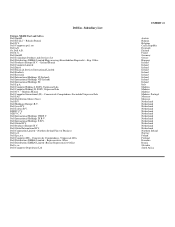

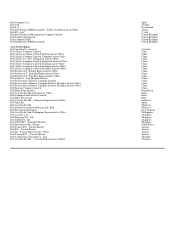

Dell 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

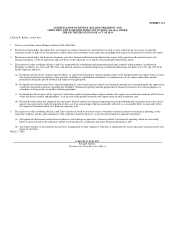

Effective as of January 1, 2005, no more than ninety (90), and no fewer than thirty (30), days prior to the beginning of each Plan Year, the Employer

shall provide to each Participant a Safe Harbor Notice. If an Employee will become a Participant in the Plan after the date such notice is provided for

a Plan Year but prior to the beginning of the next Plan Year, then the Employer shall provide such Employee a Safe Harbor Notice no later than the

date such Employee becomes eligible to participate in the Plan. The Safe Harbor Notice shall be sufficiently accurate and comprehensive to inform

the Employee or Participant of his rights and obligations under the Plan and shall be written in a manner calculated to be understood by the average

Employee. The Safe Harbor Notice shall accurately describe (i) the Safe Harbor Matching Contribution as set forth in this Section 3.2(d), (ii) any

other contributions under the Plan, including the potential for discretionary Employer contributions, and the conditions under which such

contributions are made, (iii) the type and amount of Compensation that may be deferred under the Plan, (iv) how to make Salary Reduction

Contributions, including the requirements for completing and returning the election forms, (v) the periods available for making Salary Reduction

Contributions, (vi) withdrawal and vesting provisions applicable to all contributions under the Plan, and (vii) information that makes it easy to obtain

additional information about the Plan such as telephone numbers, addresses and, if applicable, electronic addresses, of individuals or offices from

whom employees can obtain such plan information.

During any Plan Year in which the safe harbor requirements of Code Section 401(k)(12) and 401(m)(11) have been satisfied to the date of

amendment, the Employer may amend the Plan to eliminate or reduce the Safe Harbor Matching Contribution provided in Section 3.2(d) of the Plan,

in which case (i) the ADP and ACP testing limitations set forth in Code Section 401(k)(3) and 401(m)(2) shall apply to the Plan for the entire Plan

Year using the current year testing method and (ii) the Employer shall, no fewer than thirty (30) days prior to the date such amendment becomes

effective, deliver to each Participant a supplemental notice that informs the Participant (i) of the consequences of the amendment and the date the

elimination or reduction of the Safe Harbor Matching Contributions shall become effective and (ii) that he has the right for thirty (30) days after

receipt of such supplemental notice to change his or her elections. If the Employer amends the Plan in any Plan Year to suspend Safe Harbor

Matching Contributions, such amendment shall be effective no earlier than thirty (30) days after the Participants are given the supplemental notice

described above or the date the amendment is adopted (if later)."