Dell 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

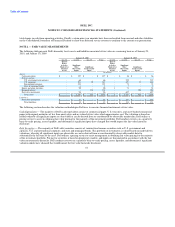

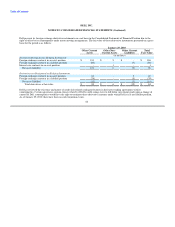

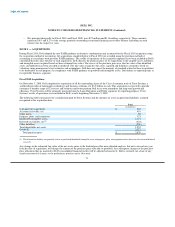

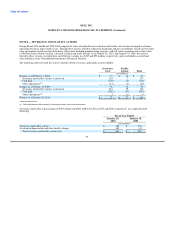

Delinquency and charge-off statistics for customer receivables are:

– As of January 29, 2010, and January 30, 2009, customer financing receivables 60 days or more delinquent were $127 million and

$58 million, respectively. These amounts represent 4.4% and 3.7% of the ending gross customer financing receivables balance

for the respective periods.

– Net principal write-offs charged to the allowance for Fiscal 2010 and Fiscal 2009, were $130 million and $86 million,

respectively. These amounts represent 6.2% and 5.5% of the average quarterly gross outstanding customer financing receivables

balance (including accrued interest) for the respective periods.

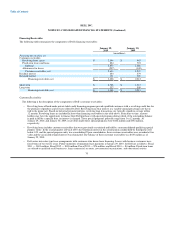

Residual Interest

Dell retains a residual interest in equipment leased under its fixed-term lease programs. The amount of the residual interest is established

at the inception of the lease based upon estimates of the value of the equipment at the end of the lease term using historical studies,

industry data, and future value-at-risk demand valuation methods. On a quarterly basis, Dell assesses the carrying amount of its recorded

residual values for impairment. Anticipated declines in specific future residual values that are considered to be other-than-temporary are

recorded currently in earnings.

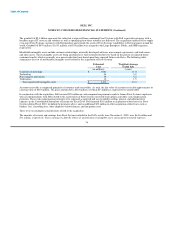

Retained Interest

Certain transfers of financial assets to nonconsolidated qualified special purpose entities are accounted for as a sale. Upon the sale of the

customer receivables to nonconsolidated qualifying special purpose entities, Dell recognizes a gain on the sale and retains a residual

beneficial interest in the pool of assets sold, referred to as retained interest. The retained interest represents Dell's right to receive

collections for assets securitized exceeding the amount required to pay interest, principal, and other fees and expenses.

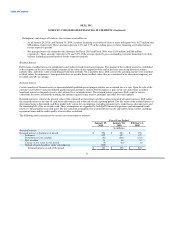

Retained interest is stated at the present value of the estimated net beneficial cash flows after payment of all senior interests. Dell values

the retained interest at the time of each receivable transfer and at the end of each reporting period. The fair value of the retained interest is

determined using a discounted cash flow model with various key assumptions, including payment rates, credit losses, discount rates, and

the remaining life of the receivables sold. These assumptions are supported by both Dell's historical experience and anticipated trends

relative to the particular receivable pool. The key valuation assumptions for retained interest can be affected by many factors, including

repayment terms and the credit quality of receivables securitized.

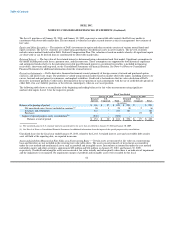

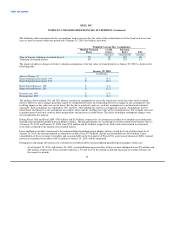

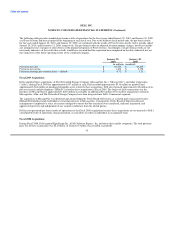

The following table summarizes the activity in retained interest balances:

Fiscal Year Ended

January 29, January 30, February 1,

2010 2009 2008

(in millions)

Retained interest:

Retained interest at beginning of period $ 396 $ 223 $ 159

Issuances 322 427 173

Distributions from conduits (91) (246) (132)

Net accretion 31 16 31

Change in fair value for the period (5) (24) (8)

Impact of special purpose entity consolidation (502) - -

Retained interest at end of the period $ 151 $ 396 $ 223

71