Dell 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

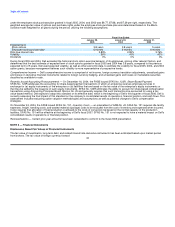

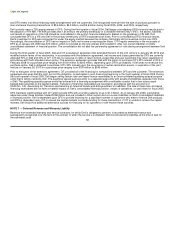

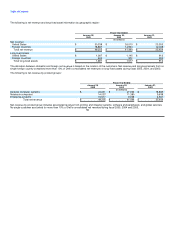

and DFS enters into direct financing lease arrangements with the customers. Dell recognized revenue from the sale of products pursuant to

loan and lease financing transactions of $5.6 billion, $4.5 billion, and $3.6 billion during fiscal 2005, 2004, and 2003, respectively.

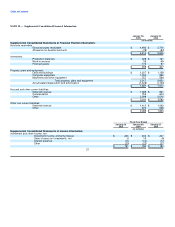

Dell currently owns a 70% equity interest in DFS. During the third quarter of fiscal 2004, Dell began consolidating DFS's financial results due to

the adoption of FIN 46R. FIN 46R provides that if an entity is the primary beneficiary of a Variable Interest Entity ("VIE"), the assets, liabilities,

and results of operations of the VIE should be consolidated in the entity's financial statements. Based on the guidance in FIN 46R, Dell

concluded that DFS is a VIE and Dell is the primary beneficiary of DFS's expected cash flows. Prior to consolidating DFS's financial results,

Dell's investment in DFS was accounted for under the equity method because the company historically did not exercise control over DFS.

Accordingly, the consolidation of DFS had no impact on Dell's net income or earnings per share. CIT's equity ownership in the net assets of

DFS as of January 28, 2005 was $13 million, which is recorded as minority interest and included in other non-current liabilities on Dell's

consolidated statement of financial position. The consolidation did not alter the partnership agreement or risk sharing arrangement between Dell

and CIT.

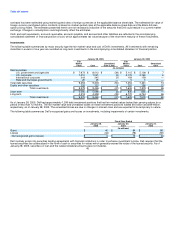

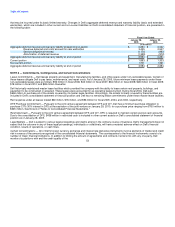

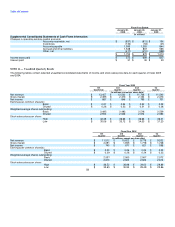

During the third quarter of fiscal 2005, Dell and CIT executed an agreement that extended the term of the joint venture to January 29, 2010 and

modified certain terms of the relationship. In accordance with the extension agreement, net income and losses generated by DFS are currently

allocated 70% to Dell and 30% to CIT. CIT has no recourse or rights of return to Dell, except that end-user customers may return equipment in

accordance with Dell's standard return policy. The extension agreement provides Dell with the option to purchase CIT's 30% interest in DFS in

February 2008 for a purchase price ranging from $100 million to $345 million, depending upon DFS's profitability. If Dell does not exercise this

purchase option, Dell is obligated to purchase CIT's 30% interest upon the occurrence of certain termination events, or expiration of the joint

venture on January 29, 2010 for a purchase price ranging from $100 million to $345 million.

Prior to execution of the extension agreement, CIT provided all of the financing for transactions between DFS and the customer. The extension

agreement also gives Dell the right, but not the obligation, to participate in such financings beginning in the fourth quarter of fiscal 2005. During

the fourth quarter of fiscal 2005, Dell began selling certain loan and lease finance receivables to an unconsolidated qualifying special purpose

entity that is wholly owned by Dell. The qualifying special purpose entity is a separate legal entity with assets and liabilities separate from those

of Dell. The qualifying special purpose entity has entered into a financing arrangement with a multiseller conduit that in turn issues asset-

backed debt securities to the capital markets. Transfers of financing receivables are recorded in accordance with the provisions of

SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities. The sale of these loan and lease

financing receivables did not have a material impact on Dell's consolidated financial position, results of operations, or cash flows for fiscal 2005.

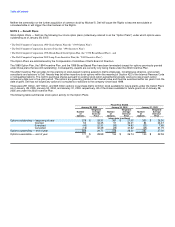

DFS maintains credit facilities with CIT which provide DFS with a funding capacity of up to $1.0 billion. As of January 28, 2005, outstanding

advances under these facilities totaled $158 million and are included in other current and non-current liabilities on Dell's consolidated statement

of financial position. Dell is dependent upon DFS to provide financing for a significant number of customers who elect to finance Dell products,

and DFS is dependent upon CIT to access the capital markets to provide funding for these transactions. If CIT is unable to access the capital

markets, Dell would find additional alternative sources for financing for its customers or self-finance these activities.

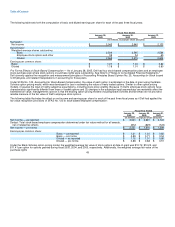

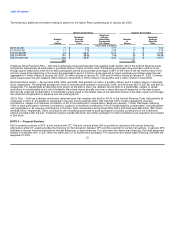

NOTE 7 — Deferred Revenue and Warranty Liability

Revenue from extended warranty and service contracts, for which Dell is obligated to perform, is recorded as deferred revenue and

subsequently recognized over the term of the contract or when the service is completed. Dell records warranty liabilities at the time of sale for

the estimated costs 52