Dell 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

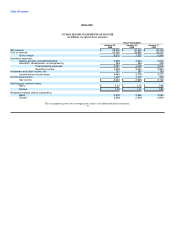

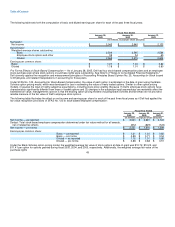

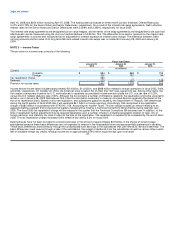

under the employee stock purchase plan granted in fiscal 2005, 2004, and 2003 was $9.77, $7.88, and $7.39 per right, respectively. The

weighted average fair value of options and purchase rights under the employee stock purchase plan was determined based on the Black-

Scholes model weighted for all grants during the period, utilizing the following assumptions:

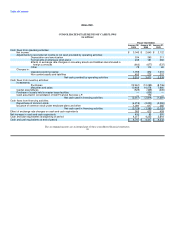

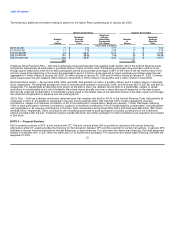

Fiscal Year Ended

January 28, January 30, January 31,

2005 2004 2003

Expected term:

Stock options 3.8 years 3.8 years 5 years

Employee stock purchase plan 6 months 6 months 6 months

Risk-free interest rate 2.89% 2.99% 3.76%

Volatility 36% 43% 43%

Dividends 0% 0% 0%

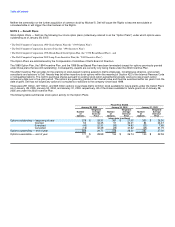

During fiscal 2005 and 2004, Dell evaluated the historical stock option exercise behavior of its employees, among other relevant factors, and

determined that the best estimate of expected term of stock options granted in fiscal 2005 and 2004 was 3.8 years, compared to the previous

expected term of 5 years. Dell used expected volatility, as well as other economic data, to estimate the volatility for fiscal 2005, 2004, and 2003

option grants, because management believes such volatility is more representative of prospective trends.

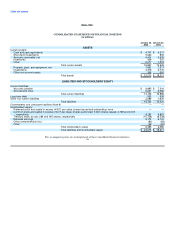

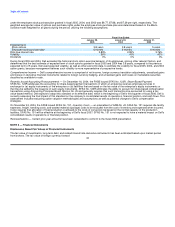

Comprehensive Income — Dell's comprehensive income is comprised of net income, foreign currency translation adjustments, unrealized gains

and losses on derivative financial instruments related to foreign currency hedging, and unrealized gains and losses on marketable securities

classified as available-for-sale.

Recently Issued Accounting Pronouncements — On December 16, 2004, the FASB issued SFAS No. 123R, Share-Based Payment.

SFAS No. 123R addresses the accounting for share-based payment transactions in which an enterprise receives employee services in

exchange for (a) equity instruments of the enterprise or (b) liabilities that are based on the fair value of the enterprise's equity instruments or

that may be settled by the issuance of such equity instruments. SFAS No. 123R eliminates the ability to account for share-based compensation

transactions using Accounting Principles Board Opinion No. 25 and generally requires that such transactions be accounted for using a fair-

value-based method. Dell expects to adopt this standard on its effective date, which is the beginning of Dell's third quarter of fiscal 2006. Dell is

currently assessing the final impact of this standard on the company's consolidated results of operations, financial position, and cash flows. This

assessment includes evaluating option valuation methodologies and assumptions as well as potential changes to Dell's compensation

strategies.

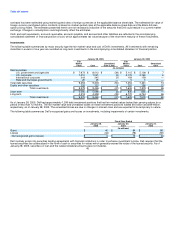

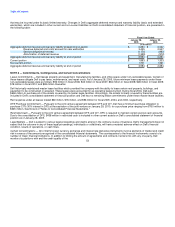

On November 24, 2004, the FASB issued SFAS No. 151, Inventory Costs — an amendment of ARB No. 43. SFAS No. 151 requires idle facility

expenses, freight, handling costs, and wasted material (spoilage) costs to be excluded from the cost of inventory and expensed when incurred.

It also requires that allocation of fixed production overheads to the costs of conversion be based on the normal capacity of the production

facilities. SFAS No. 151 will be effective at the beginning of Dell's fiscal 2007. SFAS No. 151 is not expected to have a material impact on Dell's

consolidated results of operations or financial position.

Reclassifications — Certain prior year amounts have been reclassified to conform to the fiscal 2005 presentation.

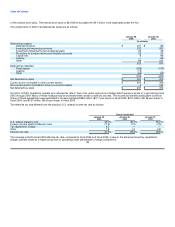

NOTE 2 — Financial Instruments

Disclosures About Fair Values of Financial Instruments

The fair value of investments, long-term debt, and related interest rate derivative instruments has been estimated based upon market quotes

from brokers. The fair value of foreign currency forward 44