Dell 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

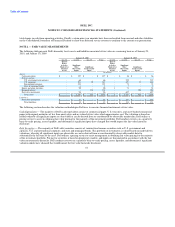

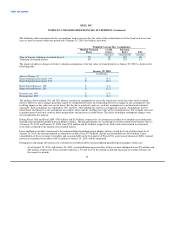

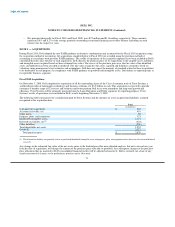

During Fiscal 2010, Fiscal 2009, and Fiscal 2008, gross realized gains recognized in interest and other, net were $6 million, $14 million,

and $17 million, respectively. Dell recognized gross realized losses of $4 million, $24 million, and $3 million, respectively, during the

same periods.

Derivative Instruments and Hedging Activities

Derivative Instruments

As part of its risk management strategy, Dell uses derivative instruments, primarily forward contracts and purchased options, to hedge

certain foreign currency exposures and interest rate swaps to reduce the exposure of its debt portfolio to interest rate risk. Dell's objective

is to offset gains and losses resulting from these exposures with gains and losses on the derivative contracts used to hedge them, thereby

reducing volatility of earnings and protecting fair values of assets and liabilities. Dell applies hedge accounting based upon the criteria

established by accounting guidance for derivative instruments and hedging activities, including designation of its derivatives as fair value

hedges or cash flow hedges and assessing of hedge effectiveness. Dell records all derivatives in its Consolidated Statements of Financial

Position at fair value.

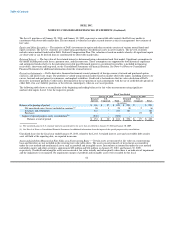

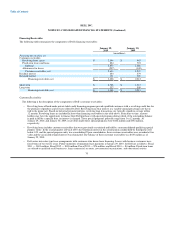

Cash Flow Hedges

Dell uses a combination of forward contracts and purchased options designated as cash flow hedges to protect against the foreign

currency exchange rate risks inherent in its forecasted transactions denominated in currencies other than the U.S. dollar. The risk of loss

associated with purchased options is limited to premium amounts paid for the option contracts. The risk of loss associated with forward

contracts is equal to the exchange rate differential from the time the contract is entered into until the time it is settled. The majority of

these contracts typically expire in 12 months or less. For derivative instruments that are designated and qualify as cash flow hedges, Dell

records the effective portion of the gain or loss on the derivative instrument in accumulated other comprehensive income (loss) ("OCI")

as a separate component of stockholders' equity and reclassifies these amounts into earnings in the period during which the hedged

transaction is recognized in earnings. Dell reports the effective portion of cash flow hedges in the same financial statement line item

within earnings as the changes in value of the hedged item.

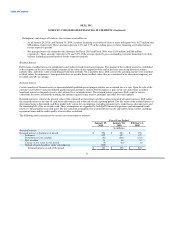

For foreign currency forward contracts and purchased options designated as cash flow hedges, Dell assesses hedge effectiveness both at

the onset of the hedge as well as at the end of each fiscal quarter throughout the life of the derivative. Dell measures hedge

ineffectiveness by comparing the cumulative change in the fair value of the hedge contract with the cumulative change in the fair value of

the hedged item, both of which are based on forward rates. Dell recognizes any ineffective portion of the hedge, as well as amounts not

included in the assessment of effectiveness, in earnings as a component of interest and other, net. Hedge ineffectiveness for cash flow

hedges was not material for year ended January 29, 2010. During the year ended January 29, 2010, Dell did not discontinue any cash flow

hedges that had a material impact on Dell's results of operations, as substantially all forecasted foreign currency transactions were

realized in Dell's actual results.

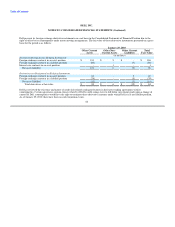

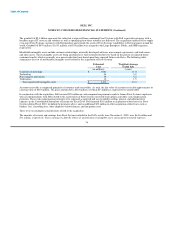

The aggregate unrealized net gain recorded as a component of comprehensive income net of tax, for Fiscal 2010 and 2009 was $1 million

and $324 million, respectively. The following table summarizes the fair value of the foreign

64