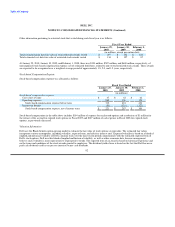

At the beginning of Fiscal 2008, Dell adopted the accounting guidance for uncertain tax positions, which requires that a tax benefit from

an uncertain tax position not be recognized in the financial statements unless it is more likely than not that the position will be sustained

upon examination. The cumulative effect of adoption of this standard was a $62 million increase in tax liabilities and a corresponding

decrease in stockholders' equity.

85